As a seasoned crypto investor with a knack for spotting trends and patterns in the digital currency market, I find myself both excited and cautious about Cardano’s current trajectory. The rapid rise to $0.657 was reminiscent of the Dotcom boom, albeit on a smaller scale, which is always an exhilarating experience.

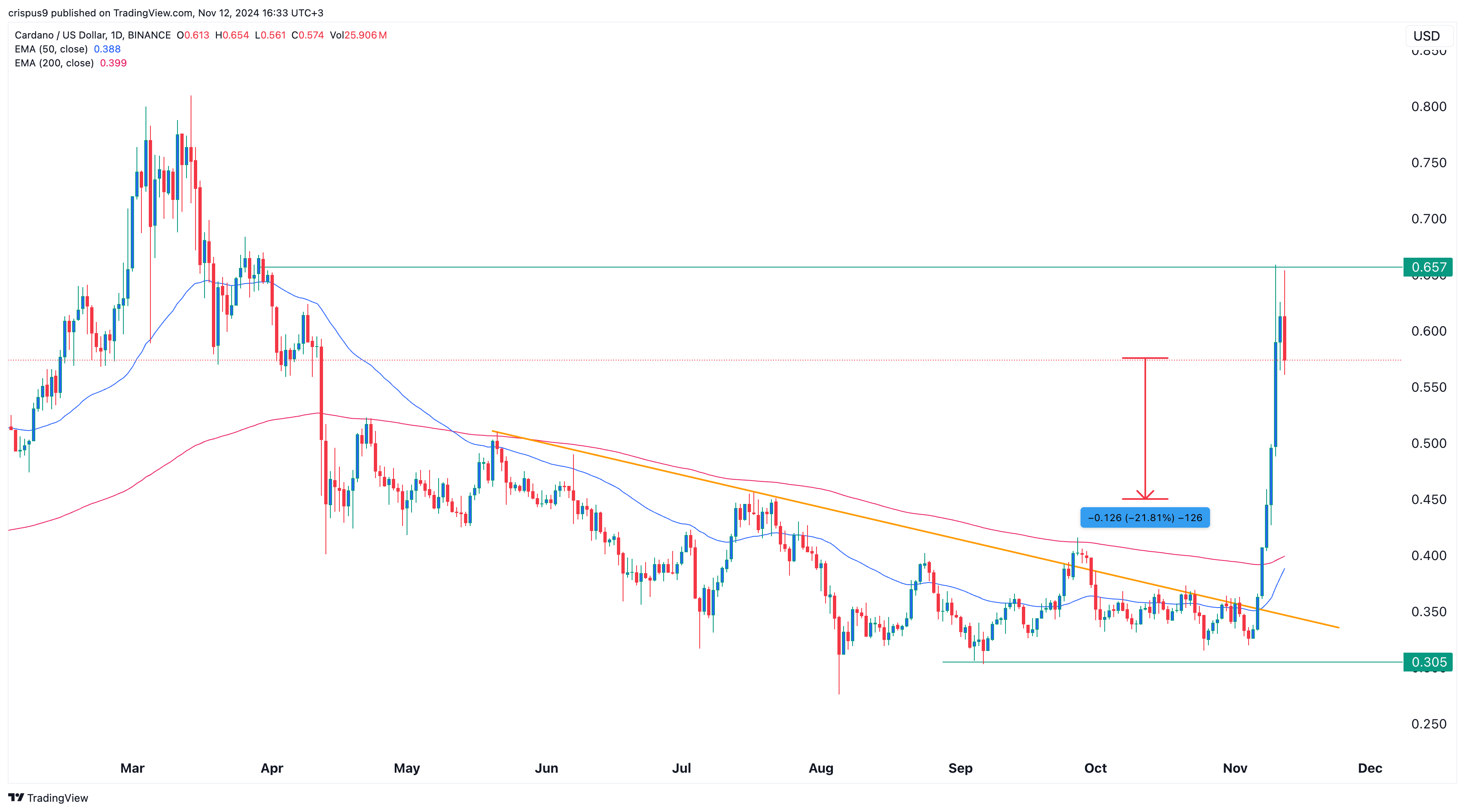

After hitting a peak of $0.657, which was last seen on March 30 and represented a 138% rise from its lowest point this year, the price of Cardano underwent a significant drop.

At the moment of reporting, Cardano (ADA) was experiencing a dip, having dropped by approximately 14% from its weekly peak and trading at $0.562. This downward trend resembled the pullback seen in other prominent cryptocurrencies. Following an approach towards $90,000, Bitcoin (BTC) retreated to $86,000. The majority of significant digital coins exhibited a similar pattern, largely due to profit-taking, as many assets have been on a strong upward trend in recent days. During such bull runs, financial assets typically pause as investors choose to cash in their profits.

The recent surge in Cardano can be attributed to a variety of reasons. Notably, its founder, Charles Hoskinson, has signaled his intention to increase involvement in U.S. politics following Donald Trump’s election victory.

Furthermore, the value locked in Cardano’s DeFi sector has reached an all-time high of $350 million in the past 7 months. This significant amount could potentially increase even more, given the forthcoming integration of BitcoinOS, which is projected to unleash a staggering $1.3 trillion worth of liquidity.

The increase in the value of Cardano also corresponded with an uptick in the amount of futures contracts being held (open interest), hitting a multi-month high. This high open interest has been sustained for three consecutive days, marking the first time this has happened since March.

Cardano price could suffer double-digit losses

Based on the daily chart analysis, it appears that prior to the recent surge, Cardano’s price pattern took on the shape of a reversed head and shoulder formation.

Looking on the optimistic side, the coin is approaching the formation of a ‘golden cross’, which is a bullish indicator that takes place when the short-term (50-day) and long-term (200-day) moving averages intersect. This pattern will become evident if Cardano’s upward trend persists.

On the other hand, indications are pointing towards a possible slowdown in the rally, given that the cryptocurrency is showing a bearish engulfment pattern. This pattern emerges when a larger bearish candle (red) fully encompasses a smaller bullish one.

If there’s a change in trend, the price of Cardano could drop to around $0.45, which is about 21% lower than its current value. However, if ADA’s price surges and manages to turn this week’s high of $0.657 into a support line instead, this prediction would no longer hold true.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2024-11-12 17:15