As a seasoned investor and crypto enthusiast with over a decade of experience under my belt, I find myself constantly on the lookout for promising altcoins that could potentially yield significant returns. After careful analysis and consideration, I’ve compiled a list of 10 altcoins that I believe have strong potential this cycle.

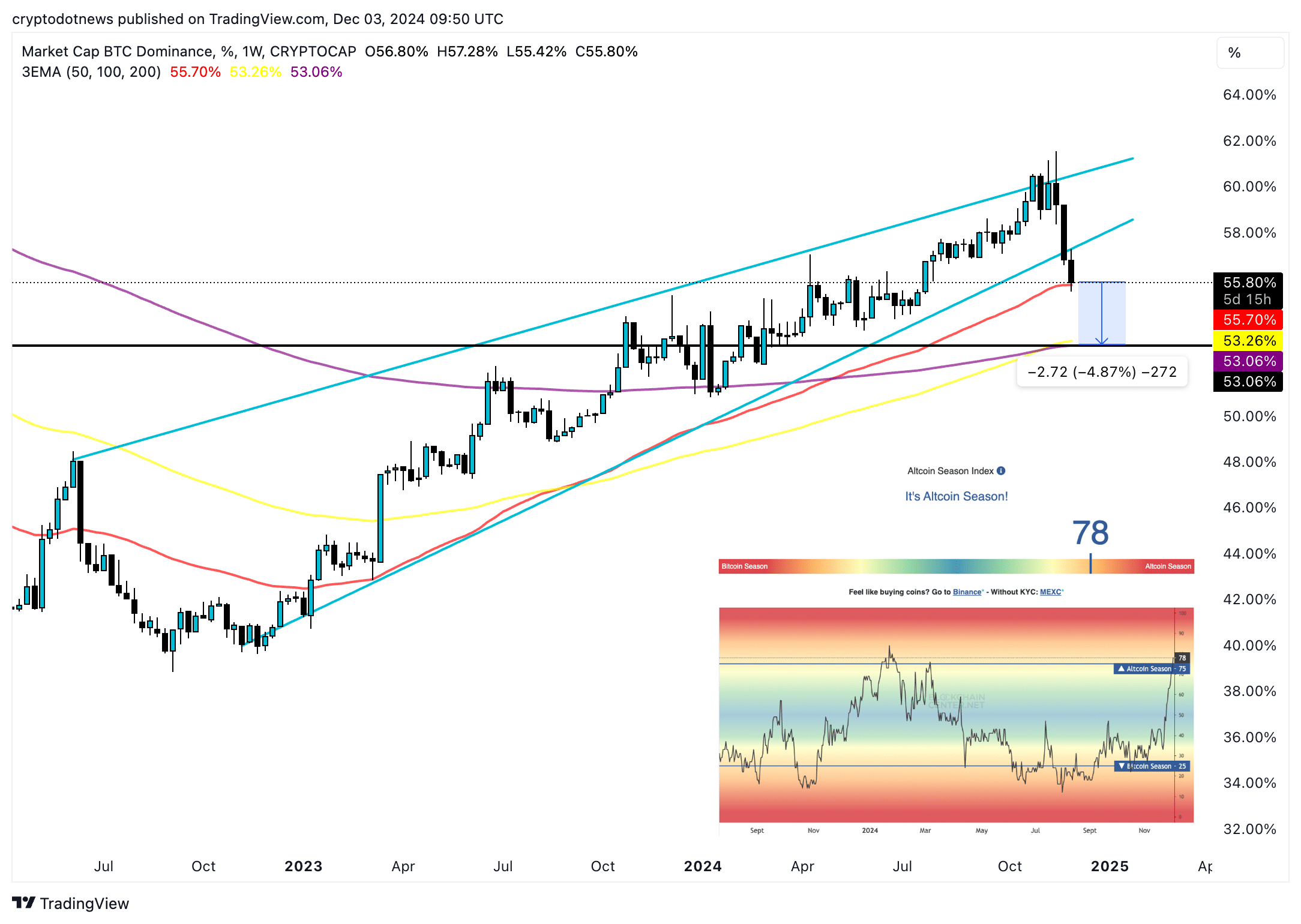

As a researcher, I’ve noticed an interesting shift in the cryptocurrency market: The dominance of Bitcoin has dipped to 55.81%, down from its peak of 61.53% in November 2024. This decrease in Bitcoin’s dominance seems to be opening up opportunities for altcoins, with more than 75% of the top 100 altcoins consistently outperforming Bitcoin. I find myself intrigued by this development and feel it’s worth exploring further. So, let’s delve into the top 10 altcoins that could be a good buy for beginners in December 2024.

Table of Contents

Why Bitcoin dominance matters to altcoin traders

As an analyst, I’d express it this way: The Bitcoin (BTC) Dominance represents the proportion of the overall crypto market’s value that’s held by Bitcoin. This metric is crucial for traders because it aids in understanding the distribution of capital between Bitcoin and other digital currencies, often referred to as altcoins.

Approximately 55.81% of the entire cryptocurrency market value can be attributed to Bitcoin, with the remaining portion probably being invested in other cryptos, often referred to as altcoins. During bull markets, a decrease in Bitcoin’s dominance is typically an indicator that returns on altcoins might be higher. Consequently, Bitcoin’s dominance serves as a tool for identifying potential trading opportunities in altcoins.

Bitcoin’s dominance unexpectedly plummets, indicating the beginning of an ‘altseason’, a phase when more than 75% of the top 100 alternative cryptocurrencies consistently surpass Bitcoin over a 90-day span. This change is due to a redirection in investment capital, and traders take advantage by reducing their Bitcoin holdings and instead investing in high-liquidity altcoins.

According to the Bitcoin dominance graph on TradingView, there’s about a 53% chance that Bitcoin could decrease by almost 5%, reaching a point where its 100 and 200-day Exponential Moving Averages (EMAs) intersect.

What makes an altcoin worth investing in

To maximize profits during an altcoin season, new investors should keep these five factors in mind before purchasing an altcoin, using them as a guide or checklist.

Fundamental use case and utility

The purpose of the real-world use case of an altcoin is one of the most important points to consider before buying a token. Questions to consider are: what is the real-world use case? How do blockchain technology and the token simplify an existing problem? What is the unique value proposition of the altcoin?

Among the digital currencies in the top 100 by market value, Polygon (MATIC) and Chainlink (LINK) meet specific requirements and stand out. Polygon serves as a layer-2 scaling solution, allowing for quicker and more affordable transactions for users while leveraging Ethereum (ETH) as its primary security foundation.

Chainlink enables smart contracts to access real-world data, offering versatility within both conventional and decentralized finance systems, as well as cryptocurrency exchanges and banking institutions.

Investing in tokens without any practical value can lead to temporary profits, but when the excitement around the project fades, the majority of investors often end up with losses that weren’t realized beforehand.

Market capitalization and liquidity

An altcoin’s market capitalization is a measure of the size and relevance of the project among traders. Large market cap projects like Ethereum, Binance Coin (BNB) are typically considered safer than other altcoins, the potential of price gains is low to moderate in most cases. But mid to small-market cap projects, meme coins on Base, and Ripple (XRP) have a relatively higher potential for gains with higher risk.

