As a researcher with a background in economics and finance, and having closely followed El Salvador’s unique journey into Bitcoin adoption, I find myself both intrigued and cautiously optimistic about the recent developments.

The country, El Salvador, is in talks about securing a $1.3 billion loan from the International Monetary Fund, which might lead to substantial alterations in their Bitcoin-recognized currency legislation.

Over the next few weeks, El Salvador may complete a substantial agreement worth billions with the International Monetary Fund. This deal could potentially open up additional financing from international creditors. However, there’s a condition – El Salvador might have to reassess its primary investment in Bitcoin (BTC).

Based on a Financial Times report dated December 9, it’s been suggested that the negotiations involve pledges to address the nation’s budget shortfall. Economists predict that the overall government fiscal deficit will decrease from 3.9% of GDP in 2024 to 3.1% in 2025.

Table of Contents

Bold gamble

In 2021, President Nayib Bukele led El Salvador in making Bitcoin a legal tender, making it the first nation to do so. Yet, this action received significant criticism from international financial bodies such as the IMF, who warned that this daring step could potentially pose “significant risks” related to Bitcoin’s impact on financial stability, integrity, and consumer protection.

As a forward-thinking crypto investor, I find myself at the forefront of a revolutionary shift in my home country, El Salvador. Here, we’ve embraced the future by making Bitcoin a legal tender, alongside the U.S. dollar – our primary currency since 2001. This decision places me and other residents squarely within the global crypto movement, as we explore new horizons in digital finance.

Tomorrow, for the first time ever, El Salvador will capture global attention as it takes a historic step involving Bitcoin. #Bitcoin makes this possible. #BTC 🌍🇸🇻

— Nayib Bukele (@nayibbukele) September 6, 2021

The connection between El Salvador and the IMF grew tense, causing the country to be cut off from international lending markets. Despite this predicament, President Bukele continued to push forward with the Bitcoin trial, positioning the nation as a welcoming destination for cryptocurrency and unveiling plans for an innovative “Bitcoin City” fueled by geothermal energy derived from a volcano.

Last August, I shared on X that Yilport Holdings, a Turkish company, announced its largest private investment ever in Salvadoran history – approximately $1.6 billion. This significant investment will be channeled towards the development of a port at the proposed Bitcoin City location within La Unión, a municipality nestled in the Department of La Unión, El Salvador.

