As a seasoned crypto enthusiast and investor with over a decade of experience in the digital asset market, I find myself intrigued by the latest developments in the world of cryptocurrency. The recent trends in Bitcoin (BTC), Ripple (XRP), and Solana (SOL) have caught my attention, as they seem to be driving the conversation in the crypto sphere right now.

First off, Bitcoin has been consistently showing signs of strength, with its upward trend continuing unabated. As someone who has weathered numerous market cycles, I can attest to the fact that BTC’s resilience is a testament to its intrinsic value and widespread adoption. However, I would caution investors not to get too overzealous and always keep an eye on potential corrections, as they are an integral part of any investment journey.

Moving onto Ripple, the recent dip in XRP price has left many wondering if it’s a good time to buy. Personally, I believe that Ripple holds significant potential due to its partnerships with major financial institutions and the ongoing legal battle between Ripple Labs and the SEC. As someone who has seen numerous projects rise and fall, I find myself optimistic about XRP’s prospects in the long run.

Lastly, Solana’s uptrend is worth noting, with its innovative smart contract platform attracting developers and investors alike. However, I would encourage caution when it comes to Solana, as the recent selling pressure from Pump.fun could potentially lead to a correction. As someone who has witnessed the rise and fall of numerous altcoins, I always remind myself (and others) that the crypto market is unpredictable and requires a disciplined approach to investing.

Now for a little humor to lighten things up: I remember when Bitcoin was just a few dollars and Solana was just a glimmer in its creators’ eyes – if only we could turn back time and buy as much as we could! But alas, the crypto market moves fast, so we must always stay nimble and adapt. Happy investing, fellow crypto enthusiasts!

Bitcoin has surged past $96,000 again, bouncing back after it dipped to $92,000 on New Year’s Eve. The cryptocurrency market is rebounding from a dip and various alternative coins are also starting to recover. Excitement for potential pro-cryptocurrency laws and policies in the U.S. is growing in 2025.

As a seasoned crypto investor with several years under my belt, I believe that President-elect Donald Trump’s inauguration is just around the corner and its impact on the crypto market could be substantial. In particular, I anticipate significant price fluctuations in three digital currencies: Bitcoin (BTC), Solana (SOL), and Ripple (XRP).

My experience has taught me that political events can have a profound influence on the crypto world, and Trump’s presidency could bring about changes that affect these specific tokens. I have closely followed their developments and believe they are poised for price swings in the coming weeks.

Bitcoin, as the largest and most well-known cryptocurrency, is always under the spotlight and its performance is often a barometer of the overall market sentiment. Solana, on the other hand, has shown impressive growth in recent months and could continue to rise if it manages to maintain its momentum. Lastly, Ripple’s relationship with regulators and its role as a bridge between traditional finance and digital assets make it an intriguing choice for investors looking to capitalize on any potential shifts in the market.

In conclusion, I urge fellow crypto enthusiasts to keep a close eye on these three tokens as we approach Trump’s inauguration. The price swings and changes that could occur may present lucrative opportunities for those who are prepared and informed.

