As a seasoned crypto investor with over two decades of market experience under my belt, I find Michael Saylor’s relentless pursuit of Bitcoin for MicroStrategy absolutely captivating. The strategic moves he’s made have not only transformed the company but also sent shockwaves throughout the crypto world.

Shortly after advocating for Bitcoin to Microsoft, Michael Saylor revealed that MicroStrategy had made a substantial Bitcoin investment.

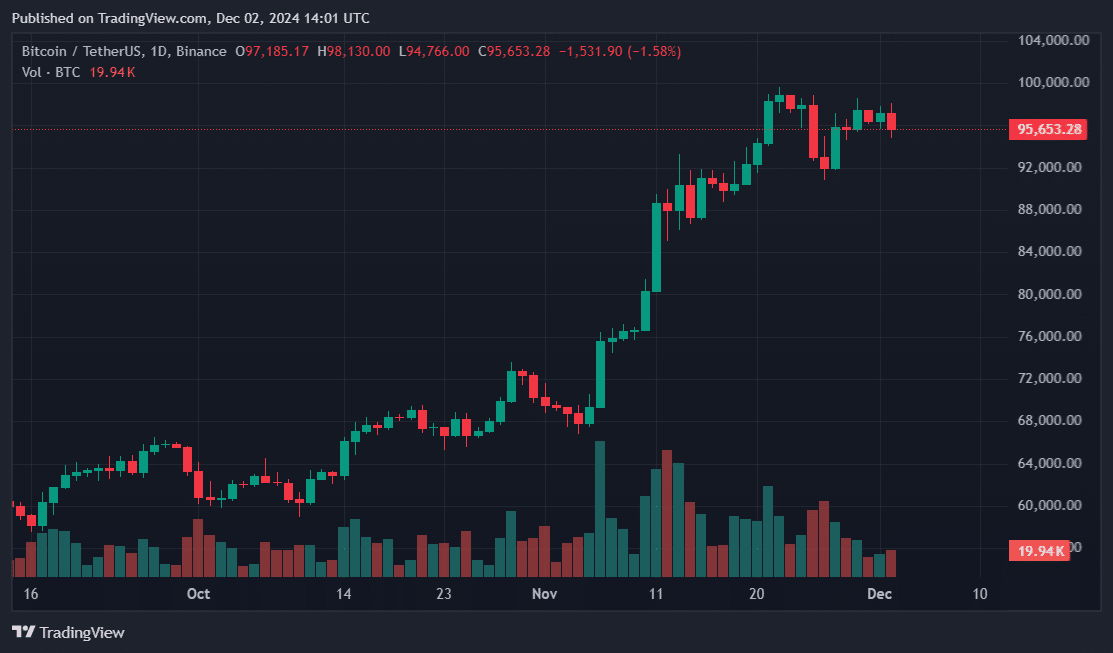

On December 2nd, it was disclosed that MicroStrategy purchased 15,400 Bitcoins (BTC) for a total of $1.5 billion, which equates to approximately $95,976 per coin. This purchase boosted MicroStrategy’s Bitcoin holdings to around 402,100 BTC, giving them a value exceeding $38 billion as the press release was issued, with Bitcoin trading at roughly $95,194 at that time.

I’ve personally invested a whopping $23.4 billion in Bitcoin through MicroStrategy, with an average price of approximately $58,263 per coin. This move has brought us substantial returns, as our holdings have yielded over $15 billion in unrealized gains since we started buying Bitcoin back in 2020.

MicroStrategy’s Bitcoin playbook

MicroStrategy has obtained financing for its Bitcoin acquisitions through the selling of shares and issuance of securities. They’ve introduced a new metric called “BTC Yield” to assess the growth of their Bitcoin holdings in comparison to share dilution. As reported by Saylor, MicroStrategy’s BTC Yield amounts to 38.7% for the current quarter and 63.3% for the year so far.

Other businesses, such as Metaplanet from Tokyo and Bitcoin mining company Marathon Digital, have been influenced by the company’s strategy. Notably, they’ve both followed a similar path in funding their Bitcoin purchases. In fact, Metaplanet has gone a step further by planning to give Bitcoin as a reward to its shareholders who hold onto their stock.

Just prior to Saylor’s revelation, Marathon had announced plans for a private offering of convertible notes worth approximately $700 million, with an additional extension option of $105 million. According to Marathon, the funds raised would primarily be used to purchase more Bitcoin and initiate the repurchase of these notes, similar to their past Bitcoin-centric fundraising efforts.

Saylor, a dedicated supporter of Bitcoin, persists in championing its use. Recently, he presented Bitcoin to Microsoft’s governing body, further establishing himself as a key influencer in the realm of corporate Bitcoin investments.

My 3-minute presentation to the $MSFT Board of Directors and @SatyaNadella, articulating why the company should do the right thing and adopt #Bitcoin.

— Michael Saylor⚡️ (@saylor) December 1, 2024

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

2024-12-02 17:26