Mixed results

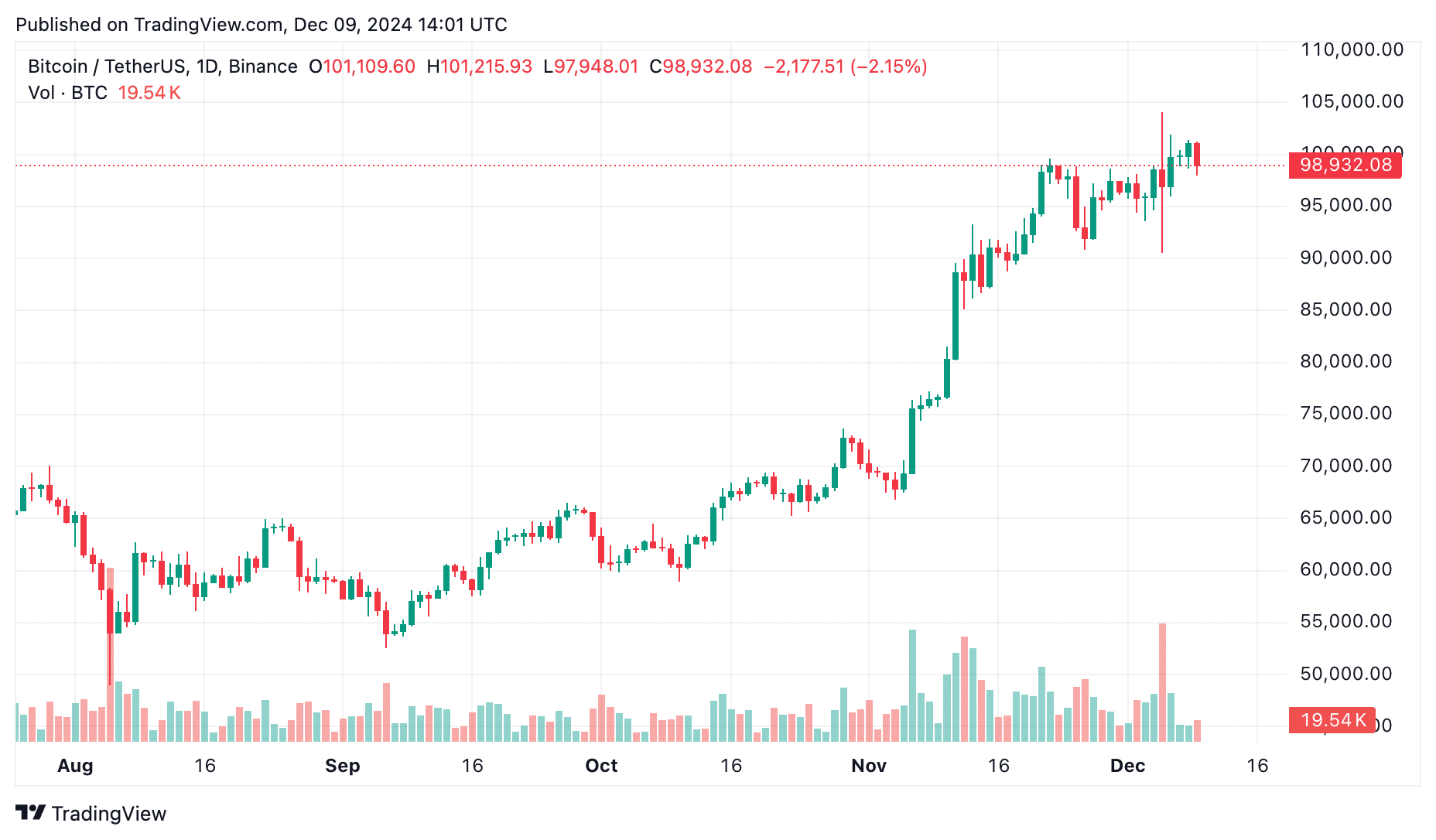

In terms of results, El Salvador’s decision to embrace Bitcoin has brought about a blend of positive and negative impacts. On one side, it garnered worldwide attention, attracted crypto fans, and enhanced Bukele’s reputation as an innovator. Moreover, the rise in Bitcoin’s price to over $100,000 this year has significantly increased the worth of the nation’s digital currency holdings.

Ülkemizin tarihindeki en büyük özel yatırım 🇸🇻🇹🇷

— Nayib Bukele (@nayibbukele) August 12, 2024

As per Bukele’s recent post on X, the value of El Salvador’s Bitcoin reserves has surpassed $550 million, marking a 127% increase. In his words, “you could refer to it as our first Bitcoin savings jar. It may not seem like much, but every little bit counts.

For numerous Salvadorans, Bitcoin has not met its projected potential, as it remains a secondary choice compared to the U.S. dollar when it comes to daily transactions. Despite legal recognition, many people continue to favor the U.S. dollar, often citing Bitcoin’s instability and their lack of faith in it as primary reasons for sticking with the familiar currency. A survey carried out by Francisco Gavidia University in San Salvador in 2024 revealed that merely 7.5% of the 1,224 respondents actually utilize Bitcoin for transactions.

Details on IMF deal

As reported by the Financial Times, the International Monetary Fund’s loan agreement could prompt shifts in El Salvador’s Bitcoin regulations. This would mean eliminating compulsory business acceptance of Bitcoin as legal tender, allowing such transactions to become optional instead. The government has also consented to reduce its budget shortfall by 3.5% of GDP over the next three years, combat corruption, and boost its foreign reserves from $11 billion to $15 billion.

As a crypto investor, I’m keeping a close eye on the situation, but I must admit, the timeline for approval remains uncertain, and it’s hard to tell if the proposed changes will suffice. Yet, there’s a silver lining – the IMF loan could potentially unlock another $1 billion from the World Bank and an additional $1 billion from the Inter-American Development Bank. This influx of funds could help the country regain access to global financial markets, which is certainly good news for all investors.

Economic revival amid controversy

Over the past period, Bukele’s domestic backing remains robust due to a significant decrease in crime rates stemming from his tough stance on violent gangs. His recent re-election with an impressive 85% of votes cast may indicate his widespread appeal among citizens. However, his government has been under scrutiny overseas for alleged human rights abuses and corruption concerns.

As an analyst, I’ve observed a noteworthy evolution in the relationship between the Biden administration and El Salvador’s President Bukele. Initially, there were criticisms of each other’s policies, but recently, we’ve seen signs pointing towards a strengthening bond. This transformation has been quite evident in the performance of El Salvador’s sovereign bonds. Earlier this year, these bonds rallied an impressive 22%, effectively erasing the deep discount that had previously caused concern among investors.

Bitcoin’s surge to $100k

Bitcoin’s skyrocket price surge has definitely played its role in softening criticism of El Salvador’s crypto gamble. The crypto’s value boost provided a windfall for the government, helping to bolster reserves and partially vindicating Bukele’s strategy of buying Bitcoin during market dips.

Despite some progress, the nation’s economy continues to exhibit vulnerability, as growth in GDP slows and public debt levels rise. Experts warn that Bitcoin’s price increases may not be sufficient to tackle deeper economic problems. If approved, an IMF loan would signify a significant move towards resolving these issues, albeit under terms that could necessitate reining in some of the initial crypto aspirations that catapulted El Salvador into international spotlight.

The International Mononial Fund (IMF) hasn’t made any public statements regarding the current negotiations.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-12-09 17:13