Table of Contents

On-chain metrics support gains in Bitcoin, XRP and Solana

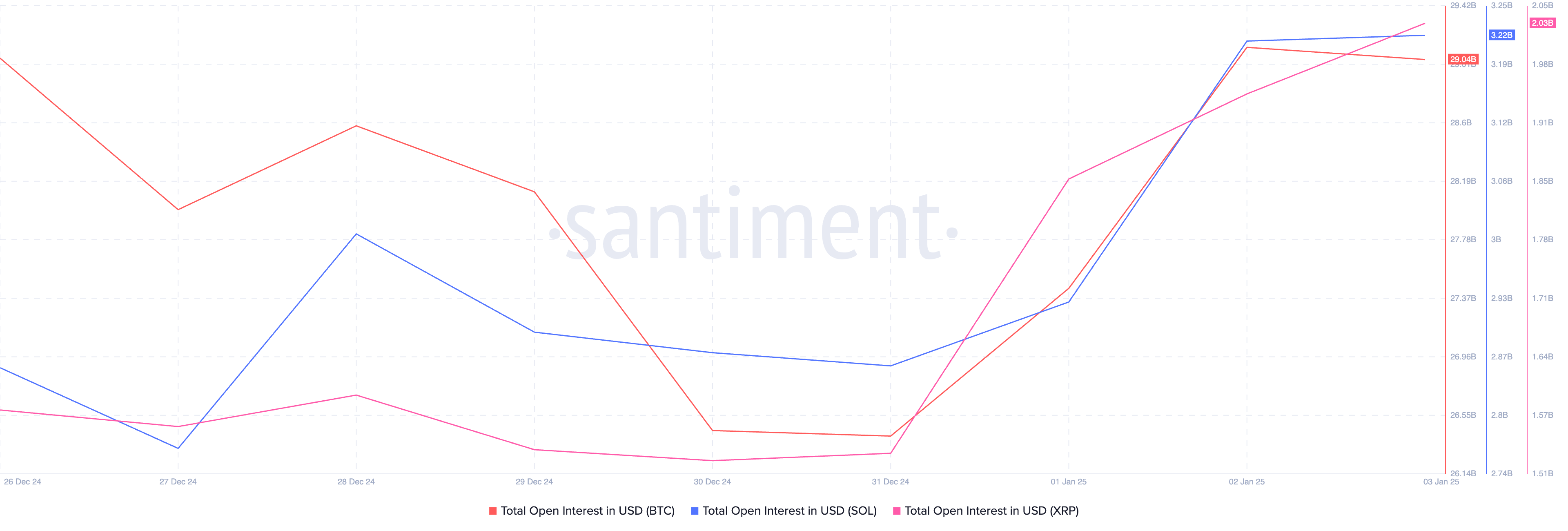

Traders’ interest and demand for Bitcoin, XRP, and Solana seems to be growing, as shown by the rise in open interest on these crypto tokens. According to Santiment, the open interest has been climbing since its low point on December 31.

Over the first three days of January, the demand among derivatives traders for the three specific tokens has grown significantly, lending credence to a positive outlook or bullish perspective.

