As someone who has been navigating the cryptocurrency market for the past few years, I’ve learned to expect the unexpected and embrace volatility as a part of this thrilling yet unpredictable ride. The recent flash crash serves as a stark reminder that even the most seasoned investors can get caught off guard.

What caused such a sudden plunge in the cryptocurrency market, resulting in massive losses within mere hours, and how might this impact Bitcoin and other altcoin investors in the near future?

Table of Contents

Crypto markets in freefall

Over the past two days, the cryptocurrency market has encountered a significant setback, with a sudden drop (flash crash) causing a substantial loss in its overall worth. In just the last day, the global crypto market cap has decreased by approximately 8.7%, reaching an estimated value of $3.52 trillion, as reported by CoinGecko.

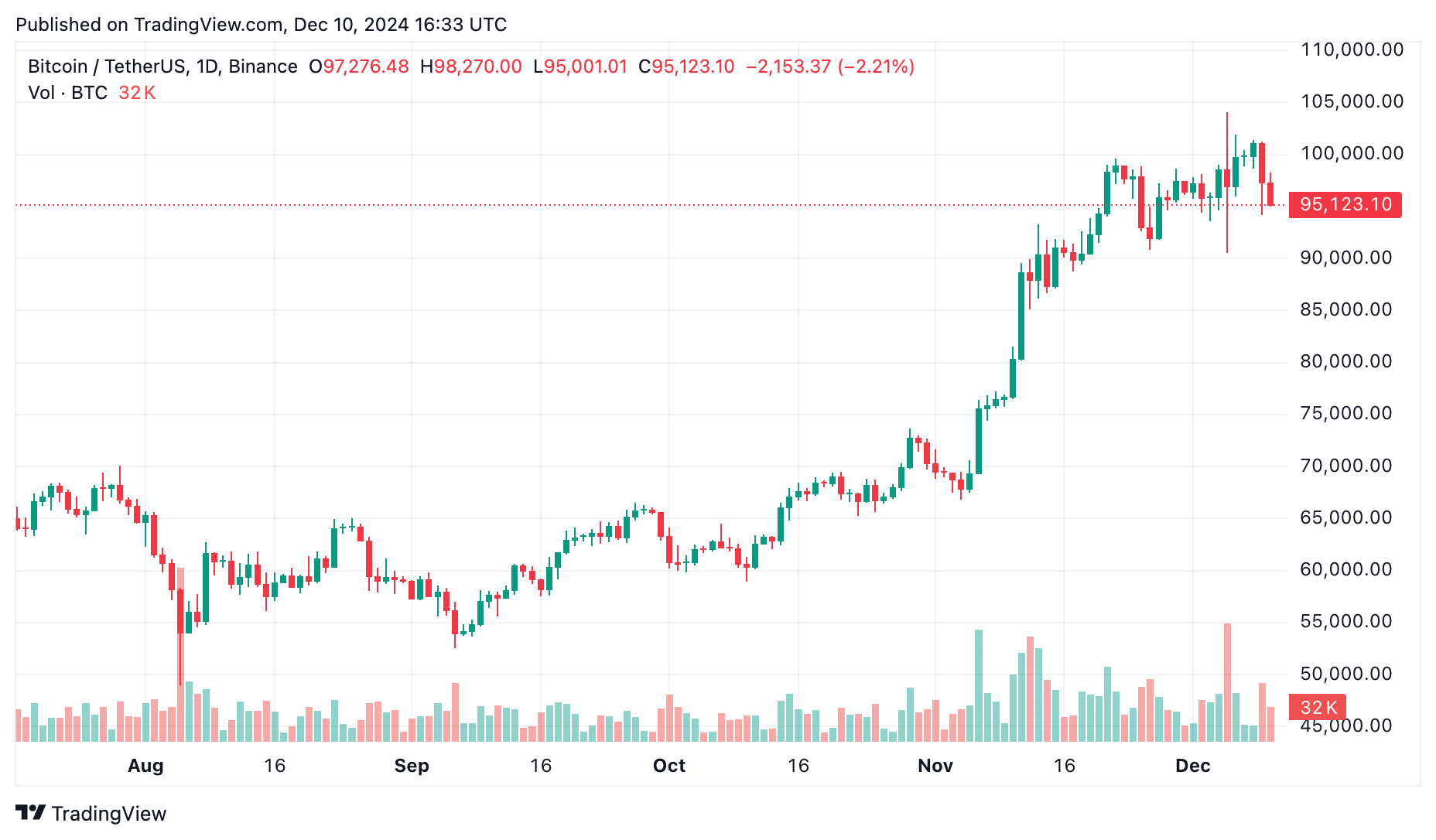

Despite Bitcoin (BTC) holding up fairly resiliently, dropping approximately 2% to reach $95,800 on December 10, it’s important to note that many alternative cryptocurrencies have not fared as well in the same period.

Currently, Ethereum (ETH) is down approximately 6%, with its price standing at $3,580. Meanwhile, Ripple (XRP) experienced a sharper decrease of 12.5%, reaching $2.09 and amplifying its weekly losses to an alarming 17%. Solana (SOL), a prominent player in the blockchain industry, has also dipped by 6%, trading at $210.

