As an analyst with over two decades of experience in the financial markets, I have witnessed numerous cycles of market euphoria and despair. The current surge in Bitcoin activity, as evidenced by whale accumulation and increased retail participation, is reminiscent of the dot-com bubble days. However, unlike that speculative frenzy, Bitcoin’s underlying technology has proven resilience and real-world utility.

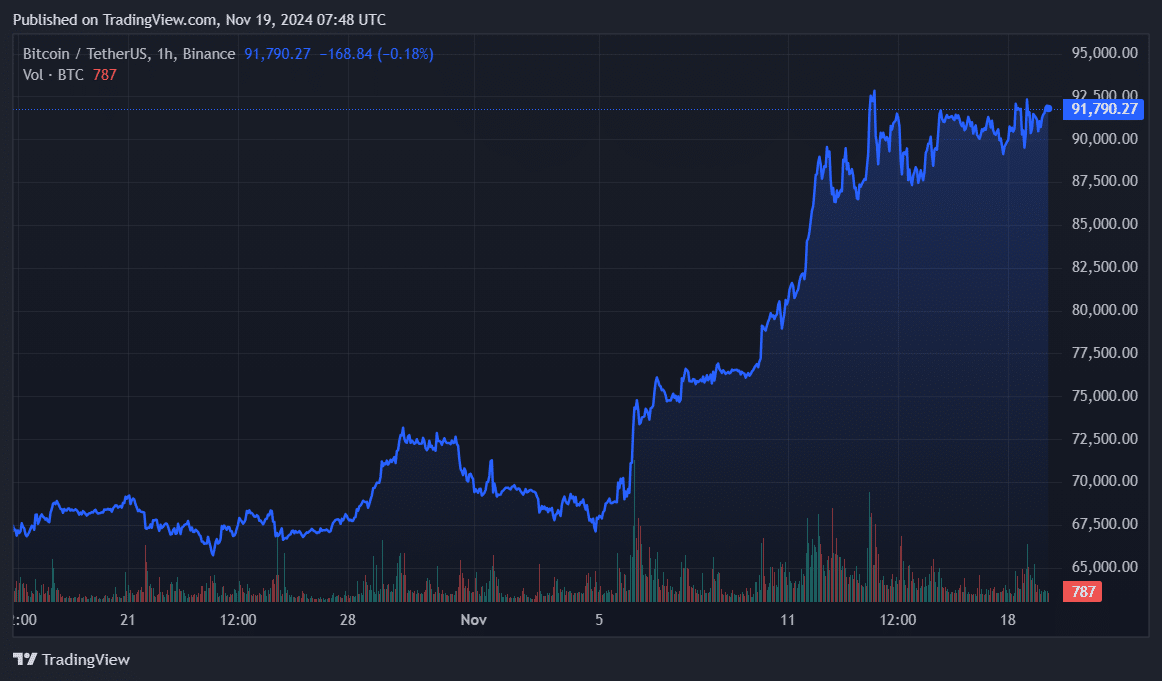

Recent increases in whale investments have brought Bitcoin very near to its record peak, with prices reaching just over $92,000.

On Monday, November 18th, as per IntoTheBlock’s data, substantial Bitcoin (BTC) wallets received approximately 21,470 BTC more than they sent out.

On that particular day, more than 23,000 unique whale transactions involving at least $100,000 worth of Bitcoin each, summed up to an impressive $78.37 billion. ITB data confirms this figure. Over the past week, the total value of such large-scale transactions surpassed $228 billion.

According to information from Arkham Intelligence, one of the major Bitcoin investors bought this digital currency on Binance and then moved it into a custodial wallet, holding approximately 2.2 billion dollars worth of Bitcoin.

As more whales become active in the market, it often triggers a sense of urgency among participants, leading to increased volatility within the cryptocurrency industry. This situation may result in conflicting indicators for traders, as they closely watch the potential achievement of the $100,000 milestone.

According to Bernstein Research, their prediction for Bitcoin’s price surge has been boosted from $150,000 to $200,000 by 2025. They attribute this anticipated rally mainly to two factors: potential regulatory adjustments and growing institutional interest in the asset.

Bitcoin is trading at $91,800 at the time of writing. Its market cap is sitting at $1.82 trillion.

Furthermore, ITB reports a 13% surge in the number of daily active Bitcoin wallets, bringing the total to approximately 818,910.

As a researcher, I’ve observed an intriguing trend: It appears that retail investors are actively engaging with blockchain technology, as evidenced by a staggering 63% increase in daily trading volume, reaching a significant figure of $75.2 billion.

Yesterday, one of America’s top business intelligence companies, MicroStrategy, increased its Bitcoin holdings by acquiring an additional 51,780 Bitcoins, valued at approximately $4.6 billion. As a result, the company now controls over 331,200 Bitcoins in total.

Immediately following a significant buildup, MicroStrategy disclosed intentions to procure an additional $1.75 billion by selling convertible senior notes in a private transaction, with the funds intended for purchasing more Bitcoin.

Further institutional endorsements might spark fear-of-missing-out (FOMO) among individual investors, potentially propelling Bitcoin’s value above the $100,000 threshold.

Keep in mind that if the Federal Reserve takes a more aggressive approach with interest rates (possibly increasing them), this could alter the trajectory of financial markets and potentially affect the value of Bitcoin.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Hero Tale best builds – One for melee, one for ranged characters

2024-11-19 11:24