Liquidity ensures traders have an out in the case of large price swings or corrections.

Litecoin, represented by the symbol LTC, is a well-established alternative cryptocurrency that boasts strong liquidity. It’s often referred to as the “silver” to Bitcoin’s “gold” ever since it was first introduced.

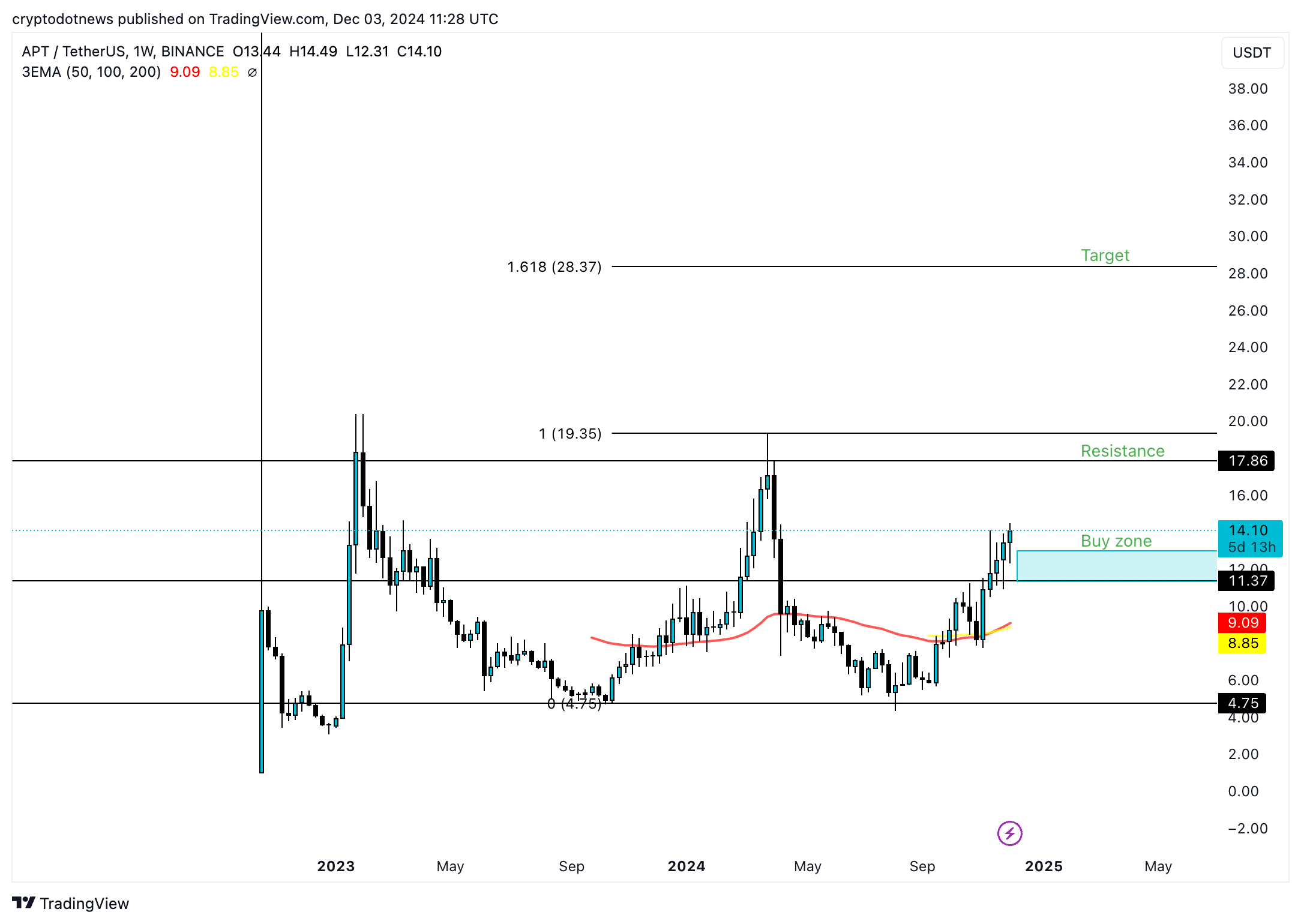

Aptos (APT) is a mid-market-cap token focused on scalability and security.

Development activity and team transparency

Assessing the dedication of the team responsible for the project and monitoring its progress are essential actions to guarantee that the token is backed by a committed workforce.

Monitoring the advancement of the roadmap, assessing the team’s reputation within the blockchain sphere, and keeping tabs on discussions about the project in places like Discord or elsewhere are also valuable strategies.

Within the cryptocurrency realm, Cardano (ADA) stands out for its scholarly, methodical approach and boasts an extremely dynamic developer community.

Optimism (OP), a scaling solution on the Ethereum network, regularly undergoes updates and boasts a development team that operates with transparency.

Community support and adoption

Many meme coins that are often criticized for their lack of practical use make up for it by having a robust online community as their foundation. This is apparent through various indicators such as active addresses, high trading volumes, involvement in burn or staking events, and announcements about upcoming airdrops.

Coins that aren’t Bitcoin (alternative cryptocurrencies) often receive more backing from the community if they have a larger presence on platforms like Reddit, X, or Telegram. Keeping an eye on partnerships and integrations of these projects can help determine how relevant and widely adopted their token is within the market.

