As a seasoned researcher with over a decade of experience in the dynamic world of cryptocurrencies, I’ve seen my fair share of market fluctuations driven by various factors, from technological advancements to political developments. The recent surge in DYDX is no exception, and it’s fascinating to observe how events unfold in this rapidly evolving space.

On November 6th, the native token of the decentralized trading platform dYdX, known as DYDX, experienced a significant surge in value. This upward trend may have been fueled by news that it has gained support from the recently appointed White House advisor on cryptocurrency within Trump’s administration.

Yesterday, the value of the altcoin climbed an impressive 35%, reaching a seven-month peak of $2.45 on November 6th. This increase boosted its total market capitalization above $1.67 billion. The current upward trend has placed DYDX at the forefront among the top 100 cryptocurrencies by market cap, currently ranking as the 94th most valuable according to CoinGecko’s latest data.

The price increase of DYDX continued, leading to a 83% gain over the past fortnight and pushing its monthly growth beyond 125%. Moreover, the daily trading volume for this token saw an uptick of 113.9%, reaching over $369 million.

Why did DYDX price soar today?

As a researcher, I’ve noticed an impressive surge in DYDX’s performance lately, and upon closer inspection, it appears this rally can be attributed to the news that President-elect Donald Trump has appointed David O. Sacks as the White House Director of Artificial Intelligence and Cryptocurrency. This appointment seems to have instilled confidence in the crypto community, potentially fueling DYDX’s recent growth.

The buzz grew around the news that Sacks’ venture capital company, Craft Ventures, has poured a substantial amount of money into DYDX. This link between the newly crowned crypto leader and the digital token sparked optimism among investors, contributing to DYDX’s recent price increases.

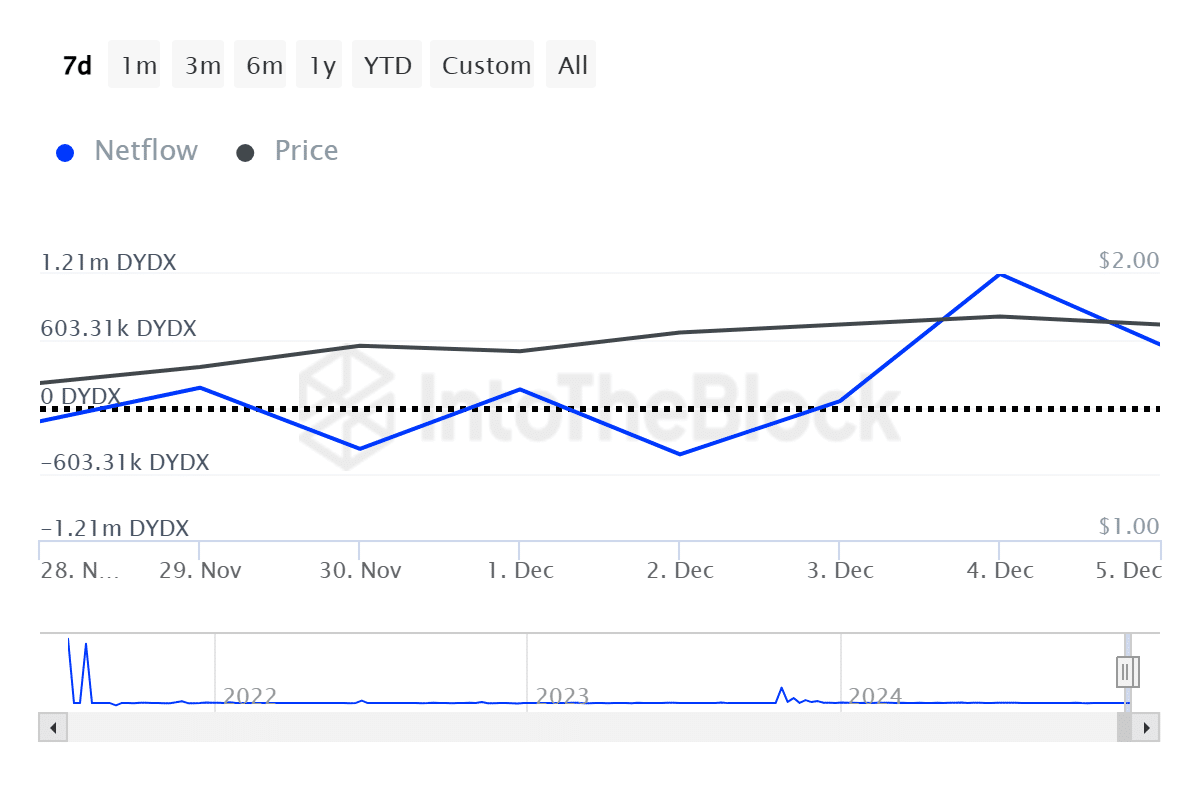

A significant factor possibly boosting the altcoin’s surge could be the increasing interest shown by large-scale investors, known as whales. According to IntoTheBlock’s data, there was a shift from a net outflow of approximately $766K in DYDX tokens on December 2, to a net inflow exceeding $2.2 billion worth of DYDX tokens on Wednesday, December 4, among these whale investors.

When whales start buying a particular altcoin, it often creates a sense of fear of missing out (FOMO) among individual investors, leading them to follow suit and invest in the hope of earning profits.

Additionally, as per DeFiLlama’s statistics, the amount of value locked within the DeFi protocol has significantly increased, rising from approximately $226 million in November to more than $445 million currently.

In my role as an analyst, I’ve observed that political events can indeed spark rallies within the cryptocurrency market. For instance, the native token of Reserve Rights, RSR, experienced a significant surge—over 130% in a single day—following news that Donald Trump had approached Paul Atkins, a former advisor to the Reserve Rights Foundation, as a potential successor to Gary Gensler as the next SEC Chair. This political development seemed to stir excitement and anticipation among RSR holders, possibly due to the potential impact Atkins’ appointment could have on the regulatory landscape for Reserve Rights and the broader crypto market.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- PUBG Mobile heads back to Riyadh for EWC 2025

- Hero Tale best builds – One for melee, one for ranged characters

2024-12-06 12:13