As a seasoned analyst with over two decades of experience in the financial industry, this move by BlackRock into major cryptocurrencies is undeniably a game-changer. Having witnessed the rise and fall of numerous assets and market trends, I can confidently say that BlackRock’s $1 billion investment into Bitcoin within 48 hours is not just a dabble, but a strategic move reflecting their belief in the long-term potential of cryptocurrencies.

It’s been reported that BlackRock, the globe’s leading asset manager, has significantly increased its investment in prominent cryptocurrencies. According to figures from Arkham Intelligence, the firm purchased approximately a billion dollars’ worth of Bitcoin over a span of two days.

Over the past day, the value of Bitcoin has fluctuated from a low of around $103,188 to a high of about $107,659, and it’s now being traded at roughly $104,693. Given that the average price was $103,188 during this period, BlackRock’s purchase of one billion dollars could potentially have secured around 9,695 Bitcoins.

Recently, our organization shared a concise educational video on Bitcoin, advocating that potential investors might find it worthwhile to allocate up to 2% of their investment portfolios towards this digital currency.

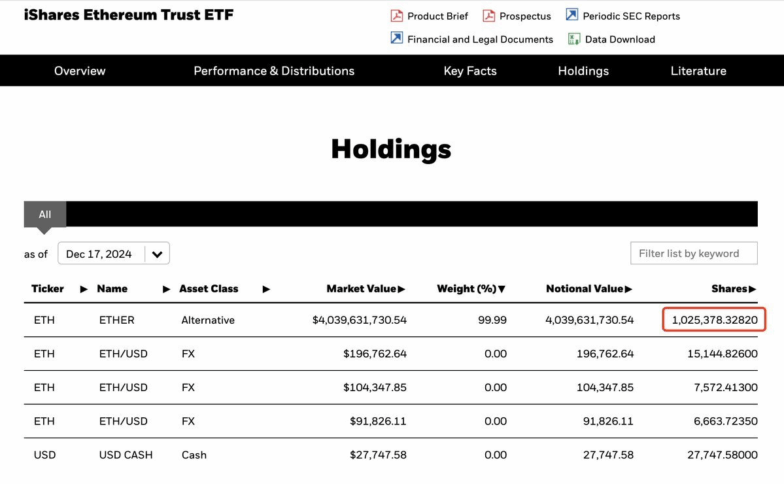

Furthermore, BlackRock’s iShares Ethereum Trust currently possesses more than a million Ethereum (ETH) tokens, equating to approximately $4.04 billion. This underscores BlackRock’s increasing involvement with digital assets.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-12-18 23:32