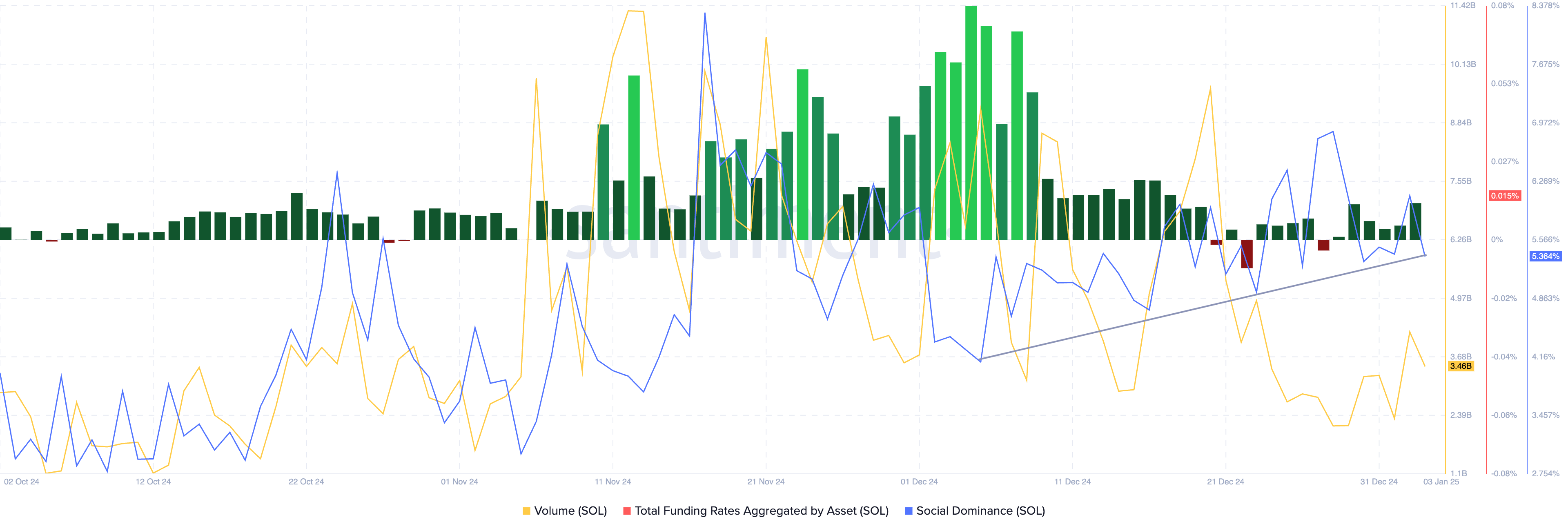

Solana’s influence is on the rise, with its token gaining more attention on social media platforms such as X and a growing number of SOL transactions on exchanges. The graph below from Santiment indicates that the funding rate across derivatives exchanges has been positive for the past five days, suggesting that traders are optimistic.

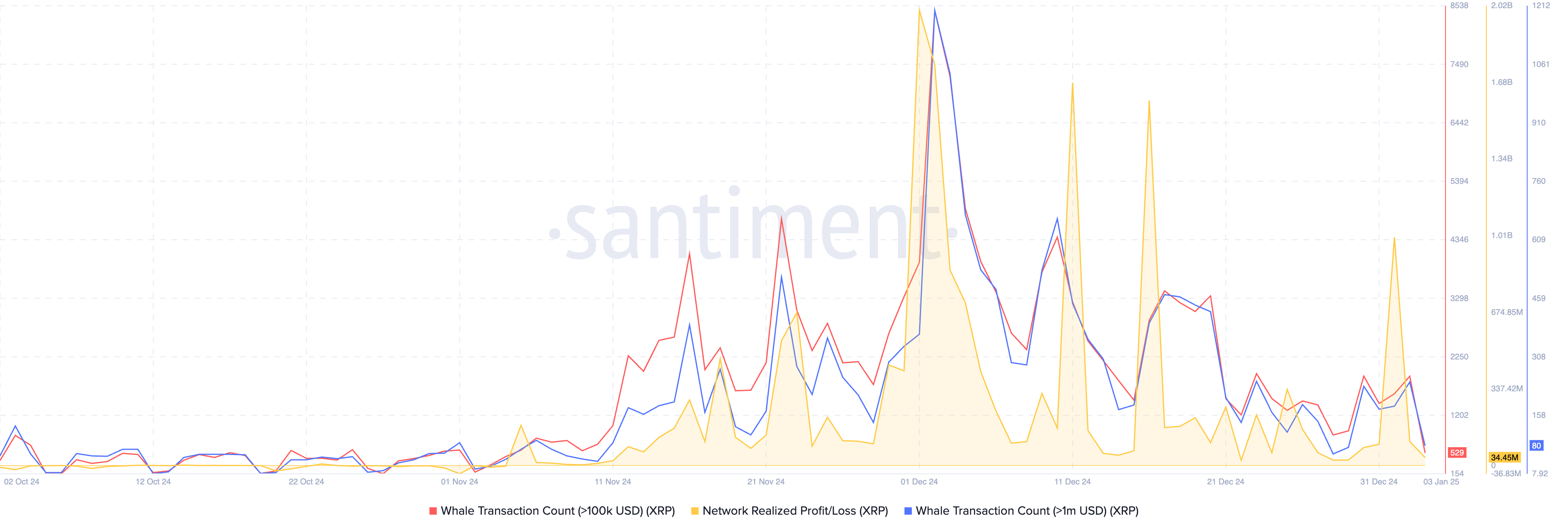

As a seasoned cryptocurrency investor with several years of experience under my belt, I’ve learned to keep a close eye on transaction volume trends, especially when it comes to large-value transactions. Over the past few days, I’ve noticed that the number of XRP transactions valued at $100,000 and $1,000,000 has decreased significantly since December 31.

