As a seasoned analyst with years of experience observing the cryptocurrency market, I find myself intrigued by the current state of Pepe (PEPE). While it has taken a 27% tumble from its yearly high, the ongoing whale activity and exchange supply suggest that we may be witnessing the early stages of an uptrend.

The price of Pepe coin has dropped more than 27% from its peak this year, yet persistent whale activity and exchange supply could potentially drive it upwards.

On Wednesday, November 27th, the digital currency PEPE, known as the third largest meme coin, was being exchanged for approximately 0.0000187 US dollars per unit. This trading activity elevated its total market value to an impressive figure surpassing 7.8 billion dollars.

According to data from Nansen, a leading analytics platform, Pepe coins held on exchanges amounted to approximately 239.84 trillion, marking a decrease of 1.46% compared to their levels a week ago. This figure represents around 57% of the total supply of these coins.

According to Nansen’s findings, it appears that the majority of these digital coins are being held on platforms such as Binance, Bybit, OKX, Crypto.com, and Robinhood. Furthermore, the data indicates that over $9.19 million worth of Pepe tokens were withdrawn from centralized exchanges (CEX) within the past 24 hours.

In the world of cryptocurrencies, an increase in crypto assets being withdrawn from exchanges is often viewed favorably, as it indicates that many investors intend to keep their investments for a longer period.

As a crypto investor, it’s intriguing to see the ongoing trend of whale activity in Pepe. Yesterday alone, one of these significant investors purchased coins valued at approximately $2.7 million. Meanwhile, another whale transferred coins nearly equal to $1 million from Binance. This kind of movement suggests potential bullish sentiment towards Pepe, and it’s exciting to observe such developments.

Another factor that could influence Pepe coin’s price is its high trading volume relative to other meme coins. In the last 24 hours, it traded a significant amount of around $2.9 billion, placing it second only to Dogecoin (DOGE) with its $8 billion in daily trading volume.

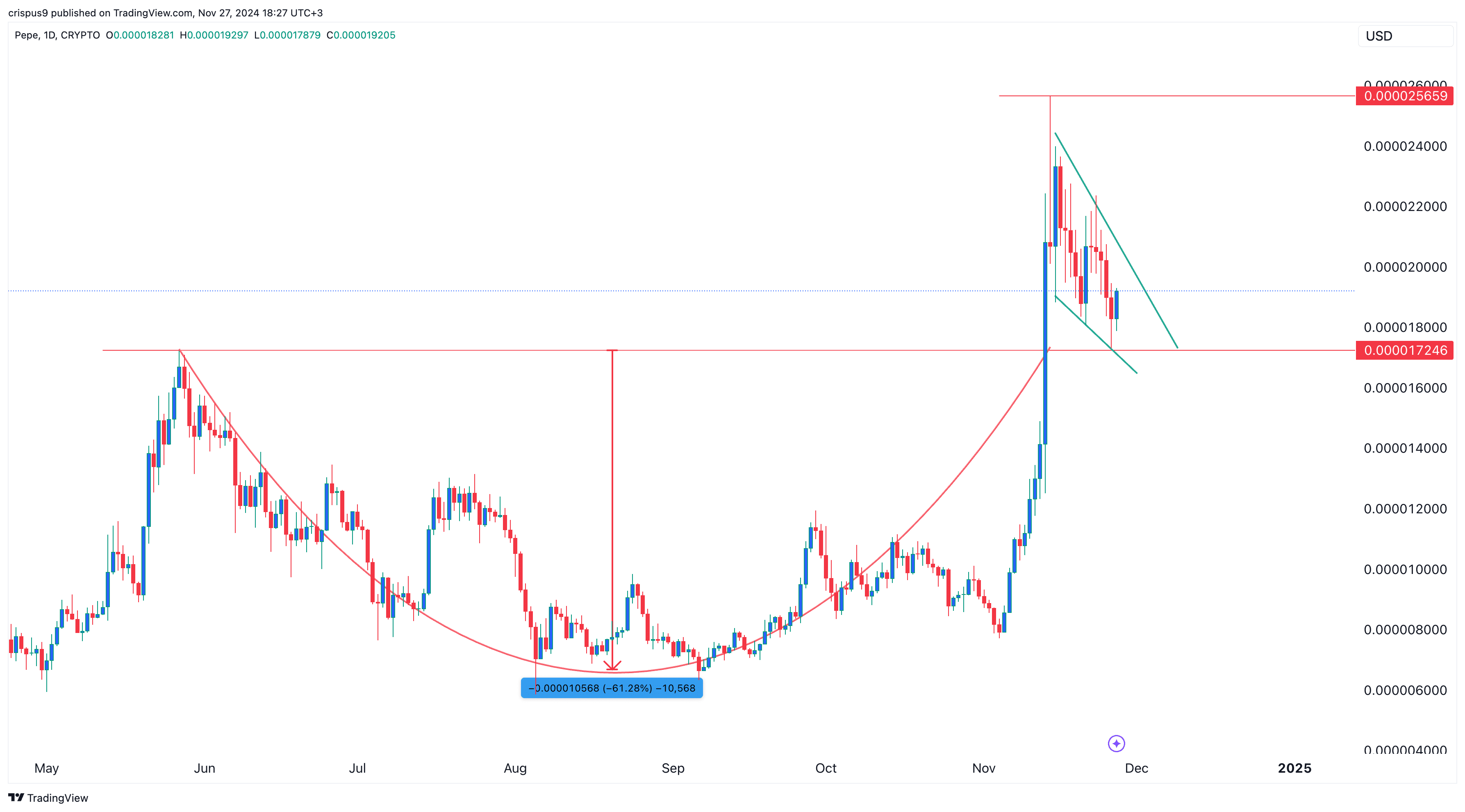

Pepe price break and retest completes

Essentially, Pepe’s price movement has followed a typical pattern known as a “break and retest.” This is when the price climbs above a significant resistance level, then falls back to test that same level again. Often, this is a signal that a bullish trend will continue. Recently, Pepe dropped but tested its support at $0.0000172, which was its highest point in March 2024 and also the upper boundary of the “cup and handle” pattern.

By gauging the depth of the cup, we arrive at an approximate forecast for the next Pepe price, set at $0.000028 – representing a 45% rise compared to the present value. Additionally, bolstering the optimistic outlook are the development of a falling wedge chart pattern and a small morning star formation.

A wedge, which is shown in green above, is made up of two falling and converging trendlines and is a popular bullish reversal pattern. A morning star is a candlestick pattern that has a small body and upper and lower shadows. These patterns point to a potential bullish breakout in the next few weeks. The initial target will be the year-to-date high of $0.000025, followed by $0.0000172.

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

2024-11-27 18:54