As a seasoned crypto investor with battle-scarred fingers from past market swings, I find myself standing at the crossroads, gazing at XRP‘s chart with a mix of caution and hope. The prolonged consolidation phase has been a rollercoaster ride, filled with moments of anticipation, followed by disappointment when the crucial resistance level remains unbroken.

The sudden plunge in Open Interest in XRP Futures is a clear signal that bears have taken over the market, leaving traders hesitant and uncertain. The Price DAA Divergence adds fuel to the bearish fire, suggesting profit-taking and potential price declines. It’s a chilling wind that whispers of $2.00 support levels being breached.

Yet, amidst this gloomy outlook, there are glimmers of optimism from analysts like Dark Defender, Egrag, and Peter Brandt. Their bullish predictions offer a ray of hope, painting a picture of XRP soaring to new heights in the future. If their forecasts prove true, we might just see XRP breaching its resistance at $2.73 and aiming for its all-time high of $3.31.

So here I stand, on the edge of a precipice, peering into an uncertain future. Will it be a bullish shift that propels me to new heights, or will I find myself tumbling down the bear market abyss? Only time will tell.

And as I wait for the market to make its move, I can’t help but chuckle at the irony. Here I am, an investor in a digital asset that was born out of the banking industry, and I find myself playing a game that’s more reminiscent of stock market gambling than sound financial planning. But hey, that’s crypto for you – a rollercoaster ride where every day brings a new twist and turn!

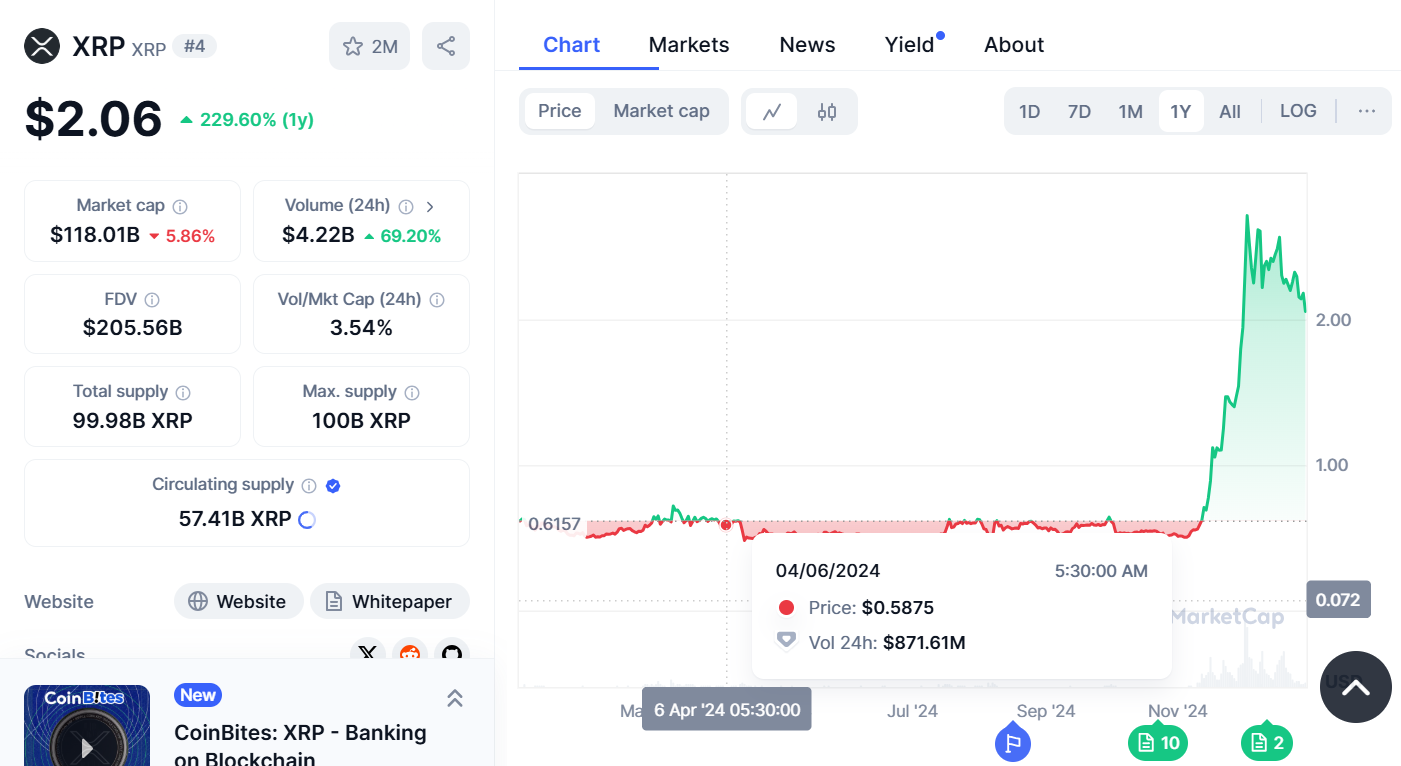

For more than a month now, the price of XRP has been stuck at a significant barrier, causing frustration among investors since the digital currency fails to build sufficient strength for a bullish surge. This prolonged stagnation has eroded the conviction of traders, resulting in decreased involvement and withdrawals from the market.

Over the past day, the total amount of contracts for XRP Futures dropped by a billion dollars, having peaked at 2.9 billion earlier due to optimism about an upcoming surge. This rapid fall suggests that traders are becoming more pessimistic and uncertain about XRP’s potential to surpass its resistance level at $2.73.

Enhancing investors’ worries, the overall momentum of XRP appears to be waning. The DAA Price Divergence indicates a bearish outlook, as investor activity lessens and prices show little progress. This situation might prompt selling and additional price drops, possibly causing XRP to fall below its $2.00 support threshold.

As a researcher delving into the cryptocurrency market, I’ve noticed an interesting perspective from Analyst Dark Defender regarding XRP. Despite the generally bearish sentiment, he sees potential for growth. He has identified a bull flag pattern on XRP’s weekly chart, predicting a target of $8.67 once the current correction phase ends. Key support levels are marked between $2.03 and $2.17, while resistance could be encountered up to $2.69.

Currently, crypto analyst Egrag is anticipating a positive trend for XRP, with a predicted price of $15 by May 5, 2025. Similarly, seasoned trader Peter Brandt expects a significant increase, suggesting a potential 100-fold rise in the near future. He recently posted a chart displaying a bullish wedge pattern on a weekly timeframe.

Currently, the direction of XRP is influenced by market feelings and broader cryptocurrency movements. If a positive trend emerges, XRP could potentially overcome its resistance at $2.73 and strive for its record high of $3.31. Until that happens, XRP will need to hold strong at its $2.00 support level.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2024-12-30 12:53