As a seasoned investor with a keen eye for market trends and a knack for spotting opportunities, I find myself drawn to the shifting landscape of digital assets, particularly Bitcoin. With my roots firmly planted in traditional investments like gold, I’ve seen the yellow metal hold its ground for centuries, but the rise of Bitcoin is a testament to the power of innovation and the relentless march of technology.

Since the U.S. presidential election, gold has faced pressure, whereas bitcoin has flourished, as experts anticipate a significant move towards cryptocurrencies due to a predicted shift in economic policies.

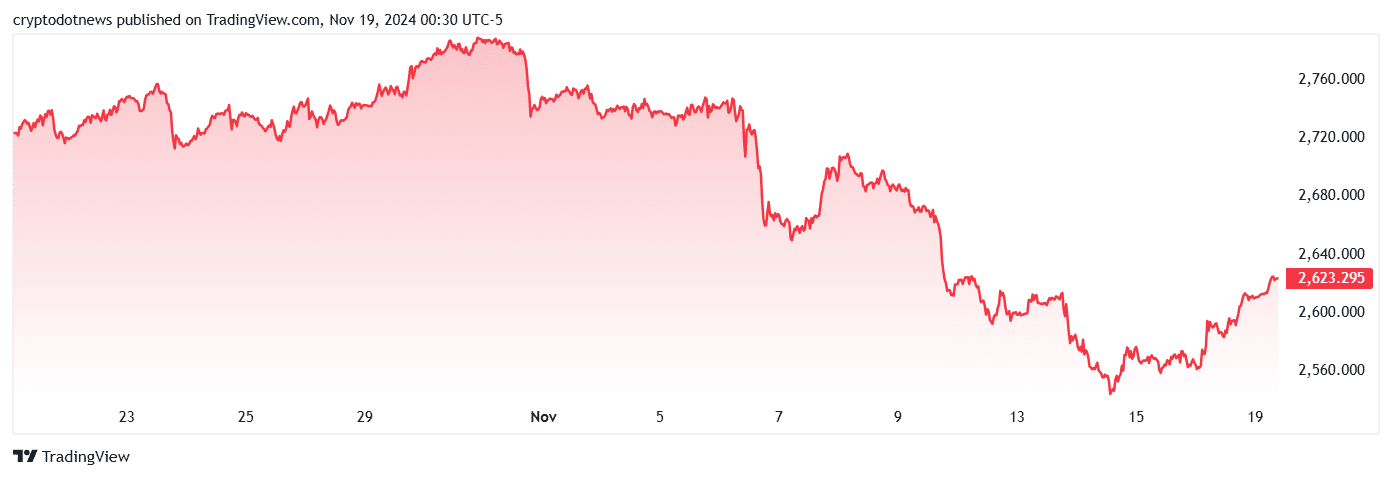

On November 14th, the principal investment asset often employed as a safeguard against inflation reached a one-month low of $2,543 – a dip that occurred just under 24 hours after the release of the US Consumer Price Index report. This report indicated an inflation rate in the United States of 2.6% for October, which was consistent with expectations.

Despite its recent surge to $2,623, gold is still down by 2.6% over the last 30 days.

Conversely, Bitcoin (BTC), often referred to as digital gold, soared to a record peak exceeding $93,400 mere hours following the release of the U.S. Consumer Price Index data.

Besides Bitcoin, reducing interest rate decreases might also cause U.S. Treasury bond returns to appear more attractive compared to gold.

As a researcher studying the impact of economic policies on digital currencies, I anticipate that the allure of gold may undergo a significant transformation with Donald Trump’s robust emphasis on taxation, tariffs, and cryptocurrency. The potential changes in these areas could influence investor behavior and preference towards assets like gold.

Though gold has been a reliable asset for over a century in dealing with inflation, the growing attention towards Bitcoin could potentially diminish gold’s role as a safe haven. In other words, this trend might cause investors to divert their funds from gold into Bitcoin, which could lead to a swift increase in Bitcoin’s value.

Yusupov told crypto.news.

According to the co-founder of Deenar, if the Federal Reserve adopts a more aggressive approach by increasing interest rates (taking a hawkish stance), it could help stabilize economic indicators. Yet, such action might diminish the allure of investing in gold.

Those seeking to spread their investments might opt for Bitcoin over other options due to its generally higher returns.

Yusupov says.

According to Yusupov, making the U.S. dollar stronger might pose a risk to gold in the future, as the need for investing in gold or alternative hedges may become less relevant over time.

On November 17th, Republican US Senator Cynthia Lummis suggested a plan to exchange some of the Federal Reserve’s gold holdings for Bitcoin, aiming to establish Bitcoin as part of our national reserve. As per Gold.org statistics from Q2 2024, the United States had approximately 8,133 metric tons of gold reserves on hand.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2024-11-19 10:02