After delving into the stories of these businesses, it seems to me that the journey of an entrepreneur is as much about resilience and adaptability as it is about innovation and product development. Some of these ventures, though they secured deals on “Shark Tank“, ultimately succumbed to the challenges of scaling up, managing demand, or maintaining communication with investors.

As a gamer, I’ve always been amazed by shows like “Shark Tank” that give birth to countless successful companies. It ain’t a walk in the park impressing those seasoned entrepreneurs, so when a deal goes through, it’s definitely time to crack open the champagne. Some of the most profitable businesses showcased on “Shark Tank” are none other than Bombas Socks, raking in over a billion dollars in sales, and Scrub Daddy, the grinning sponge now stocked in countless retail stores nationwide.

Indeed, not every aspiring entrepreneur gets the chance for a deal. The sharks on these shows can be tough, scrutinizing potential flaws in a business idea from the outset. However, there are instances where a deal is struck on TV, but complications arise behind the scenes. It’s important to remember that reality television often presents a simplified version of events. Even though an entrepreneur might appear thrilled at the end of their segment, there can be numerous challenges when it comes to finalizing all the necessary paperwork afterwards.

“This list includes the products that didn’t succeed on ‘Shark Tank’. You might have pondered about their fate after securing a deal, and why they never made it to store shelves near you. After all the TV excitement fades, this is what’s left of these once-promise businesses.

Sweet Ballz

The founders of Sweet Ballz, James McDonald and Cole Egger, had already achieved some level of success in selling their unique ball-shaped cakes before they appeared on “Shark Tank.” Their delectable treats were already available in 7-Eleven stores. Seeking an investment of $250,000 to expand their reach further, they entered the Shark Tank. Mark Cuban and Barbara Corcoran decided to invest, which brought them even more success. So, what became of Sweet Ballz after “Shark Tank”?

Following their appearance on “Shark Tank”, McDonald filed a lawsuit against Egger alleging breach of contract. The complaint asserted that Egger attempted to purchase out not only McDonald but also Matt Landis, who had been with the company since its inception. Moreover, it was alleged that Egger manipulated the website Sweetballz.com to redirect users to Cakeballz.com, a site offering similar products. Subsequently, Sweetballz.com ceased to exist (although it has since been reinstated).

McDonald once sought a restraining order against Egger and their partnership disintegrated. Nevertheless, Sweet Ballz is often mentioned among Shark Tank products that didn’t succeed, not because they went out of business. The program is not just about securing an investment; it’s also valuable publicity. Unfortunately, Sweet Ballz struggled to utilize its time in the limelight effectively due to legal complications.

The Breathometer

Initially, Mark Cuban and other “Shark Tank” investors collectively invested a million dollars in Breathometer, a breathalyzer app-connected device that aimed to save lives by determining blood alcohol levels. However, Cuban later deemed it his worst investment ever. At the time of the show appearance by CEO Charles Michael Yim, the product appeared promising for success.

During a relevant precursor in the “Shark Tank” episode, there was a conversation about the precision and lawfulness of the product, which eventually led to Breathometer, Inc.’s downfall. Unfortunately, they faced issues with the Federal Trade Commission due to misleading advertising and false claims. For instance, Breathometer advertised that their device had undergone rigorous government-lab testing for accuracy in measuring blood alcohol content. However, it was discovered that no such tests were conducted. As a result, the company was compelled to offer refunds to all customers who purchased the product.

Breathometer, a company initially known for breathalyzers, transitioned briefly to producing a device for detecting bad breath. However, this idea didn’t attract as much investment as life-saving technologies. The appearance of Breathometer on “Shark Tank” serves as a reminder that even seasoned entrepreneurs should always thoroughly research before committing to any venture.

ToyGaroo

Subscription models for everything from TV streaming to clothing delivery have gained immense popularity today. Back in 2011, ToyGaroo was an exciting startup that pitched its unique concept on “Shark Tank.” Nikki Pope described their business model where parents would pay a monthly subscription fee to receive new toys every month. The plan was for kids to play with the toys until they lost interest, at which point parents could send them back and receive a fresh toy at a lower cost compared to continuously purchasing new ones. Mark Cuban and Kevin O’Leary invested $250,000, but what followed demonstrates how too much interference can potentially lead a business to failure.

In a conversation with Failory, Phil Smy, a developer at ToyGaroo, discussed the reasons behind the company’s collapse. It seems there were disagreements between ToyGaroo’s original team and new members from Cuban and O’Leary. Smy also expressed misgivings about their business strategies, stating that offering free shipping for toys, given their irregular shapes and sizes, was a mistake. He recalled that the team wanted to abandon the ‘free shipping’ policy, but the Cuban team was resolute in maintaining it. Ultimately, shipping and sourcing expenses proved too high for the company to handle, leading to its demise. Joining the list of companies from “Shark Tank” that no longer exist is ToyGaroo. When asked if there was anything he would change about ToyGaroo, Smy responded, “I wouldn’t have appeared on ‘Shark Tank.’

