As a seasoned crypto investor with a knack for spotting trends and patterns, I’ve seen my fair share of market ups and downs. The recent bullish engulfing candlestick pattern on Stellar (XLM) has caught my attention. After a rough couple of days that pushed XLM into a local bear market, this strong reversal is a welcome sight.

The XLM price staged a strong comeback on Nov. 27, forming a bullish engulfing candlestick pattern.

In simpler terms, Stellar (XLM), which is the second-largest digital network focused on payments following Ripple (XRP), reached its highest point of the day at $0.5311. This increase marked a reversal from a two-day decline that had driven it into a temporary downturn, often referred to as a local bear market.

Stellar’s resurgence occurred simultaneously with the wider cryptocurrency market recovery, where even Bitcoin (BTC) and significant coins such as others experienced a similar upswing.

As an analyst, I’m delighted to report that Stellar’s Decentralized Finance (DeFi) ecosystem has been thriving this week. According to DeFi Llama, the total value locked within Stellar’s DeFi sector has surpassed previous records, reaching a staggering $56 million and counting.

Approximately $300 million worth of total assets are almost reached within the Stellar ecosystem, encompassing those tied to the Real World Asset tokenization sector. This expansion is primarily fueled by the Franklin Templeton OnChain US Government Money Fund, which has amassed more than $400 million in accumulated assets.

In addition to Stellar’s key decentralized applications, there are other notable ones like trading platforms on the blockchain, such as LumenSwap, Aquarius for Stellar, and Scoputy.

The rise in Stellar’s price was further bolstered by indications of regulatory clarification in the United States. Lately, a court decision stated that the Office of Foreign Assets Control (OFAC) exceeded its jurisdiction when imposing sanctions on Tornado Cash, as autonomous software cannot be categorized as property.

In recent times, U.S. courts have delivered decisions beneficial to the cryptocurrency sector. For instance, last year, a judge decided that XRP was not classified as a financial security. Consequently, Ripple was mandated to pay $250 million instead of the $2 billion sought by the SEC. These events, coupled with Trump’s re-election, have sparked discussions about the possibility of an XLM Exchange Traded Fund (ETF) in 2025.

XLM price forms a bullish engulfing

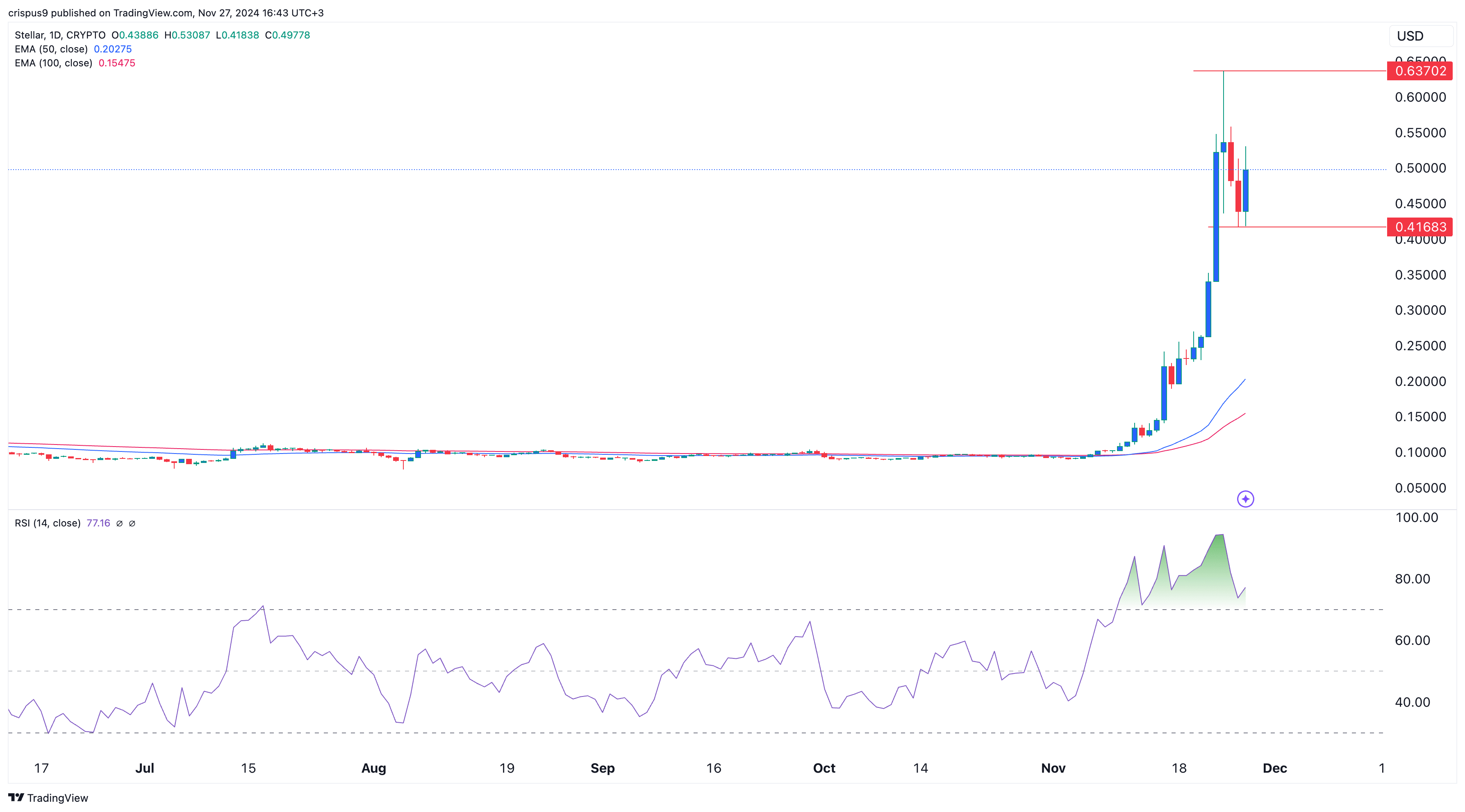

A week ago, we published an article forecasting that Stellar’s price would experience a significant downturn, and indeed it did. On November 26, the price of Stellar dropped to a low of $0.4168, marking a 35% decrease from its peak this year. Since then, it has shown signs of a bullish reversal with the formation of a candlestick pattern known as a ‘bullish engulfing,’ which is typically a strong indicator of a price trend change. This pattern occurs when a large bullish candlestick completely envelops a preceding bearish one.

If Stellar Lumens’ closing price surpasses $0.50, that would confirm the engulfing pattern and suggest potential growth. In such a case, the price might reach towards its highest point this year, which was approximately $0.6370, a level it attained earlier in May.

On the other hand, it’s important to note that this recovery might just be a short-lived surge known as a “dead cat bounce,” which occurs during a prolonged downtrend. If the price drops below $0.4168, pessimistic sentiments are likely to grow stronger.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Every Upcoming Zac Efron Movie And TV Show

- Grimguard Tactics tier list – Ranking the main classes

2024-11-27 17:17