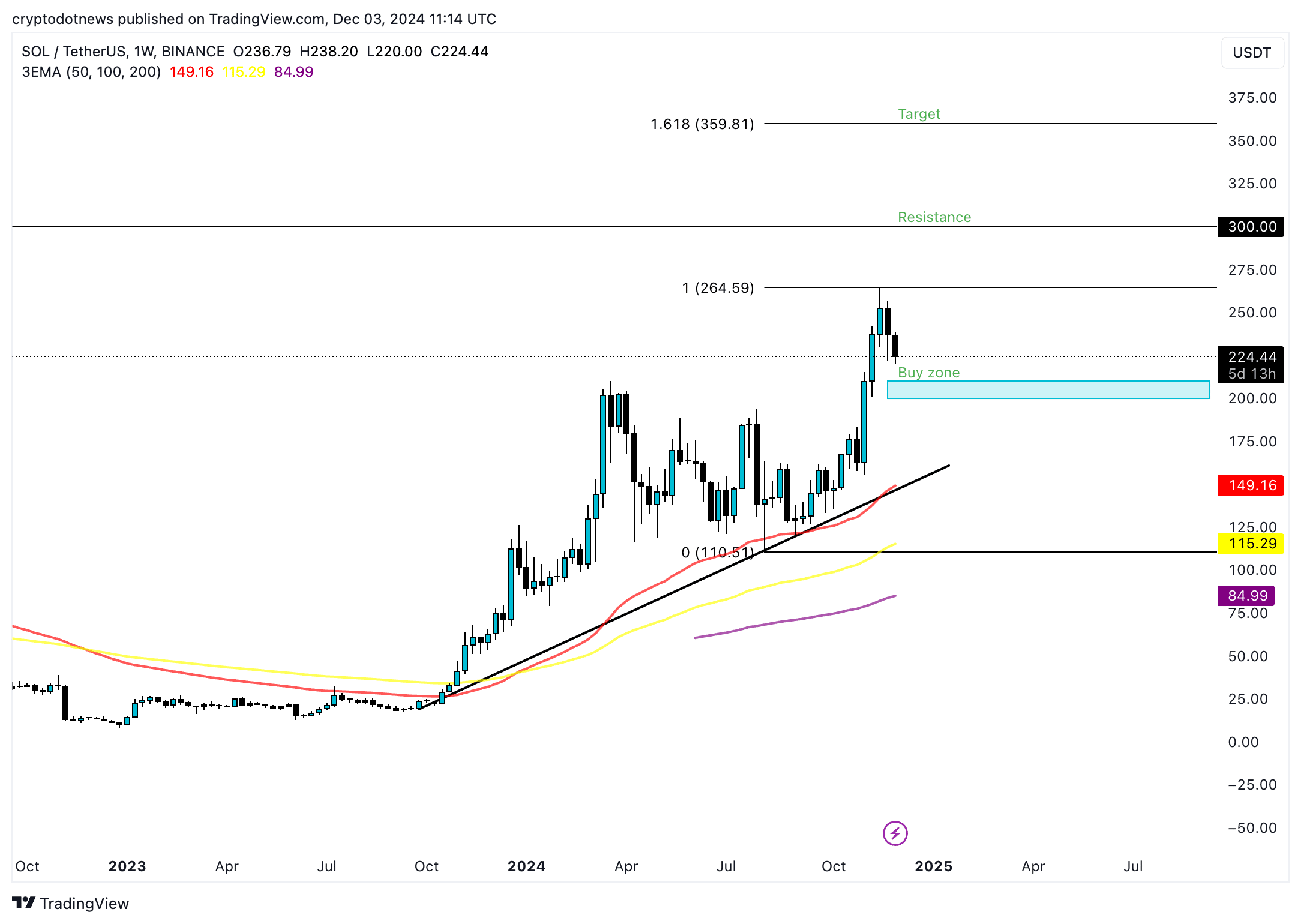

In the recent market cycle, Solana (SOL) has provided holders with returns exceeding ten percent. Furthermore, it surpassed Ethereum in terms of transaction volume on decentralized exchanges and protocol earnings during October and November 2024.

Initially, Dogecoin (DOGE) was born from a humorous internet meme, but its dedicated community has played a significant role in expanding its use beyond jokes. This expansion includes facilitating microtransactions and tips within the larger cryptocurrency market.

Risk management: Volatility and regulatory landscape

As a newcomer to the world of crypto investing, it’s crucial for me to understand that altcoins generally carry more risk than Bitcoin. To evaluate this risk, I should look at their historical price movements to gauge volatility. Furthermore, I need to check where these altcoins are listed on exchange platforms. Ideally, these platforms should have clear listing criteria, ensuring a certain level of quality and credibility. Additionally, I should research any ongoing or past legal issues in the U.S. and other economies that might impact the altcoin’s value or reputation.

Despite continuous regulatory examination, XRP is experiencing an upsurge, due to its popularity as an alternative coin for international transactions and its practical application within the XRP Ledger, which offers a distinct advantage for such purposes.

Stellar (XLM), much like XRP, primarily concentrates on facilitating cross-border transactions and the advancement of central bank digital currencies. It strives to maintain a clear understanding of regulatory requirements in this field.

Top 10 altcoins to buy in December 2024 to prepare for 2025

Solana (SOL)

In simpler terms, Solana is a digital token similar to Ethereum, but it’s currently outshining Ethereum in various aspects this year, such as transaction volume on decentralized exchanges, revenue generated by its protocol, and the number of active users daily. This has led to a popular discussion that Solana might surpass Ethereum in terms of market value, a scenario often referred to as “flipping,” where the market capitalization of Solana exceeds that of Ethereum.

For traders who have been holding back, a good range to consider purchasing could be between approximately $200 and $210. This level serves as a resistance due to the 2024 peak and the psychologically significant $300 mark. The long-term goal is for SOL to reach $359 when it starts exploring new pricing territories in this particular cycle.

Ethereum (ETH)