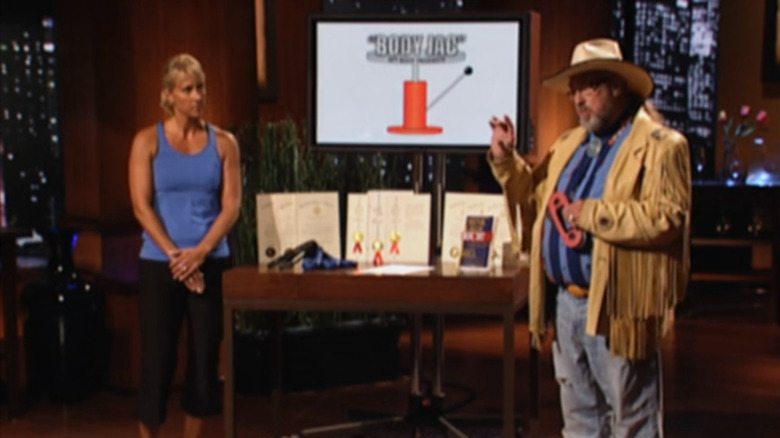

Body Jac

In a previous season of “Shark Tank”, Cactus Jack Barringer presented as one of the early pitchers an innovative workout device called the Body Jac, which was said to simplify push-ups. Barbara Corcoran and Kevin Harrington invested $180,000 in the product, with Corcoran adding a condition that Barringer must lose 30 pounds as proof of its effectiveness. Although he managed to achieve this goal, unfortunately, the Body Jac didn’t seem to have much success beyond that.

Unlike some products that failed to impress on “Shark Tank,” it seems unclear exactly why the Body Jac met with this fate, as it is no longer available for purchase. In a conversation with The Shark Tank Blog, Corcoran was rather cryptic when discussing Barringer, stating, “Should I invest once and lose my funds, like with Frank [Scozzafava of Mix Bikini], or with Cactus Jack, I also lost money on the Cactus Jack Body Jac. I admire them both; they’re both exceptional entrepreneurs, but I chose not to re-invest.

Corcoran no longer has her wealth, and Body Jac is no longer in existence. However, Barringer continues to share his knowledge. In March 2024, he delivered a talk at Iowa State titled “Outsmarting the Sharks,” offering insights into entrepreneurship. Despite being one of the enigmatic flops on Shark Tank, Body Jac remains a topic of intrigue.

Foot Fairy

Presenting an innovative product on “Shark Tank” that benefits people is always a winning move, earning applause from the guests. The Foot Fairy from Season 5 belongs to this group, as its creators, Nicole Brooks and Sylvie Shapiro, were seeking investment for an app designed to precisely determine a child’s foot size. This app aims to make it simpler to find well-fitting shoes, thereby reducing potential future foot problems. Mark Cuban proposed investing $100,000 for 40% equity, but the deal didn’t go through in the end.

It’s not shocking that the promised funds didn’t appear, given Cuban’s apparent reservations during the episode. He even expresses his frustration over the founders who frequently discuss their enthusiasm instead of concrete numbers. A few months after Foot Fairy appeared on “Shark Tank,” the company folded. It seems there were technical issues with the app on certain devices that caused problems for users. The Foot Fairy was intended to generate income via commissions through a partnership with Zappos, but the limited variety of shoes available within the app may have discouraged parents from purchasing directly from the company.

The Foot Fairy is no longer active, making it another failed business venture for Cuban on Shark Tank. Nowadays, there are numerous foot-measuring apps such as FootFact and FeetMeter, indicating that the concept had potential. However, it seems the execution was not quite right.

CATEapp

On the television show “Shark Tank”, CATEapp was criticized as a dishonest app because it conceals text messages from chosen contacts. This feature undoubtedly attracts individuals who prefer to keep certain actions private. Therefore, it’s not surprising that some sharks refused to invest due to ethical concerns. However, the potential use of CATEapp in helping undercover law enforcement and victims of domestic abuse who need to hide specific conversations was also highlighted. In the end, Neal Desai received an offer of $70,000 for a 35% stake from Daymond John and Kevin O’Leary.

On “Shark Tank” often, deals struck during the show don’t ultimately materialize. However, the app saw a surge in popularity after the episode, with an additional 10,000 downloads. Regrettably, this wasn’t sufficient to sustain the app, and it was removed from app stores soon afterwards. The reasons behind the company’s struggle are uncertain, but failing to secure the $70,000 investment may have been a fatal blow for the business, despite Desai valuing it at $1 million. Like Foot Fairy, CATEapp might have become just another app in its niche, as privacy concerns continue to grow in relevance with more and more personal data being stored on smartphones – from VPNs to apps that lock specific ones.