At first glance, this might seem like a negative sign, as it could indicate that whales or large token holders are losing interest in XRP. However, I believe that this trend may actually signal the end of a prolonged profit-taking streak for XRP. This is because such large transactions often occur when investors cash out their profits, so a decline in these types of transactions might mean that those who were profiting from XRP are now holding onto their tokens, potentially waiting for an opportunity to re-enter the market at a lower price.

In my personal experience, I’ve found that it’s essential to stay informed about transaction trends and not be swayed solely by short-term fluctuations. Instead, I focus on long-term strategies and look for opportunities that align with my investment goals. In this case, the decrease in large volume transactions might actually present a buying opportunity for those who are patient and have a long-term perspective on XRP’s growth potential.

The Network’s Profit/Loss Metric calculates the total profit or loss made by all traders who transacted tokens on a specific day. The NPL (Net Profit/Loss) metric has shown consistent profits since the first week of November, lasting for nearly two months. However, this streak could come to an end as large investors, known as whales, start to decrease their activity in XRP.

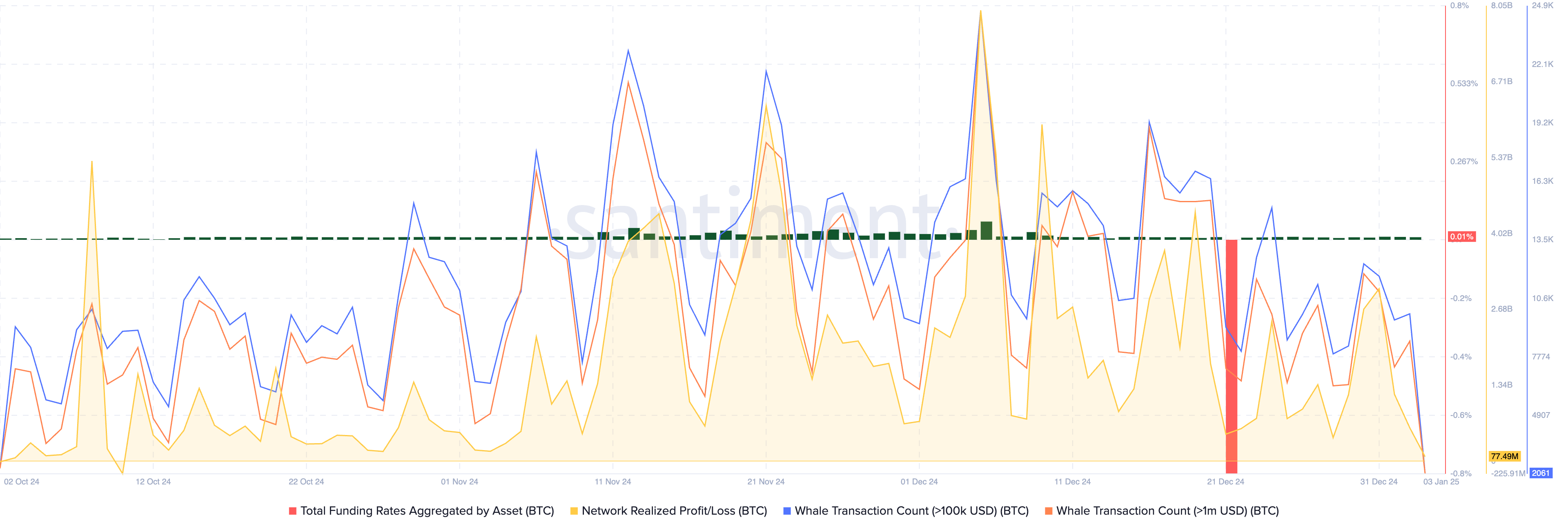

For the past ten days of December and the initial three days of January 2025, Bitcoin’s funding rate has been positive. This indicates that derivatives traders are generally optimistic. As a result, large transactions (referred to as ‘whale transactions’) have decreased, suggesting that traders might be holding onto their profits instead of selling, much like with XRP.