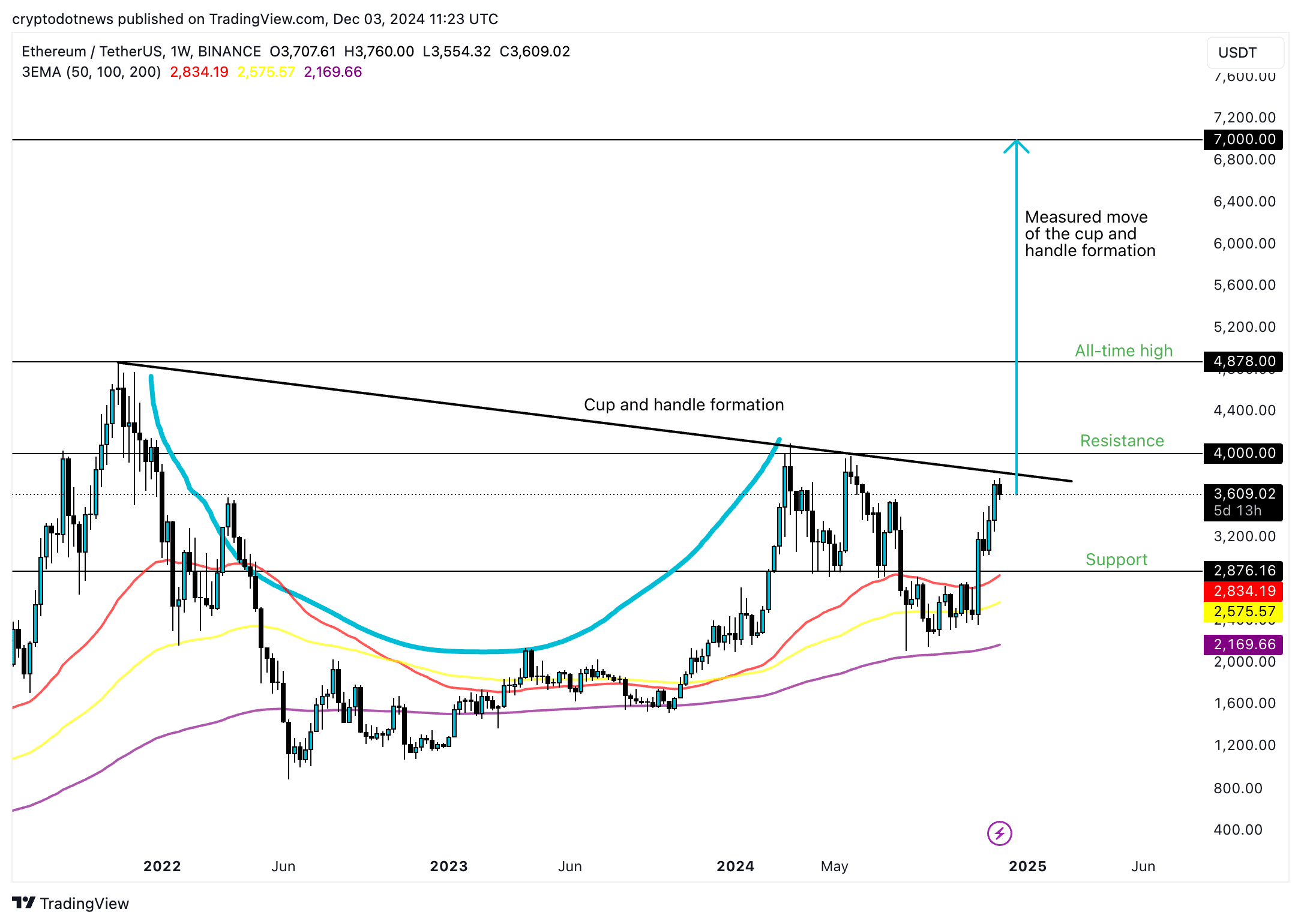

It’s predicted that Ethereum might surpass Solana for now, according to data from derivatives trading sites such as Binance. The Ethereum-to-USD Tether weekly price graph indicates a ‘cup and handle’ pattern, suggesting a potential future price of around $7,000.

As a crypto investor, I’ve been eyeing the perfect entry point for Ether, and my research indicates that a buy zone exists between $3,200 and $3,600. It’s important to note that the all-time high and a crucial resistance level are at $4,878, so it might be wise to keep an eye on these prices before making a move.

Aptos (APT)

In its weekly pricing structure, Aptos appears to be shaping a cup-and-handle pattern. This pattern indicates a potential buying opportunity for traders who have been waiting on the sidelines or are new entrants, with a suggested range of around $11.37 to $13.50. The significant resistance level is set at approximately $17.86, beyond which lies the projected target price of $28.37 for this cycle.

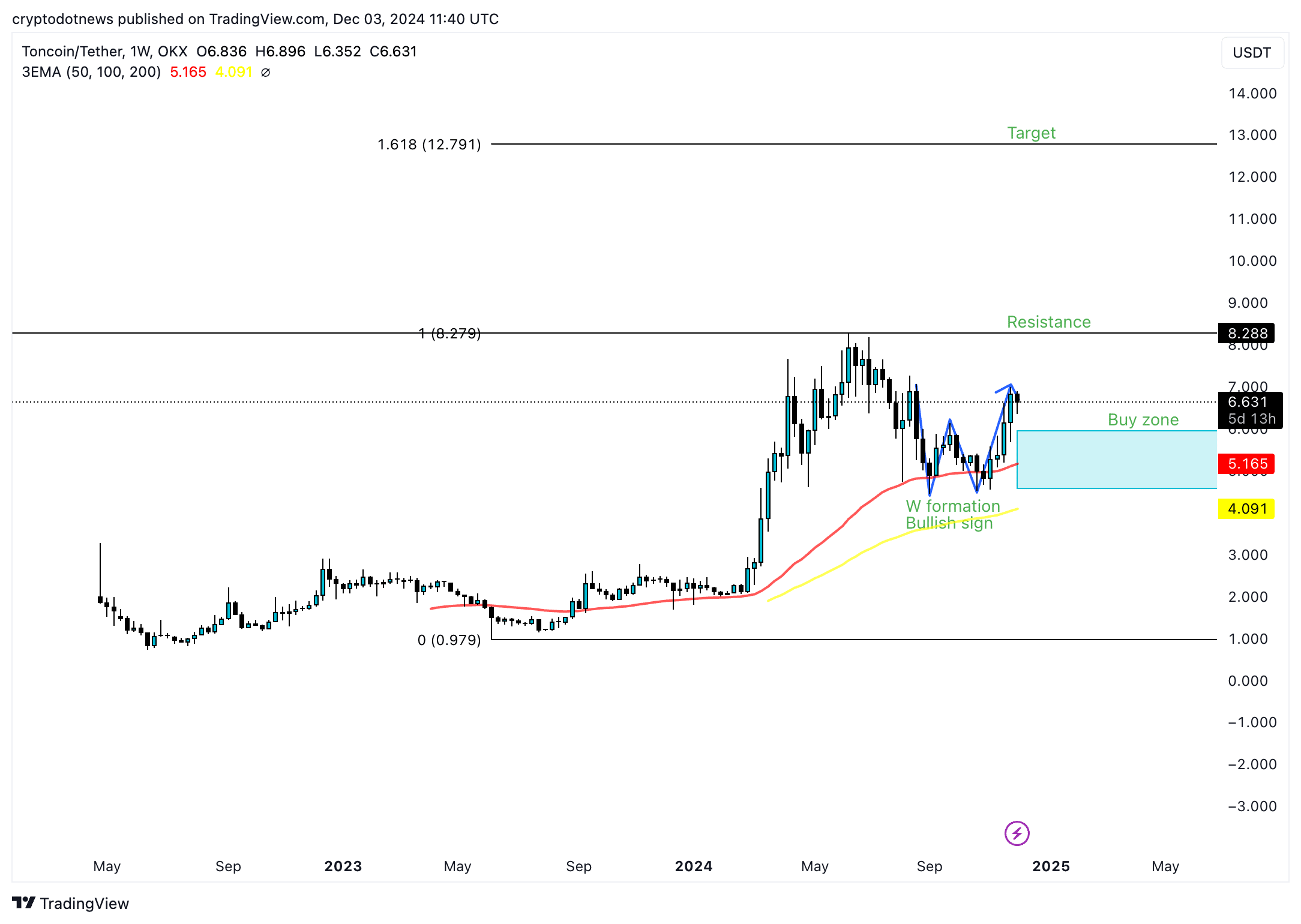

Toncoin (TON)

Toncoin’s weekly price chart shows a W-shaped pattern, indicating potential buying opportunities between approximately $4.091 and $6. However, Toncoin may encounter resistance at around $8.288. The forecast for this cycle points towards the 1.618 Fibonacci retracement level of the rally from the May 2023 low to the 2024 peak, which is estimated to be around $12.791.