ShowNo Towels

Initially, I thought ShowNo Towels was destined to join the ranks of impressive “Shark Tank” successes. There I was, pitching my line of kid-friendly poncho-shaped towels, and Lori Greiner didn’t just invest $75,000 in my company – she even handed me a check right then and there. However, it wasn’t long before things started to go awry after that.

Ehler asserted that the following day, Greiner instructed her not to deposit that check, and it seemed like he also attempted to alter the agreement’s conditions. ShowNo Towels had a high point when they were sold at Disney waterparks, but that was the peak of their existence. The Disney partnership wasn’t perpetual, and eventually, the company ceased operations.

On her own blog, Ehler shared her thoughts on a past event, saying “At one point, I criticized my ‘Shark Partner’ for letting me go. However, now I express gratitude towards her. She imparted knowledge beyond what she intended and none of it was related to business matters. All lessons are valuable. When we accept them, we receive something precious in return!” Ehler has since transitioned into a career as a hypnotherapist.

Trunkster

Jesse Potash and Gaston Blanchet boasted that their innovative luggage brand, Trunkster, would revolutionize the travel industry on Season 7 of “Shark Tank”. They showcased their unique suitcases equipped with digital scales, USB ports, and GPS trackers. With a valuation of $28 million, Trunkster attracted the investments of Mark Cuban and Lori Greiner, who offered $1.4 million for 15% ownership of the company. Yet, despite this significant investment, Trunkster is no longer in operation today.

It might have been more advantageous for Cuban and Greiner not to finalize that deal, considering the fact that Trunkster’s valuation could have inflated due to their successful crowdfunding campaigns on Kickstarter and Indiegogo, where they managed to raise over $1 million. From the comments on Kickstarter, it seems that the company struggled to meet demand from the outset, with numerous customers complaining about not receiving their luggage and requesting refunds. It’s uncertain whether refunds were given, but Trunkster eventually went bankrupt.

Among Trunkster’s founders decided to pursue opportunities elsewhere. Blanchet, one of the co-founders, is now involved in Storypod, a different business endeavor that sought financial backing via Kickstarter. Interestingly, comments from Kickstarter backers suggest greater satisfaction with their investment in this new venture.

You Smell Soap

As a gamer who followed the journey of You Smell Soap on “Shark Tank,” I can tell you that despite striking a deal with Robert Herjavec, the company ultimately didn’t make it in the long run. The founder, Megan Cummins, showcased her luxury soaps to the sharks, and Robert offered a partnership where he would get 20% equity for $55,000, plus a $50,000 salary for Megan. It seemed like a fantastic opportunity for our thriving company, but after the taping ended, communication from Robert ceased for months on end.

After the TV show, Herjavec initiated a thorough investigation process. As with Megan, during this phase, new information is uncovered and adjustments are made. In this particular case, his adjustment included seeking 50% ownership, which Cummins declined. Ultimately, Cummins decided to sell the entire company to another investor, but it eventually closed down for business.

In a conversation with Billion Success, Cummins expressed that if she could do something differently on “Shark Tank,” she would have taken more time to consider Mark Cuban’s offer when Robert Herjavec was shaking her hand, as the events unfolded rapidly and left her without a chance to think. Now, Cummins manages an Etsy shop called Downloads That Donate, where customers can purchase adorable designs to download for use on t-shirts.

Hy-Conn

Operating a business isn’t a walk in the park, a lesson Jeff Stroope has surely grasped since his “Shark Tank” performance. The Hy-Conn provides a more straightforward method for linking firefighter hoses to fire hydrants, and it was evident to Mark Cuban that promoting such a product to fire departments nationwide would be profitable. Cuban proposed purchasing the entire company for $1.25 million, with Stroope receiving a $100,000 salary plus 7.5% royalties as part of the deal. This wasn’t a shabby offer, but Stroope suggested that Cuban attempted to modify the agreement post-episode, such as by granting licenses to other companies and essentially forcing Stroope out of the business.

The agreement between Stroope and Cuban collapsed, with Stroope pointing the finger at Cuban as the cause. Although it appears that the company is still in existence, a visit to Hy-Conn’s website reveals no merchandise for sale. The product page displays, “A major development is on the horizon! Our store is under construction and will be opening soon!” It doesn’t look promising for Hy-Conn at the moment, but maybe this could turn out to be one of those “Shark Tank” ventures that eventually finds success in the future.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD CNY PREDICTION

- USD JPY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-18 22:30