As a seasoned crypto investor with a knack for spotting trends and understanding market dynamics, I find myself intrigued by the current state of Ethereum. The recent retreat to $3,340 has me feeling a bit like a roller coaster ride, but the long-term fundamentals are hard to ignore.

Over the last few days, the price of Ethereum has noticeably dropped following a strong obstacle at the $4,000 mark.

On Monday, the price of Ethereum (ETH) stood at around $3,340, marking a slight increase as the crypto market showed signs of steady growth. Notably, this figure is just above the previous week’s lowest point of $3,100.

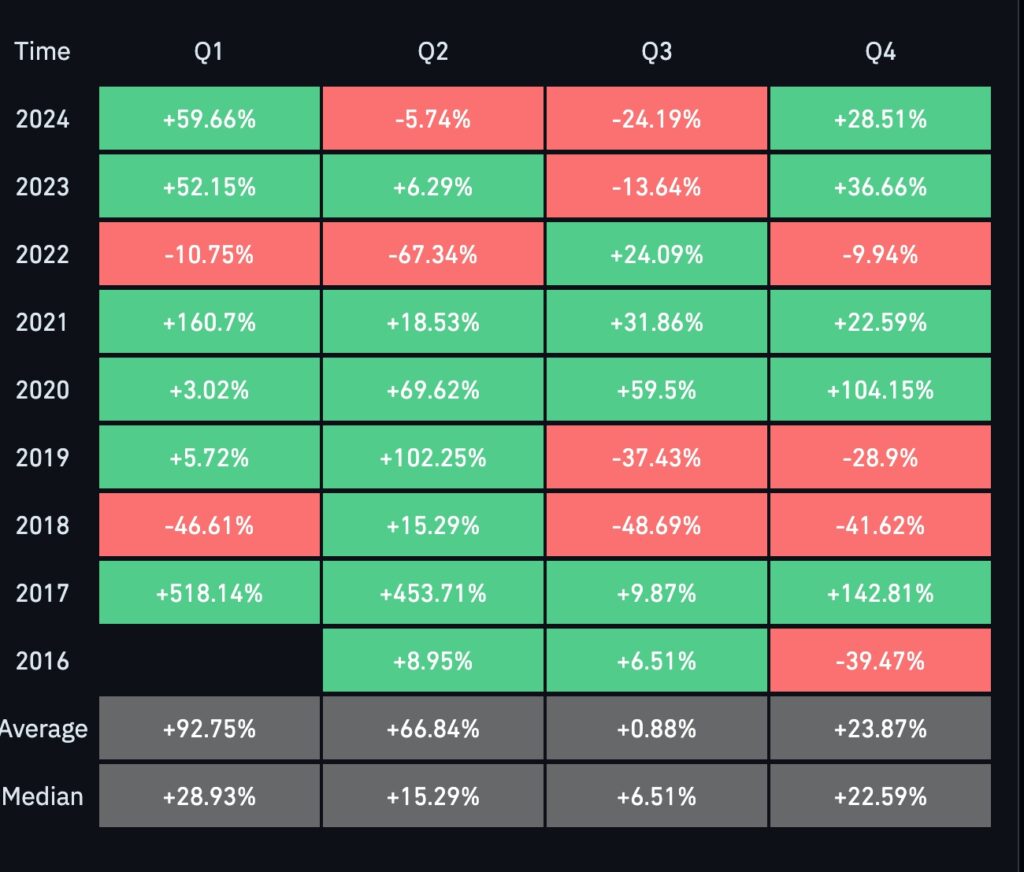

The data on seasonality indicates that the price of Ethereum could significantly increase during the first quarter of 2025. Based on information from CoinGlass, Ethereum has shown positive growth in almost all first quarters since 2017. Its most impressive gains were seen in 2017, with a surge of 518%, and again in 2021, where it increased by approximately 160%.

Since 2017, the first quarter has seen an average return of 92%, making it their most profitable timeframe. The second quarter tends to be their strongest, with Q4 coming in second. Conversely, the third quarter is typically their weakest period, possibly due to summer seasonal factors.