The carnage wasn’t limited to major altcoins. The real bloodbath unfolded in the meme coin segment, with Solana-based meme coins in the Pump.fun ecosystem plummeting by nearly 25%.

Various popular meme tokens, such as Peanut the Squirrel, Goatseus Maximus, and Just a Chill Guy, experienced losses ranging between 20% and 25%. Established Solana-based meme coins like Dogwifhat and Bonk followed suit with declines of 20% and 18%, trading at $2.74 and $0.00003475 respectively.

Despite the chaos in meme coins, Bitcoin’s associated chains and gaming tokens took a significant blow as well. In total, these associated chains fell by approximately 24%. Specifically, Stacks (STX) decreased by 16%, reaching $2.07, while Core (CORE) saw a steeper decline of 20% to settle at $1.12.

In a related field that links virtual worlds like the metaverse and economies based on blockchain and earning through play, gaming tokens experienced significant drops. Specifically, Gala (GALA) fell approximately 21% to a price of $0.04342. The Sandbox (SAND) and Decentraland (MANA) tokens saw declines of 19% and 18%, respectively.

The question now is, what caused this sudden market turbulence? And more importantly, where does the market go from here? Let’s examine how technical and fundamental indicators are shaping up for Bitcoin and altcoins.

Unraveling the flash crash: What went wrong?

Based on insights from an algorithmic trader’s comprehensive study, it appears that the dramatic market downturn on December 9 occurred progressively, driven by a combination of structural vulnerabilities within the market, excessive borrowing, and problems with available funds.

Today’s sale led to the largest scale-back since last year (2021). Let me share with you an in-depth perspective on this whole scenario. As usual, this post is packed with valuable insights, diagrams, and comments.

If you found the analysis interesting, feel free to retweet.

— ltrd (@ltrd_) December 10, 2024

The sell-off began with aggressive selling on Coinbase, where traders started offloading assets nearly an hour before the major crash. This persistent selling pressure gradually pushed Bitcoin’s price into a precarious zone, setting the stage for what’s known as a liquidation cascade.

When the cost of goods drops below specific limits, overextended trades (ones that have been financed with borrowed money) are automatically closed by trading platforms. This can cause a chain reaction because each closure puts additional downward pressure on prices, leading to even more closures in a continuous cycle where each event reinforces the next.

As a crypto investor, I noticed that one clear sign the market was getting too hot before the crash could be seen in the Funding Fee – a fee that represents the expense associated with holding long or short positions in perpetual futures contracts. In other words, when this fee started spiking, it hinted at an overheated market about to cool down.

High financing costs often reflect a strongly optimistic attitude among traders, as they tend to place numerous wagers predicting price rises. However, when the market goes in the opposite direction, these heavily-leveraged bets are quickly unwound, leading to massive liquidations at an unprecedented pace.

In simpler terms, within a day, approximately $1.64 billion worth of future trading contracts were terminated or “liquidated” based on CoinGlass data. Out of this total, around $1.46 billion were positions where traders had bet on price increases, while only about $174 million were positions where traders had bet on price decreases.

It’s quite evident that this situation mirrors the skewed nature of the market, where a significant number of players found themselves disadvantaged due to taking the incorrect position in their trades.

The predicament worsened due to unfavorable cash flow circumstances, particularly affecting lesser-known cryptocurrencies. Even coins with large market values similar to established corporations, such as XRP, experience lower levels of liquidity compared to what one might expect.

In simpler terms, this suggests that a small number of significant sell orders have the power to significantly affect the price they’re associated with. The trader described the situation as “something quite unexpected” because a chain of big sell orders for XRP occurred rapidly, causing its price to fall by 5% almost immediately.

A significant factor in the accident was the function of market makers – these organizations ensure smooth trading operations by continually purchasing and selling securities, thereby maintaining liquidity.

When there’s a large-scale selling spree, market makers find themselves compelled to protect their investments by offsetting them, a process that may intensify price fluctuations on various trading platforms.

In the case of perpetual swaps, activating the hedging mechanism can lead to immediate stop-loss orders and further liquidations, resulting in a more intense effect within a limited period.

The bigger picture amid the market chaos

Although the sudden drop in prices on December 9 temporarily halted an impressive upward trend, it’s essential to step back and look at the overall situation to grasp the dynamics shaping the market.

Initially, it’s important to note that the broader economic environment remains crucial. The value of the US dollar, as measured by its ability to buy goods and services, has consistently weakened over time.

According to The Kobeissi Letter, it’s been observed that both gold and Bitcoin have been consistently rising when compared to the U.S. dollar, which suggests they are considered effective safeguards against currency devaluation. This observation also underscores the growing acceptance of Bitcoin as a form of value storage.

Here’s one way to rephrase that statement: Gold and Bitcoin have been consistently increasing in value when compared to the U.S. Dollar, which suggests a prolonged downtrend for the U.S. Dollar’s purchasing power or strength. In simpler terms, it appears that gold and Bitcoin are both gaining value relative to the U.S. dollar, indicating that the U.S. dollar might be losing its buying power over time.