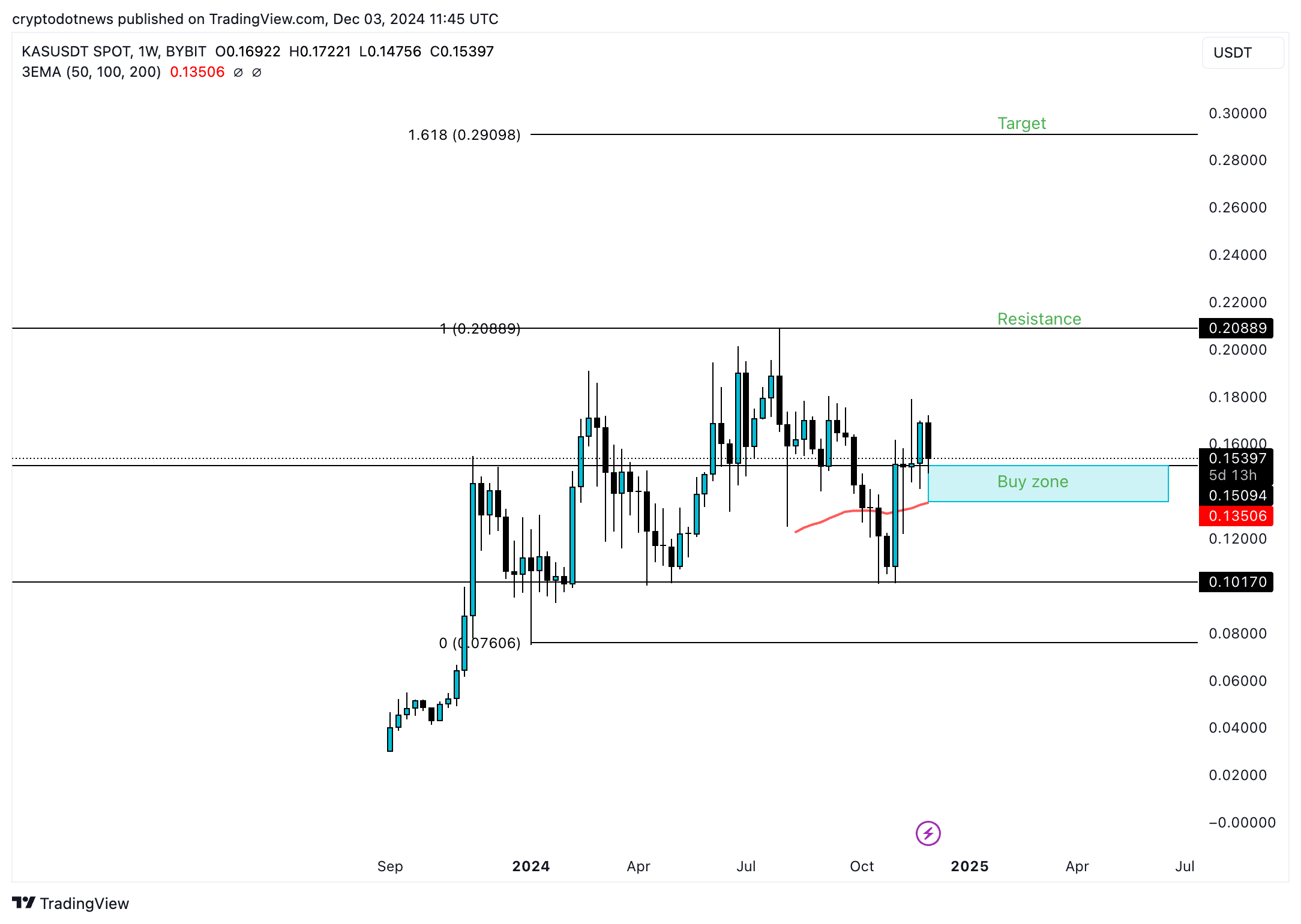

Kaspa (KAS)

Kaspa’s potential buying range lies between approximately $0.13506 and $0.15397, according to its 50-day Exponential moving average. If the trend continues, KAS might reach its resistance at around $0.20009 and potentially even hit its target of $0.29098. This Layer 1 token could see further growth during this cycle as it follows Bitcoin’s lead along with other altcoins.

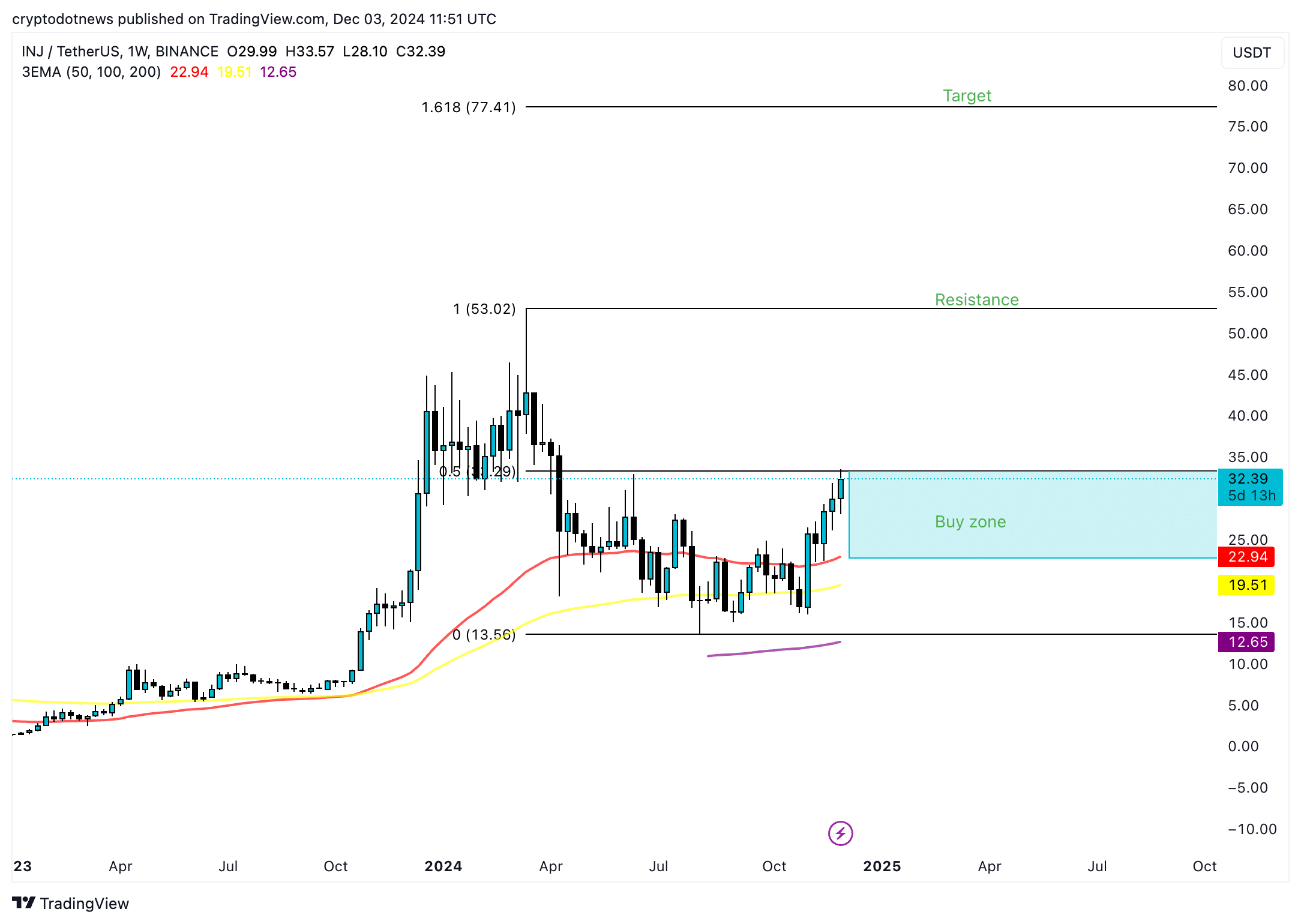

Injective (INJ)

For the Injective token within the AI sector, its ideal purchasing range lies between its 50-day Exponential Moving Average (EMA) at approximately $22.94 and $32.39. However, Injective may encounter resistance at its previous high of around $53.02, with a projected cycle target at $77.41. Additionally, the 161.80% Fibonacci retracement level for the rally is also situated at $53.02.

