As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous bull runs and bear markets, and I must say that this recent surge in Aave (AAVE) is nothing short of impressive. Having closely followed the crypto space since its inception, I can confidently assert that AAVE’s current rally could be a strong indication of a broader market recovery.

As an analyst, I’m observing a striking increase in value for Aave, making it the standout performer among the top 100 cryptocurrencies, fueled by the broadly optimistic sentiment pervading the entire crypto market.

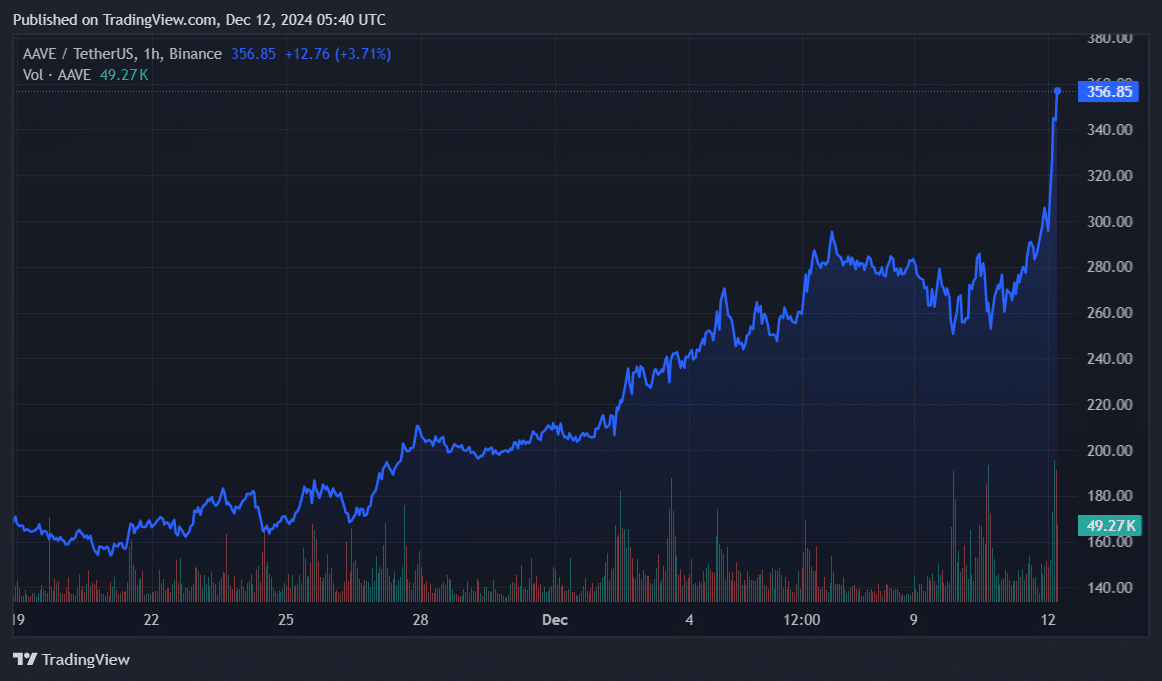

In just the last day, the value of Aave (AAVE) has jumped by a significant 34%, putting it at approximately $355 per token as we speak. This increase in value has also boosted its market capitalization to an impressive $5.3 billion, which now ranks it as the 31st largest cryptocurrency on record.

This is the first time since late August 2021 that Aave has broken the $350 mark.

4 main reasons behind Aave’s rally

Initially, the general crypto market, encompassing Bitcoin (BTC), saw an upward trend following the release of the U.S. Consumer Price Index report on Wednesday.

Inflation in the United States for November was as anticipated, reaching 2.7% compared to the same period last year. This is a slight increase of 0.1% from the previous month’s rate of 2.6%, based on information provided by Investing.com.

Afterwards, Bitcoin surpassed the $100,000 milestone once more, while the overall cryptocurrency market value climbed by 4% to reach approximately $3.82 trillion, according to data from CoinGecko.

Next, a series of recent advancements has sparked optimism among investors in the second-largest decentralized finance platform – Aave’s Total Value Locked currently stands around $22 billion.