MicroStrategy’s declining NAV is not Bitcoin’s only concern

Institutional investment into Bitcoin appears to be decreasing as evidenced by data from Farside Investors, which indicates a drop in net inflows to U.S.-based Spot Bitcoin Exchange Traded Funds (ETFs) since the last week of December 2024.

On Thursday, January 2, ETFs recorded a net outflow of $247.80 million.

In 2024, institutional investments significantly boosted the surge in Bitcoin prices. However, as inflows decrease in 2025, we’ll need to observe how this change impacts the value of the cryptocurrency.

As someone who has been closely following the cryptocurrency market for several years now, I can’t help but notice a concerning trend emerging with MicroStrategy’s recent decline in shares. Having invested in Bitcoin myself, I understand the allure of this digital asset and its potential to revolutionize the financial industry. However, it seems that the corporate adoption of Bitcoin as a treasury asset, which was initially met with enthusiasm, is now experiencing a downturn in demand.

In my personal experience, I’ve learned that market trends can change rapidly, and it’s essential to remain cautious and informed when making investment decisions. The volatility of the cryptocurrency market requires constant vigilance and a willingness to adapt strategies as needed. While I still believe in Bitcoin’s long-term potential, I urge fellow investors to approach their investments with caution and prudence, especially during this period of uncertainty.

On the designated vacation day, along with the evolving U.S. economic landscape, a decrease in trading activity and stablecoin production have collectively contributed to a downward pressure on Bitcoin’s price. Currently, Bitcoin is maintaining its position above $96,000, and there is speculation about how soon it might attempt to surpass the $100,000 mark again, potentially reaching new heights beyond $108,000.

Solana and XRP face hurdles amidst hopes of ETF approval

The lively story surrounding Solana’s meme coin, which propelled its growth and established it as a challenger to Ethereum (ETH), seems to be losing momentum. As the frequency of airdrops decreases and network activities dwindle, Solana has noticed less activity on its blockchain.

Despite the fact that Solana’s decentralized exchange statistics such as volume and protocol earnings surpass those of Ethereum, the market capitalization of its stablecoin still lags behind that of Ethereum.

The ongoing appeal by the Securities and Exchange Commission in the Ripple lawsuit continues, fueling speculation about potential shifts in U.S. cryptocurrency regulations and policies. Traders are optimistic that a new chair at the SEC could resolve this issue, potentially bringing an end to the prolonged legal dispute over XRP which lasted from 2020 to 2024.

