As an analyst with over two decades of experience in global finance and economics, I have witnessed countless instances where nations have been forced to conform to traditional financial norms at the expense of their financial sovereignty. However, El Salvador’s steadfast commitment to Bitcoin amidst IMF restrictions is a refreshing anomaly that warrants admiration.

El Salvador’s festive holiday celebrations amid IMF restrictions.

During the accumulation of Bitcoins in El Salvador’s reserves, a unique Bitcoin-inspired Christmas tree adorns the nation’s festivities for Christmas 2024, underscoring the nation’s unwavering commitment to the pioneering cryptocurrency.

On December 19, 2024, following the acquisition of a $1.4 billion loan from the International Monetary Fund, El Salvador created a stir again by purchasing 11 Bitcoin worth more than a million dollars each.

This action shows the country boldly pursuing its Bitcoin (BTC) approach, even in the face of opposition. Most of the criticism stems from conventional financial organizations and economists, who have voiced worries about the potential risks of BTC’s volatility and its possible effects on the nation’s economic security.

In September 2021, El Salvador became the pioneering country to recognize Bitcoin as a legal form of currency, marking an historic milestone. While this decision sparked debate, it signified a change in the nation’s perspective towards cryptocurrencies. Over the past few years, Bitcoin has played a significant role in El Salvador’s financial landscape.

Day-to-day transactions now frequently involve cryptocurrencies, ranging from government-supported Bitcoin Automated Teller Machines (ATMs) to their increasing adoption within businesses.

On the other hand, this method has drawn criticism, notably from international financial bodies such as the IMF, who have set requirements for the nation’s monetary policy.

The terms of the IMF loan agreed upon on December 18, 2024, worth $1.4 billion, include changes to the country’s cryptocurrency regulations. Specifically, it calls for a prohibition on cryptocurrency transactions, meaning businesses are no longer required to accept cryptocurrencies as payment, and taxes will now be collected exclusively in US dollars.

Moreover, the International Monetary Fund (IMF) has advised the government of El Salvador to discontinue the usage of the Chivo digital wallet, a state-funded crypto wallet introduced in 2021. This wallet was part of El Salvador’s broader strategy to integrate Bitcoin into their financial infrastructure, allowing businesses and citizens to utilize cryptocurrencies for accessing government services and conducting transactions.

IMF loans often come with conditions that significantly influence a nation’s monetary and economic decisions. These conditions aim to ensure fiscal discipline and adherence to international financial standards. Some autonomous financial practices, such as utilizing cryptocurrencies, might need to be curtailed or forbidden due to the loan agreement.

Due to the International Monetary Fund (IMF) encouraging countries to use traditional monetary methods such as relying on central banks and national currencies over decentralized digital ones, these lending conditions often result in a diminished ability for nations to independently manage their own financial systems, or loss of financial independence.

It appears that El Salvador is remaining firm on its stance. The government continues to place importance on cryptocurrencies, disregarding the restrictions set by the IMF. The National Bitcoin Office, established in 2021 as a vital part of the country’s BTC strategy, has reaffirmed its dedication to its long-term Bitcoin plan and declared that no Bitcoin from its reserves will be liquidated.

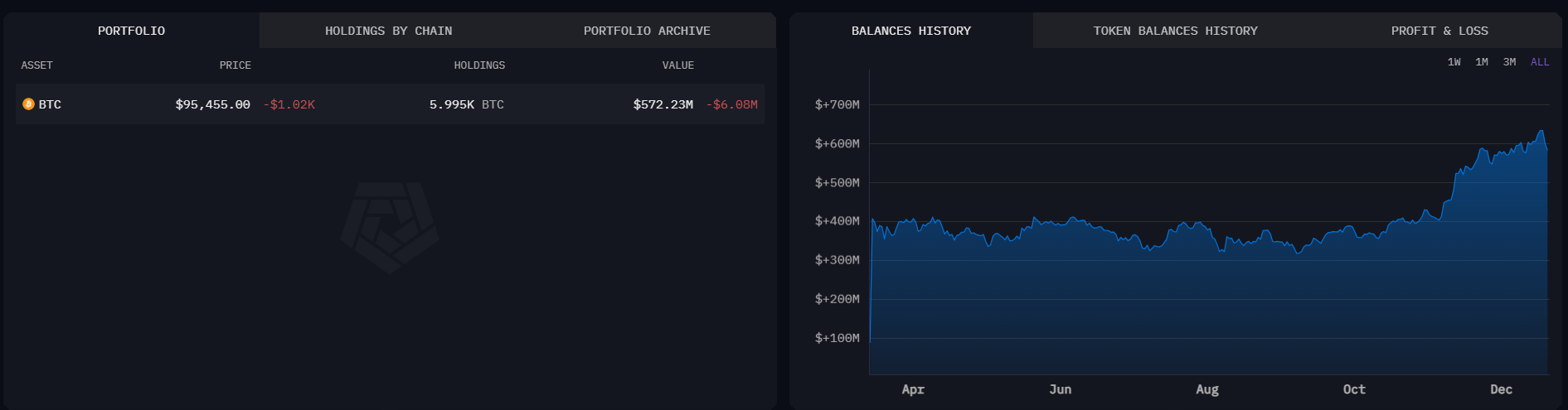

Currently, El Salvador holds approximately 5,995 Bitcoins, valued at roughly $569.5 million at the present moment. With their latest purchase of 11 Bitcoins, their total Bitcoin holdings are nearly 6,000. On average, each Bitcoin in the country was bought for around $97,000.

As a researcher, I’ve noticed an intriguing trend in the nation’s approach to Bitcoin (BTC) as a long-term investment. Latest figures from their portfolio suggest a strong commitment, indicating that they view BTC as a strategic asset for the future.

- Total BTC Holdings: Over $572 million, or around 5,995 BTC.

- Impact of BTC Price: Due to volatility, the portfolio recently had a $6.08 million decline, which is equivalent to a small decline of $1.02K per BTC.

The graph illustrates an overall upward trajectory in reserve value over time, suggesting consistent long-term expansion even amid temporary variations. Significantly, 2024 marked a substantial rise that started midway through the year and escalated steadily until December, aligning with the recent IMF agreement and the country’s continued Bitcoin investments.

Despite global criticism, El Salvador demonstrates a deliberate approach to safeguarding its digital currency reserves through robust financial monitoring mechanisms.

El Salvador has shown its commitment to the digital currency field by acknowledging its ability to foster financial self-reliance and reduce reliance on international financial bodies. Despite challenges like pressure from the IMF, the country’s stance remains firm. A BTC tree for Christmas 2024 symbolizes a future when cryptocurrencies will not just be accepted but also become crucial in shaping El Salvador’s financial future.

Read More

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

2024-12-23 13:43