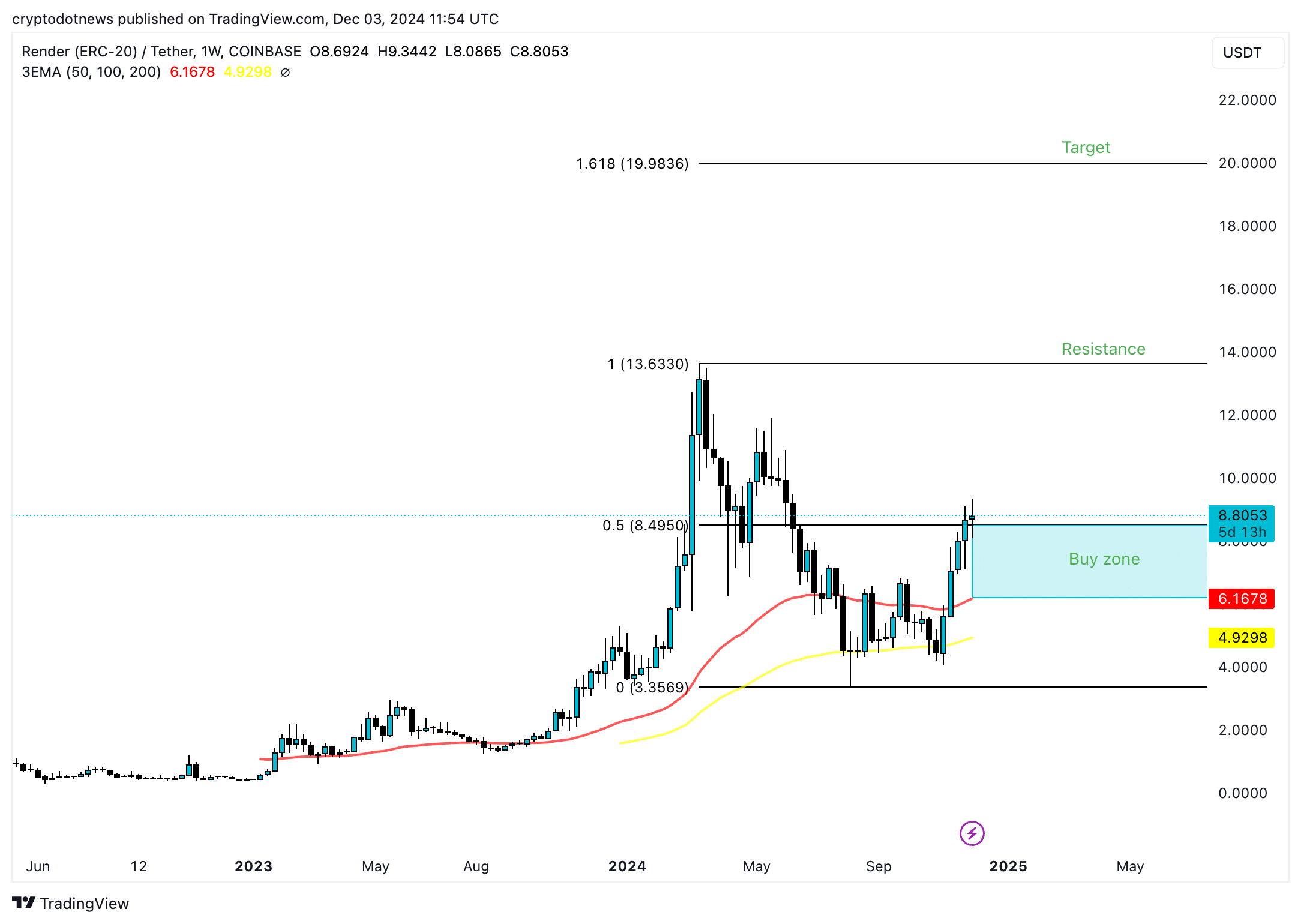

Render (RNDR)

In simpler terms, the cryptocurrency RNDR is currently trading within a profitable range, specifically between $6.6178 and $8.4950. This range represents the halfway point (50% Fibonacci retracement) of its decline in 2024. The projected peak for this cycle for RNDR is at $19.9836, while INJ encounters resistance at $13.6330.