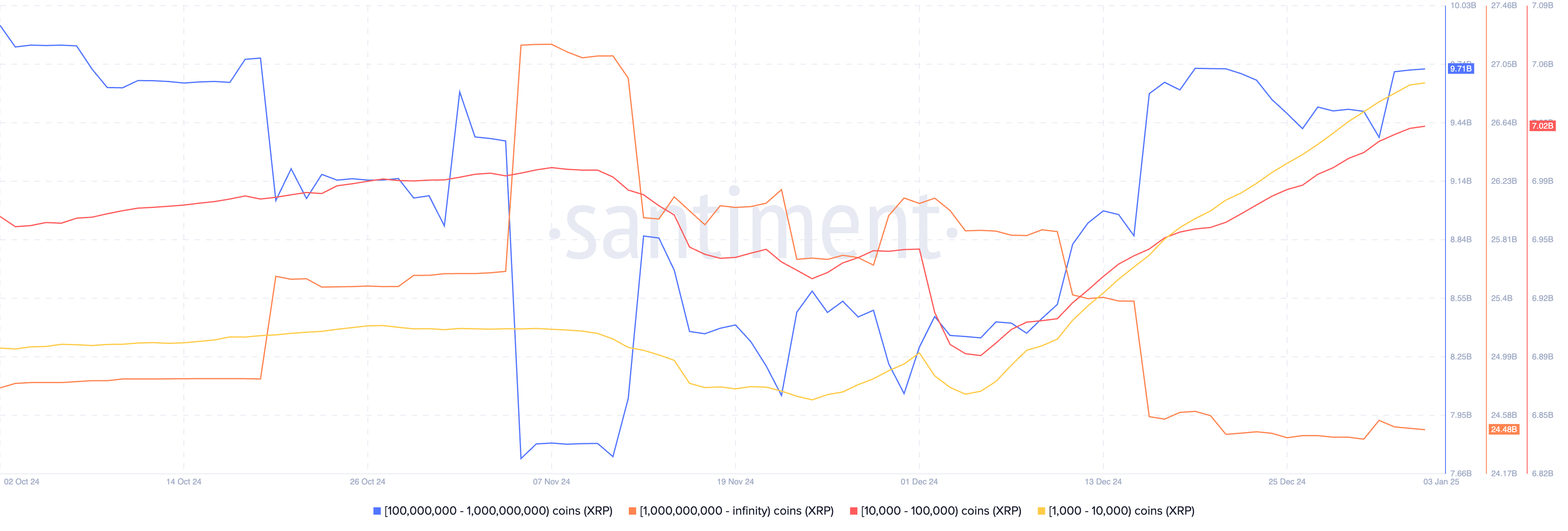

As an analyst, I’ve observed a significant trend in the XRP market: Large-scale investors, holding between 100 million and 1 billion XRP tokens, have been actively purchasing this cryptocurrency. Over the first three days of January alone, these investors added over 350 million XRP to their portfolios. This accumulation trend, as indicated by Santiment data, lends strong support to a bullish outlook for XRP as an altcoin.

