As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I can confidently say that understanding token unlock events is crucial for any investor aiming to navigate this market effectively. The Keyrock study sheds light on an essential aspect often overlooked – the impact of token unlocks on price fluctuations.

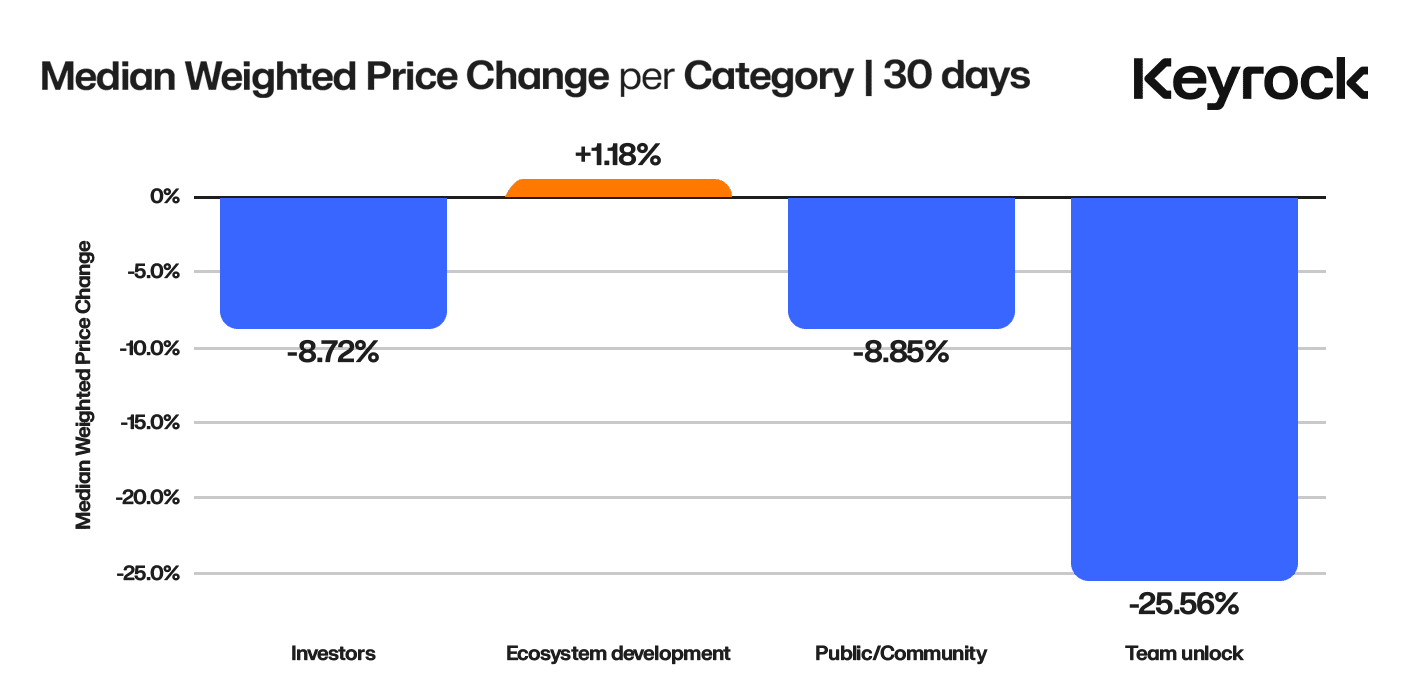

According to a recent study by Keyrock, weekly token releases leading to a 90% increase often result in price decreases. Furthermore, significant events tend to cause steeper drops, while team unlocks can even trigger price collapses of up to 25%.

As a crypto investor, I’ve noticed that when token unlock events occur, prices often experience a substantial drop. In fact, based on data compiled by market maker Keyrock, approximately 90% of these unlock events lead to price decreases. This analysis, which examined over 16,000 such events, shows that weekly unlocks introduce around $600 million worth of new tokens into the market, a factor that significantly influences market fluctuations.

In our examination of 16,000 instances where securities were unlocked, an intriguing trend surfaced: regardless of the type, size, or recipient, these unlocks generally have a negative impact on price. This underscores the significance of monitoring unlock schedules and grasping their potential effects, particularly for traders who strive to make accurate market predictions.

Keyrock

The research indicates that although general market trends may vary, it is usually an increase in token supply that leads to the frequent price declines. For example, during a team unlock event, where tokens held by the project’s team or early investors are released, the market experiences significant selling pressure as these parties sell off their holdings.

The example from Yuga Labs illustrates a downward trend for Apecoin (APE). Commencing monthly, the team gradually makes available 0.7% of the total supply, equivalent to $11 million. In just seven months, the value of the APE token plummeted by 77%, which is significantly greater than the 9% decrease experienced by Ethereum (ETH), as pointed out by analysts.

From the on-chain information, it’s clear that the team deposited funds into Market Maker Over-the-Counter accounts. If we had known about an upcoming vesting release that would last for some time, it could have been useful in making a more informed decision regarding whether to buy Ape at that specific moment, perhaps delaying the purchase.

Keyrock

Instead of causing a significant impact, investors typically exercise more control, as Keyrock points out. These shareholders frequently utilize risk management tactics such as over-the-counter transactions or options, which help to reduce market disruption. The report highlights that changes in value (price declines) are not primarily influenced by venture capitalists and investors, instead, these parties generally support long-term objectives aligned with the protocol’s goals.

As a Keyrock analyst, I’ve observed that linking ecosystem unlocks to growth strategies could significantly increase liquidity and stimulate user adoption, thereby uncovering promising prospects. Nevertheless, it’s crucial to exercise caution when managing team unlocks to avoid substantial price drops.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Maiden Academy tier list

- Hero Tale best builds – One for melee, one for ranged characters

2024-12-06 15:29