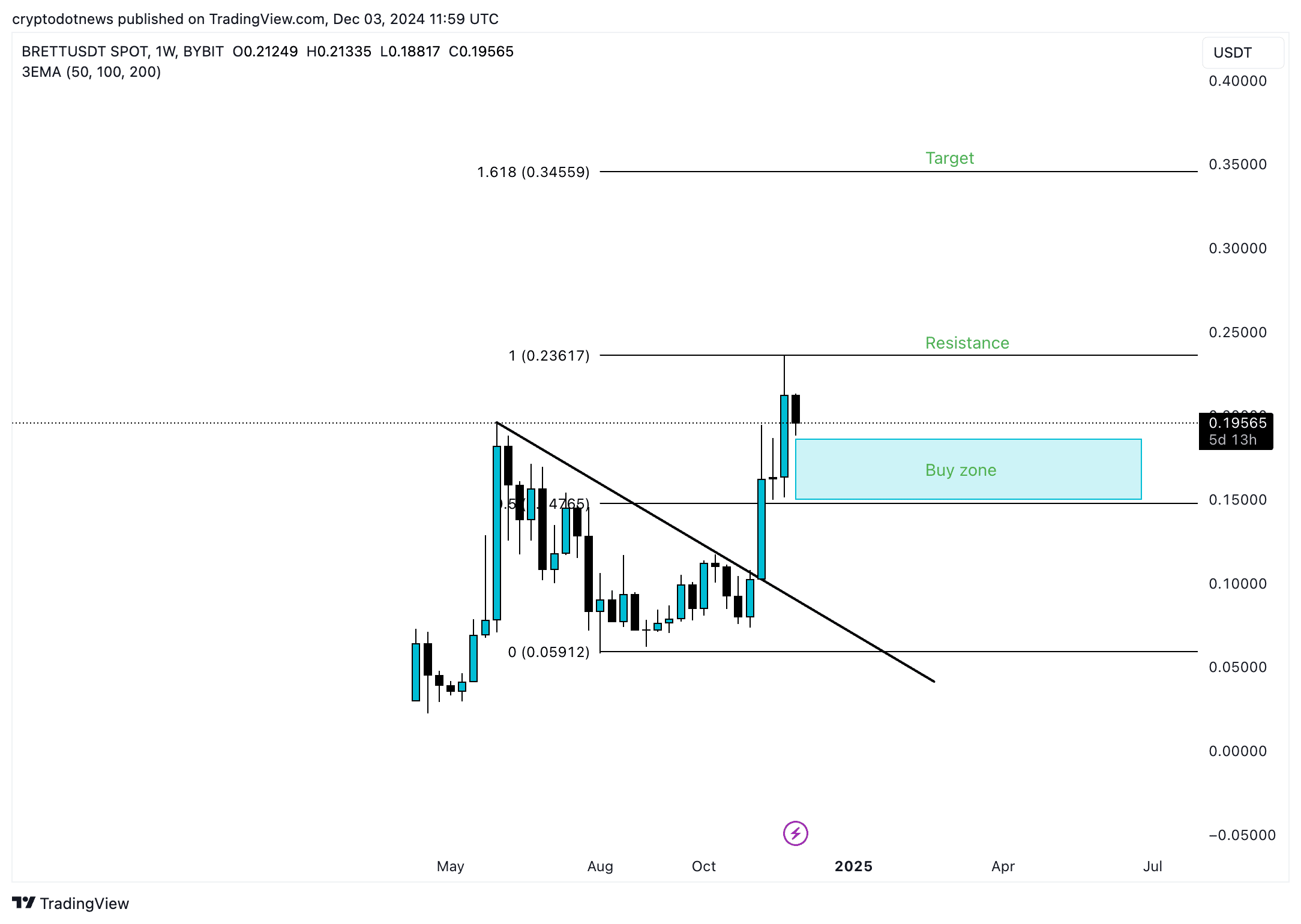

Brett (BRETT)

In the realm of meme coins, Brett’s Base-based token might continue its growth during this cycle. If it manages to surpass the resistance level at around $0.23617, it could potentially reach a goal of $0.34559. A good buying range is estimated between $0.15 and $0.18.

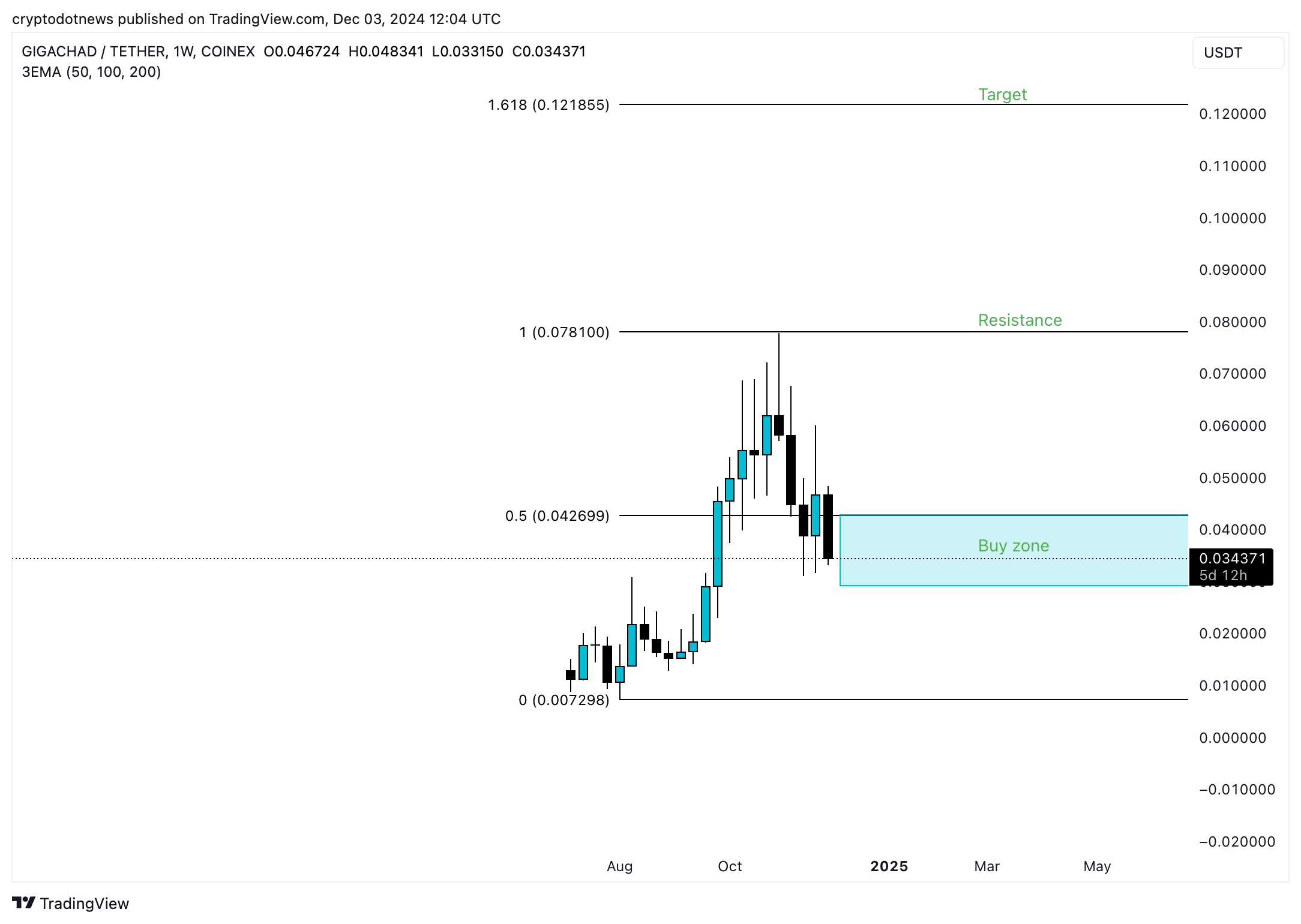

Gigachad (GIGA)

In simpler terms, Gigachad is similar to other meme-based cryptocurrencies, but it’s currently ranked around 250 in market capitalization. There’s a possibility it could continue to increase during this cycle. As of now, the price of GIGA stands at a buying opportunity, being situated below the 50% Fibonacci retracement level at approximately $0.042699.

GIGA’s cycle target is $0.121855 and resistance is $0.078100.

