As a seasoned crypto investor with a keen eye for spotting potential in emerging blockchain projects, I find Polygon’s recent performance quite intriguing. Having closely followed its journey since its transition from MATIC to POL, I can see that it is attempting to recover from the market-wide downturn. The surge in transaction volume and unique addresses on the network, coupled with the bullish crossover pattern in the MACD indicator, are promising signs.

On Tuesday, Polygon‘s price experienced a slight uptick as the Cryptocurrency Fear & Greed Index shifted towards the “greed” area.

Polygon (POL) reached a peak of $0.3340, representing a 10% jump from its lowest point this month. Despite this, it still sits 25% lower than its September high, during which it switched from MATIC to POL.

On the same day that Polygon showed signs of recovery, there was an improvement in its on-chain data. As per PolygonScan, the number of transactions on the network reached 3.1 million on Monday, marking a substantial rise compared to the 2.3 million recorded in September.

It was found that the total number of distinct network addresses had reached approximately 470 million, which is a growth of around 190,000 compared to the day before. Additionally, the Proof-of-Stake (PoS) chain usage for Polygon slightly increased to about 49%.

As a researcher delving into the dynamic world of blockchain technology, I’ve come to recognize Polygon as a significant force within the industry. This recognition stems primarily from Polymarket, a platform that has garnered considerable attention due to its operation as a prediction market. Notably, data reveals that the largest prediction market on this network holds more than $2.6 billion in assets, underscoring its popularity and influence.

Data from DeFi Llama Polymarket’s trading volume surged to over $2.08 billion in October, a significant increase from $533 million in the prior month. Its 24-hour trading volume reached $118 million, a trend that may continue in the coming days.

On the Polygon blockchain, Polymarket allows users to engage in trading activities by first depositing USD Coins (USDC).

Nevertheless, it appears that recent data indicates a decrease in Polygon’s market dominance within significant sectors of the blockchain industry. For instance, it holds approximately $1.12 billion in total value locked within decentralized finance, positioning it as the third-largest layer-2 network following networks like Base and Arbitrum.

The decentralized exchange market share held by Polygon has decreased. In October, its trading volume stood at approximately $5.1 billion, which pales in comparison to Base’s massive $25 billion and Arbitrum’s $15 billion. This drop is noteworthy since Polygon was an early entrant among popular layer-2 networks.

Polygon is attempting to recover

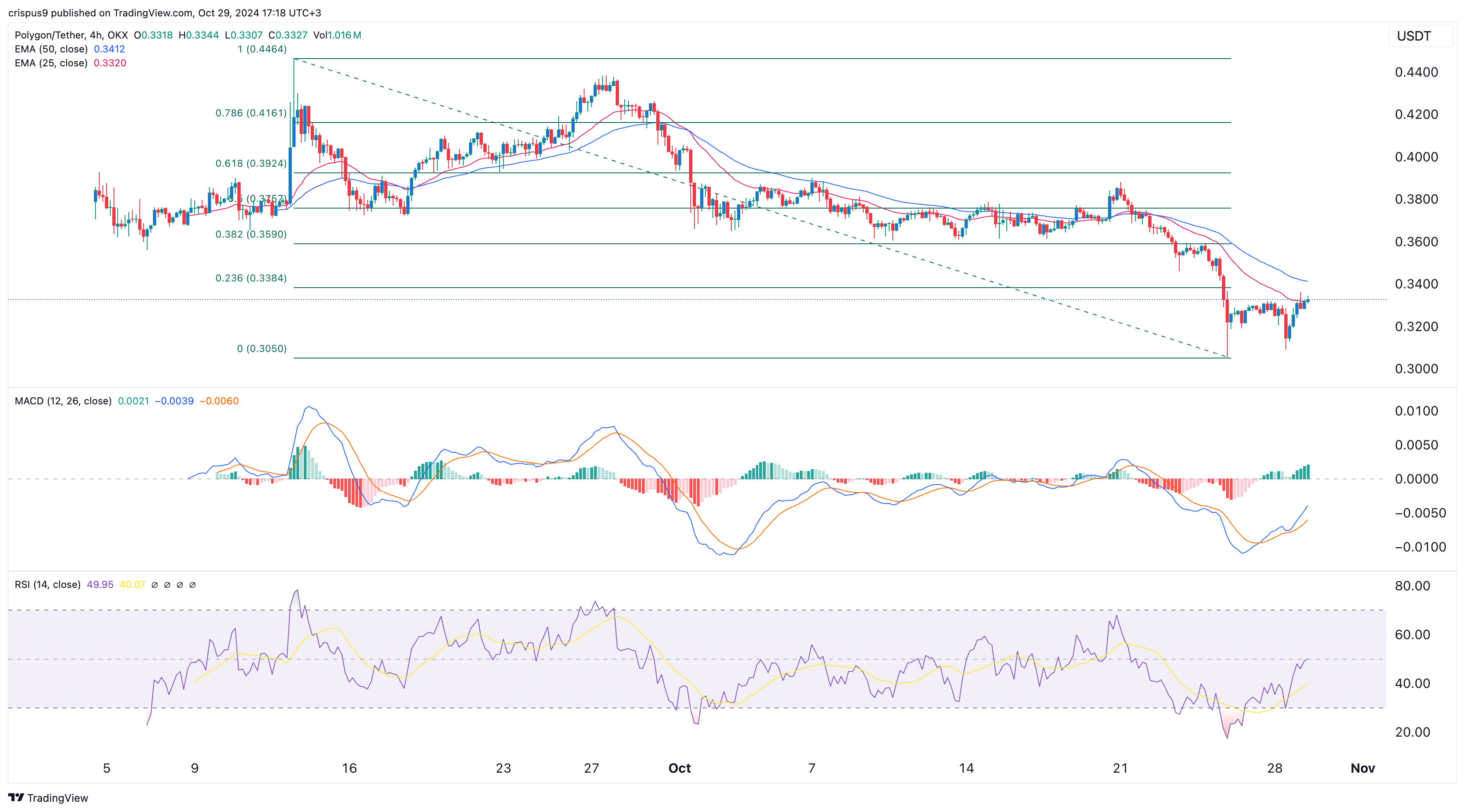

As I delve into my analysis, it’s evident that the 4-hour chart reveals a significant turning point for the Polygon token. On October 25th, it hit a low of $0.3050, but remarkably, it has since bounced back to touch its highest level since then at $0.3330.

The price hasn’t risen above the 23.6% Fibonacci retracement level or crossed over the 50-day and 12-day moving averages, as of now.

As an analyst, I’ve noticed that the Moving Average Convergence Divergence (MACD) indicator in my analysis has shown a bullish crossover pattern, which is often interpreted as a positive sign. Furthermore, the Relative Strength Index (RSI) is trending upward and has reached the 50-neutral mark, suggesting potential bullish momentum.

Consequently, it’s expected that the price of Polygon will probably keep climbing towards the 50% retrace point, which is around $0.3750, given that the bulls are aiming for this level.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Maiden Academy tier list

- Hero Tale best builds – One for melee, one for ranged characters

2024-10-29 17:42