As a seasoned researcher who has witnessed the tumultuous dance between global economies and financial markets, I find myself contemplating the potential impact of President Trump’s proposed tariffs on the crypto market with a mix of curiosity and caution.

President Donald Trump is proposing to apply a 25% tariff on all trade items originating from Canada, Mexico, and an extra 10% tariff on goods imported from China. What potential impact could these tariffs have on the cryptocurrency market?

On November 26, via his platform Truth Social, President-elect Trump declared that the existing international tariffs will continue until illegal drugs, particularly Fentanyl, and unauthorized border crossings (referred to as an “invasion”) cease within our nation.

During his presidential campaign, Trump consistently emphasized trade tariffs, particularly focusing on Mexico. He warned President Claudia Sheinbaum that he would impose tariffs of at least 25% unless she took steps to combat the influx of criminals and drugs flowing across the border.

In another announcement, he additionally warned of implementing a 10% surcharge on all goods imported from China, casting blame on them for failing to execute capital punishment for fentanyl traffickers. The tariffs Trump proposed would be added to the existing taxes that Biden had already enforced during his presidency.

As a researcher studying global trade dynamics, I cannot stress enough the potential implications of President Trump’s tariff policies. These measures might cause a significant rise in the prices of various goods, potentially throwing off the balance of businesses worldwide and contributing to an increase in inflation rates on a global scale.

How do tariffs affect the crypto market?

Tariffs, which involve increasing the tax on imported goods, serve as a financial means to shield domestic industries. This price hike can impact international trade relationships and global fiat currencies significantly. Interestingly, tariffs may also influence the crypto market indirectly.

With higher tariffs causing imported goods to become pricier, the quantity of imports might decrease, thereby advantageous for local businesses. However, this shift could result in a rise in consumer costs due to increased product prices alongside decreased demand, a sign of potential inflation.

Additionally, it’s worth noting that the trade disputes resulting from imposing tariffs could potentially bring about economic instability. This is evident in the way the U.S dollar increased by 0.4% after Trump’s tariff announcement, while the currencies of countries such as Canada, China, and Mexico experienced a minor decline.

Historically, economic turbulence stemming from inflation and trade disputes between the U.S and China have made traditional financial markets unpredictable. In response to this uncertainty, traders have tended to look towards alternative investments like Bitcoin (BTC) as a means of escaping the volatility associated with more conventional assets that are likely to be impacted by trade conflicts. This is why Bitcoin is frequently referred to as a “safe-harbor” or “safe-haven” asset by investors.

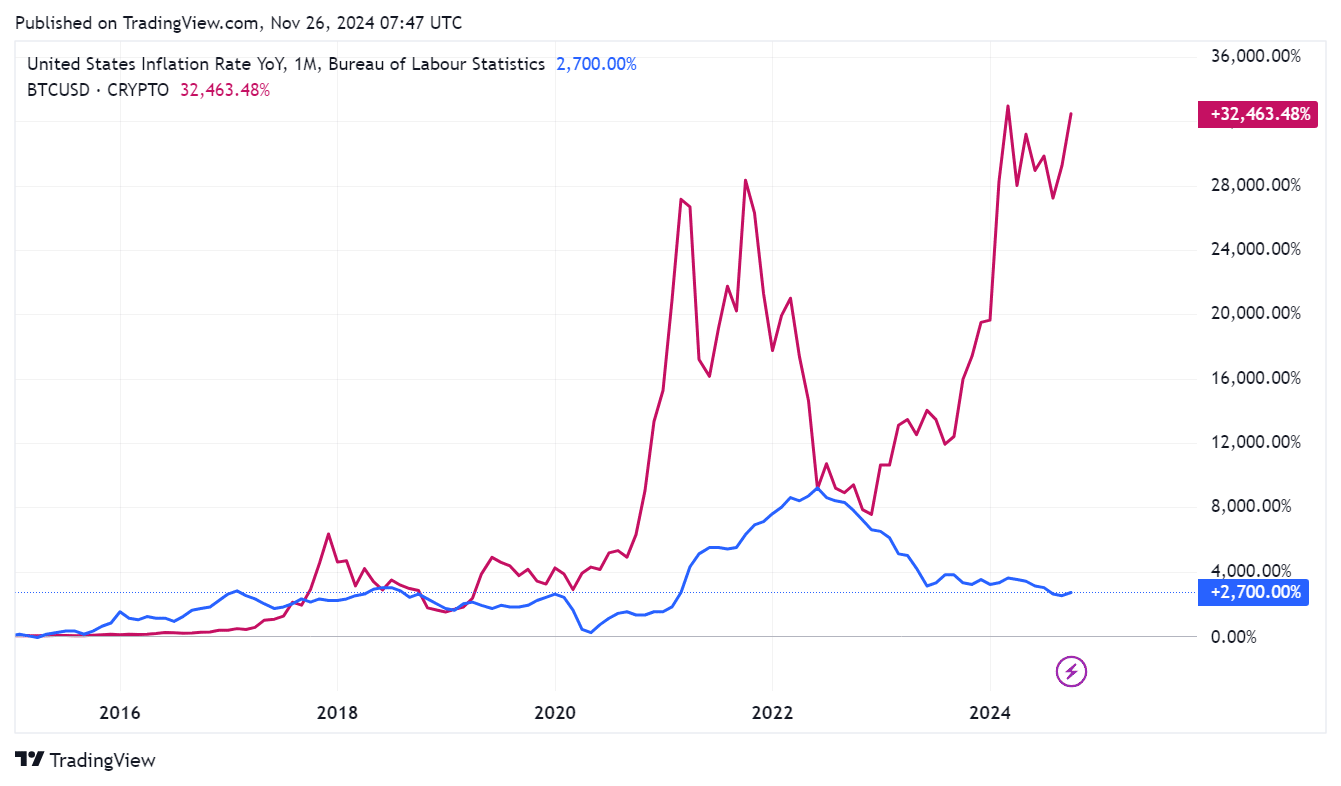

Despite the damaging effects of inflation on a country’s economy, it appears there’s a correlation between inflation and the growth of Bitcoin. To illustrate this, let’s consider the U.S.-China trade war from 2018 to 2020. The U.S imposed higher costs on technology and electric vehicles imported from China, which in turn caused instability in the market. In response, investors increasingly turned to Bitcoin as a means of safeguarding their funds during these volatile times, resulting in an upward trend in Bitcoin prices.

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-11-26 13:35