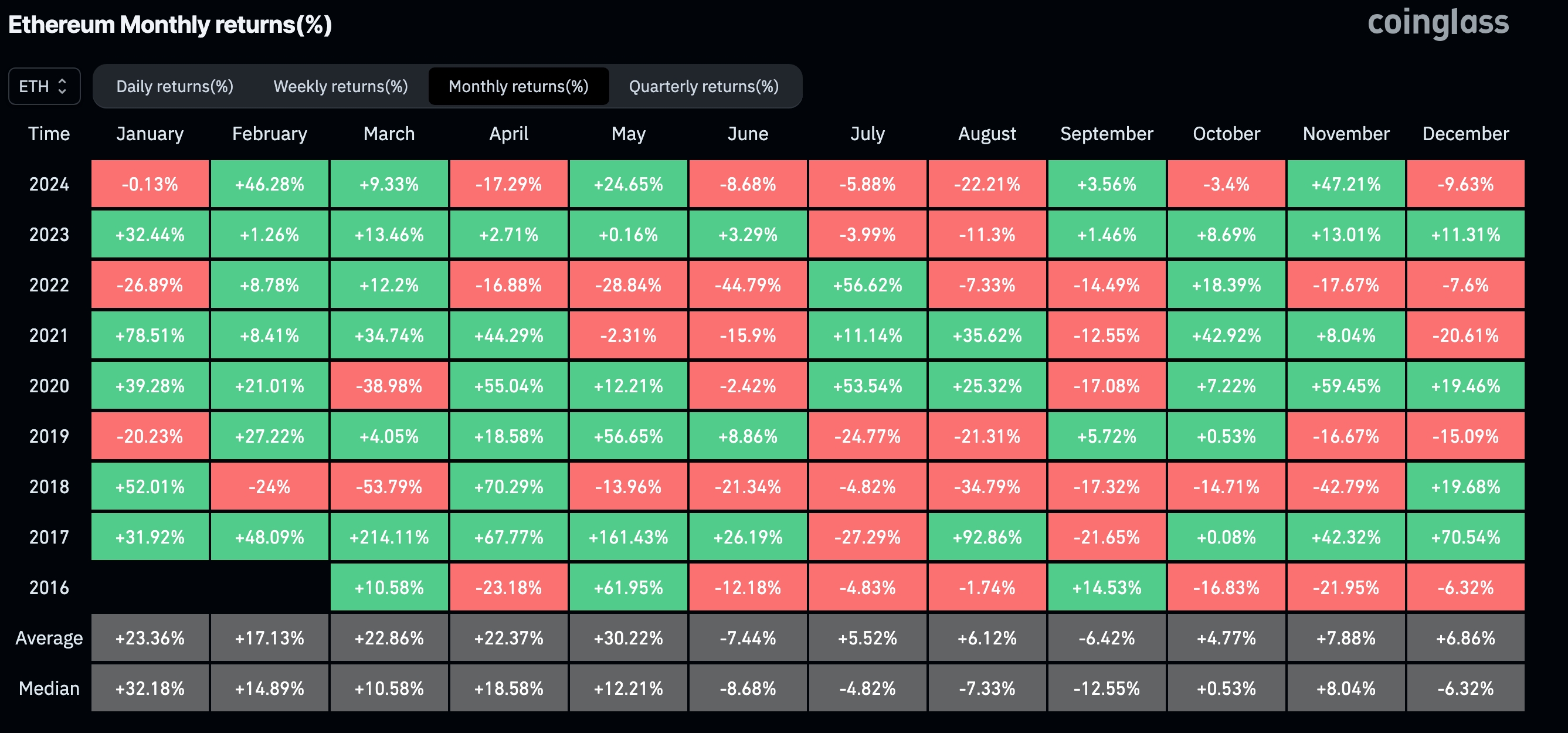

It appears that data indicates Ethereum tends to increase in value during the initial four months following a U.S. presidential election. For instance, during Donald Trump’s presidency, its average return for the first four months was approximately 90%. Similarly, after Joe Biden took office in 2021, Ethereum saw a four-month return of around $41.