According to a report by crypto.news on Wednesday, Balancer is teaming up with Aave to enhance their decentralized exchange and automated portfolio management system to version 3. This upgrade aims to improve the efficiency of the lending protocol, enabling users to optimize returns by effectively managing liquidity pools in Balancer v3.

Additionally, it has been approved by the Aave community that Aave will be deployed on Linea, a zk-rollup network backed by ConsenSys – a move designed to enhance Aave’s scalability and boost its transaction speed while reducing costs.

Personally speaking, I’m excited to share that the DeFi project led by President-elect Donald Trump, World Liberty Financial, has just amassed a substantial amount of AAVE tokens valued at approximately $1 million. This impressive acquisition was made at an average price of around $297.8 per token, as reported earlier today.

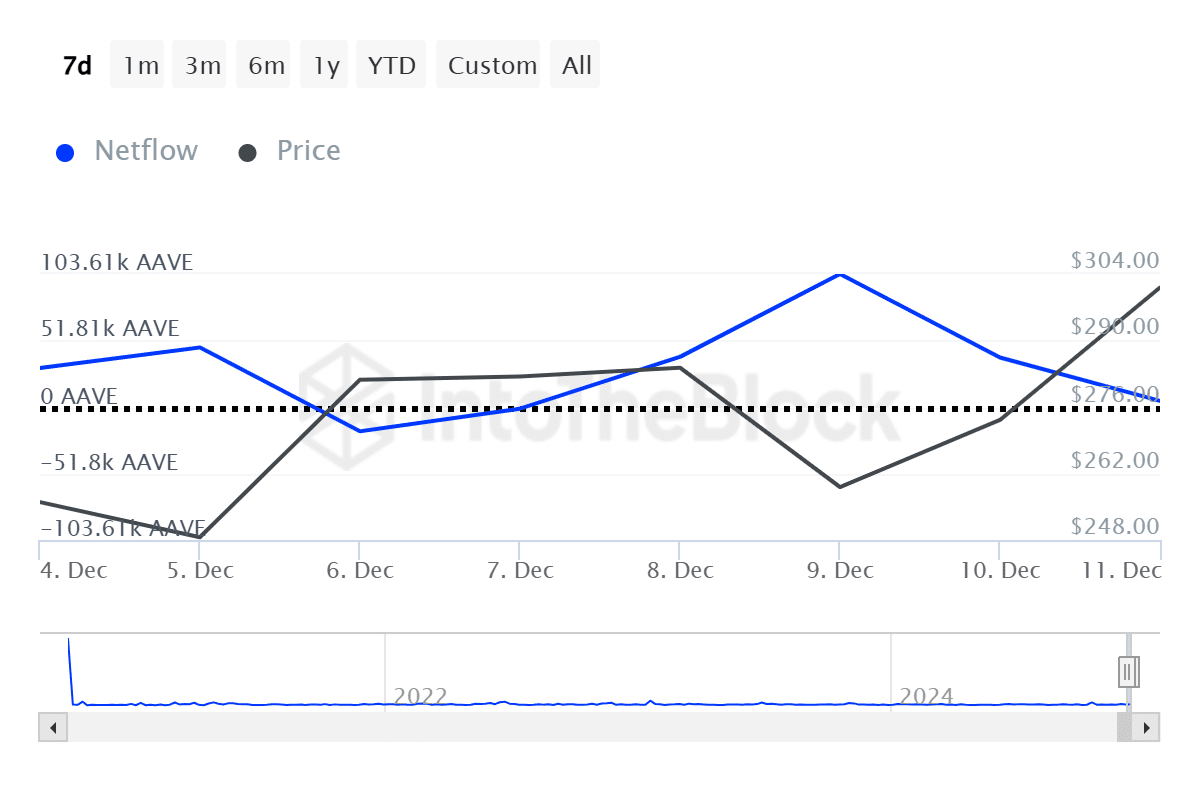

To put it simply, as the price of Aave dipped below $260 on Monday, a significant increase in whale accumulation was observed. Based on data from IntoTheBlock, a total of 103,610 AAVE tokens were added to the holdings of large investors on December 9th.

As a crypto investor, I’ve observed that unexpected surges in whale investments can ignite a sense of urgency among smaller-scale investors like myself, often leading to a ‘fear of missing out’ (FOMO). This emotional response could drive up the market prices even further.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2024-12-12 10:04