— The Kobeissi Letter (@KobeissiLetter) December 9, 2024

Under continued inflationary strain and with fiscal strategies relying greatly on borrowing, assets such as Bitcoin appear to be factoring in a prolonged weakening of the U.S. dollar’s power.

As a researcher diving into the dynamic world of cryptocurrency, I’m captivated by the surge in institutional involvement that seems to be fueling our narrative. The spot Bitcoin ETF, identifiable by its ticker IBIT, has made history by managing over $50 billion in assets within a mere 228 days – an achievement that usually takes more than five years for gold ETFs like GLD to accomplish. This rapid growth is truly redefining the pace at which we value and invest in digital assets.

Cryptocurrencies represent a significant shift:

— The Kobeissi Letter (@KobeissiLetter) December 9, 2024

The combined force of this institutional support and Bitcoin’s 32% price surge over the last month, pushing it to unprecedented heights of $100,000, has significantly added approximately $1.4 trillion to the overall cryptocurrency market, further bolstering the robustness of the crypto sector.

Presently, the CME FedWatch Tool indicates an approximately 86% chance of a 0.25 percentage point reduction in the next Federal Reserve meeting scheduled for December 18th. This probability has risen from 64% only a month ago.

As an analyst, I can say that rate reductions generally make it less expensive to borrow funds, which in turn increases the appeal of riskier assets such as cryptocurrencies. Additionally, lower interest rates tend to weaken the US dollar, thereby strengthening the argument for Bitcoin as a protective investment against currency devaluation.

If the Federal Reserve decides to lower interest rates again, it might lead to increased liquidity in financial markets, potentially fostering conditions that are advantageous for cryptocurrencies.

On the other hand, although Bitcoin appears somewhat steady, the broader market continues to be fractured, with regions of excessive borrowing and inadequately developed infrastructure that persistently present potential hazards.

What lies ahead for Bitcoin and altcoins?

Following the latest turbulence in the cryptocurrency market, a key point of interest now is: what might happen to Bitcoin and other alternative coins in the near future?

As an analyst, I find myself optimistic about the future trajectory of Bitcoin. The prevailing mood hints at continued progress towards even greater heights. Notably, experts like Doctor Profit posit that the recent period of sideways movement is merely a brief pause, with Bitcoin’s price poised to surge beyond targets ranging from $125,000 to $135,000.

Based on my recent prediction, the upcoming significant shift is a breakout towards prices between 125,000 and 135,000. This is where I anticipate the initial drop of approximately 20-30%. I’ve emphasized several times that 100,000 isn’t the peak for this cycle; we’re likely to reach greater heights and leave everyone astounded.

— Doctor Profit 🇨🇭 (@DrProfitCrypto) December 9, 2024

These optimistic forecasts are based on Bitcoin’s pattern of cyclical price fluctuations, which typically involve significant pullbacks and periods of stability followed by resuming growth. For instance, the 2020 bull market for Bitcoin experienced several corrections ranging from 20% to 30%, but eventually reached its peak.

As a researcher, I’m not entirely in agreement about the immediate course of action regarding Bitcoin. Crypto analyst Nik suggests the potential for a correction spanning multiple weeks if Bitcoin can’t sustain its momentum above significant levels like $104,000. He issues a cautionary note, indicating that a rejection below $99,000 might point towards an extended cooling-off phase that could last until the end of the year.

If the correlation persists this week, it’s likely that Bitcoin will start a prolonged correction within the next 3-4 days. Key indicators for this might be reaching above $104,000 over the weekend and then dropping back down below $99,000; if we observe such behavior, Bitcoin may experience a significant shift until new…

— Nik (@cointradernik) December 9, 2024

From this perspective, a temporary drop doesn’t automatically disprove the overall positive outlook, but rather offers a beneficial pause for the market to regroup.

Shifting focus towards alternative cryptocurrencies, it seems particularly enticing. As per Michaël van de Poppe’s analysis, altcoins are poised to break free from their prolonged bear market. With the U.S. dollar losing strength and anticipation of increased liquidity, all signs point towards a massive surge in the value of alternative coins.

It appears that we won’t be reaching our peak in the markets for now. This is because we are on the verge of exiting the longest #Altcoin bear market, and we can expect a weak US Dollar alongside increased liquidity. I believe we will continue to rise significantly.

— Michaël van de Poppe (@CryptoMichNL) December 10, 2024

Poppe’s positive outlook is mirrored by Kaizen, who made comparisons to December 2020, when a 30% drop in altcoins was followed by a three-month surge that yielded returns over 400%. A similar 25% drop in altcoins currently experienced, though it may be painful, could potentially serve as an early sign of significant growth.

As a crypto investor, reflecting on December 2020, I witnessed a steep decline of approximately 30% earlier in the month, followed by an extended three-month rally that soared over +400%. Now, it seems we’re experiencing a similar situation with a fresh 25% drawdown today.

— Kaizen (@KAIZ3NS) December 10, 2024

Still, it’s essential to temper optimism with caution, the crypto market’s inherent volatility means that sentiment can shift overnight, as seen during the recent flash crash. Hence, trade wisely, and never invest more than you can afford to lose.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2024-12-10 19:49