It’s important to note that seasonality data doesn’t consistently serve as a reliable predictor. For instance, Ethereum experienced drops in January during the years 2022, 2019, and potentially 2024 as well, suggesting this could be another such occurrence.

From a favorable perspective, Ethereum’s fundamental aspects appear robust. There’s been significant investment interest in Spot ETH Exchange-Traded Funds (ETFs), with inflows reaching more than $2.33 billion from numerous investors.

This year, Ethereum’s network has accumulated approximately $2.44 billion in transaction fees, trailing only behind Tether as the most lucrative network. In the realm of decentralized finance, Ethereum remains unchallenged, boasting a total value of around $66 billion—a figure that surpasses the combined worth of many top ten networks.

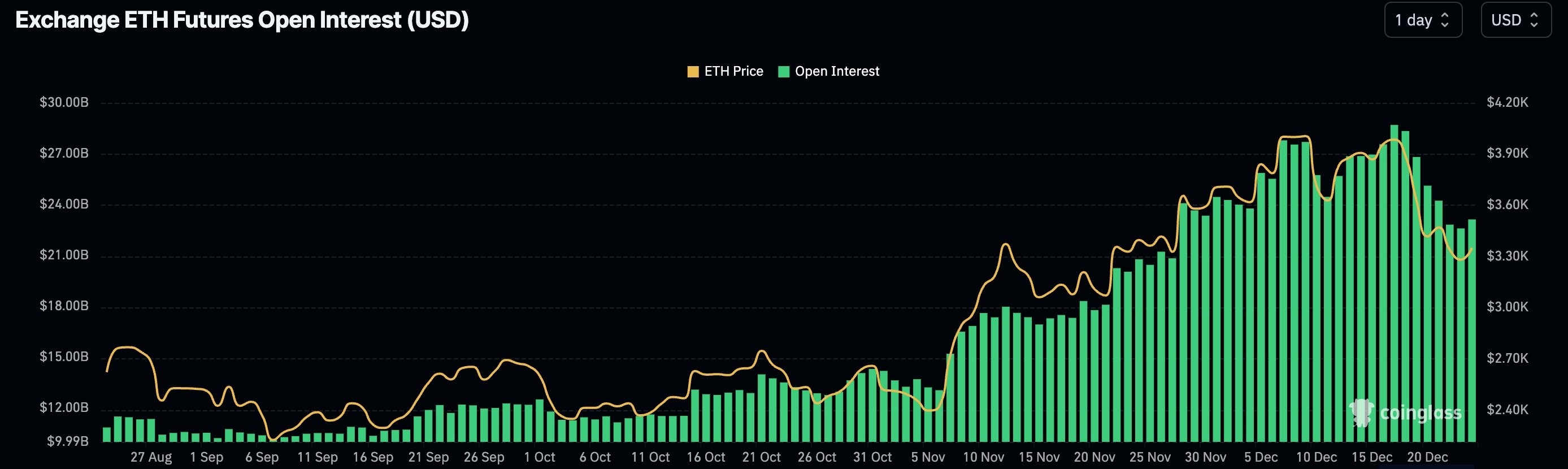

Another possible reason for the potential increase in Ethereum’s price could be the decrease in its futures open interest, which has fallen from a year-to-date high of $28 billion to currently stand at $23 billion. Notably, the last time its open interest was this low was in November, and following that, the coin saw a significant rise to approximately $4,000.

Ethereum price technical analysis

Each week’s graph demonstrates that Ether displays robust technical indicators, as it consistently stays above the upward-sloping trendline linking the lowest points since May 2022. Furthermore, it has slightly surpassed its 50-week moving average and the first support level of Andrew’s pitchfork model.

It’s reasonable to expect Ethereum prices to recover within the coming months if it successfully breaks out bullishly, which would be indicated by a rise above the triple-top chart pattern at approximately $4,027. Such a move could potentially lead us back towards its all-time high of $4,860.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

2024-12-23 18:50