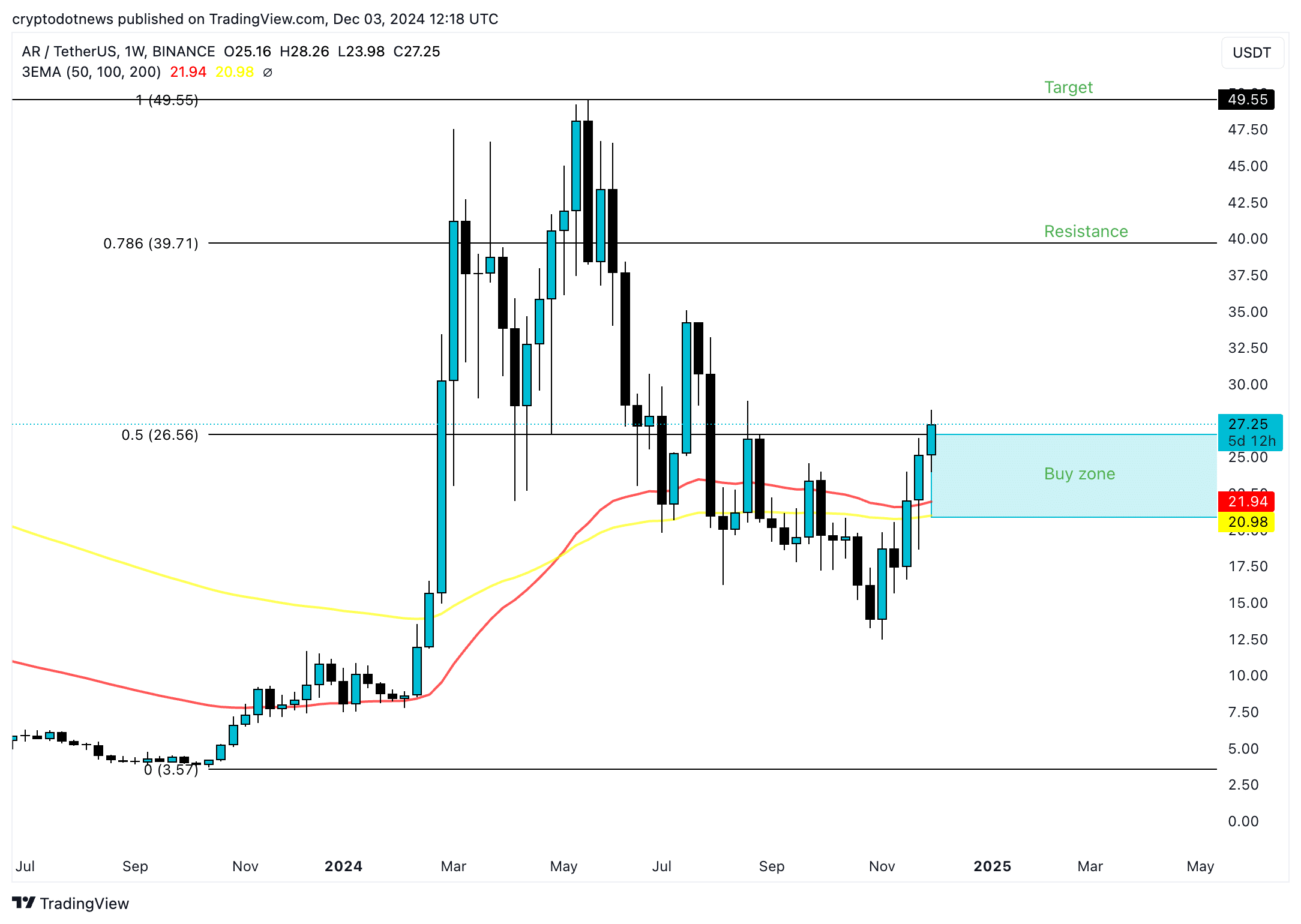

Arweave (AR)

The ideal buying range for this token that’s part of a decentralized data storage system with ties to AI and DeFi, can be found between two key levels. The first is the 100-day Exponential Moving Average (EMA) at approximately $20.98. The second is halfway through the retracement of the rally to its 2024 peak, which is around $49.55.

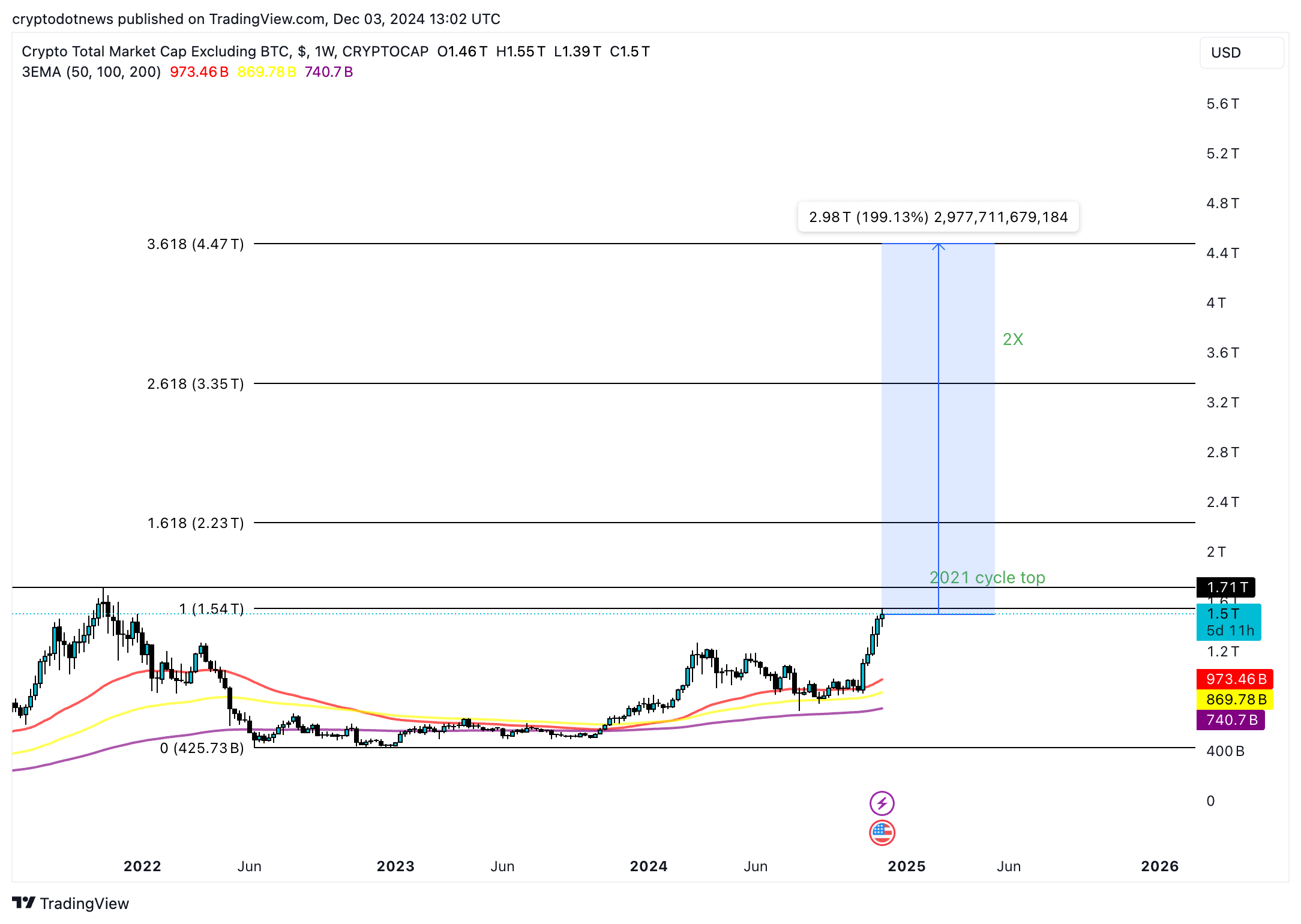

Strategic considerations and risk

The total crypto market capitalization is a key metric used to determine what to expect from a portfolio that consists of the above 10 altcoins. Based on projections, the total market capitalization of crypto excluding Bitcoin could surge to $4.47 trillion.

A rise in the anticipated levels suggests a potential doubling (2X) of returns in the top 10 altcoin portfolio. Factors such as the length of the altcoin season, Bitcoin’s behavior, investment from institutions, and capital flow can all impact the market value.

During this cycle, traders might anticipate potential profits that range from double (200%) to triple (300%) their initial investments, as indicated by the highlighted entry points on the provided weekly charts.

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-12-03 18:25