Technical analysis and targets

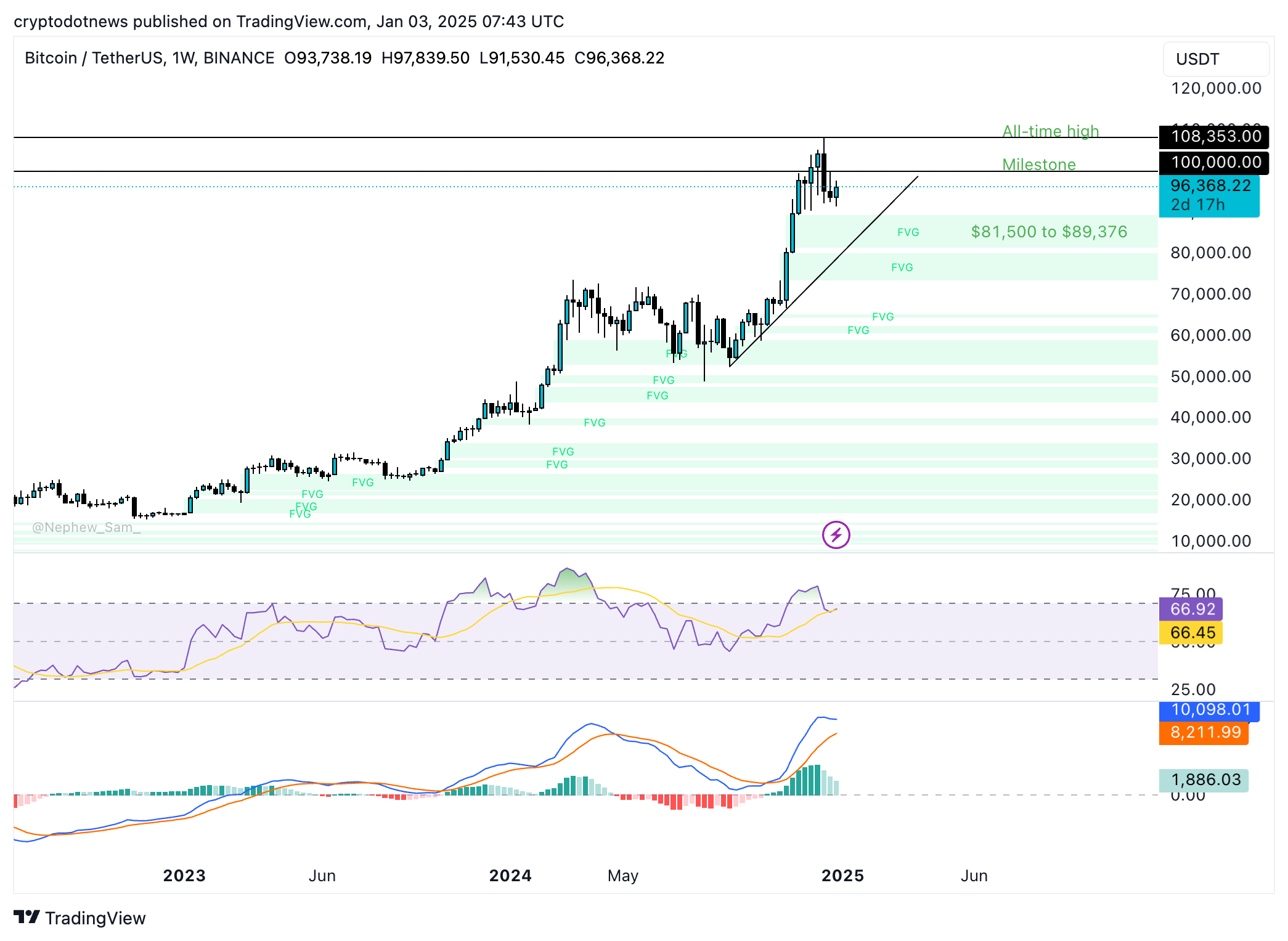

The weekly Bitcoin price graph indicates a rising trend for BTC. Various technical indicators point towards continued growth in BTC’s value. The Moving Average Convergence Divergence (MACD) displays green bars that sit above the neutral line, suggesting there is strong positive momentum driving Bitcoin prices upwards. Additionally, the Relative Strength Index (RSI) stands at 66 and is climbing, indicating robust market strength for BTC.

As a seasoned cryptocurrency investor with years of experience under my belt, I believe that Bitcoin (BTC) could find support in the fair value gap between $81,500 and $89,376 if there is a correction in the largest cryptocurrency. The BTC/USDT weekly price chart shows the token could test its $100,000 milestone and potentially revisit its all-time high, given the current upward trend. Based on my observations, I’m optimistic about the future of Bitcoin, but I always remind myself to stay cautious and vigilant in this volatile market.

As a seasoned crypto investor with years of experience under my belt, I find myself closely watching Ripple (XRP) as it hovers just shy of its peak price of $2.9092, reached back in 2024. The altcoin has shown resistance at the December 9 high of $2.6076, as evidenced by the XRP/USDT weekly chart. I’ve learned from past market fluctuations that a key factor to consider is the imbalance zone between $1.63 and $2.17, which could potentially act as a strong support for XRP should its price correct. My strategy would be to keep a close eye on this area and be prepared to make strategic moves if necessary, always keeping in mind the volatile nature of the crypto market.

The Relative Strength Index (RSI) suggests that the value of the altcoin is inflated at present. On the other hand, the Moving Average Convergence Divergence (MACD) shows a strong underlying momentum in the upward trend of XRP’s price.

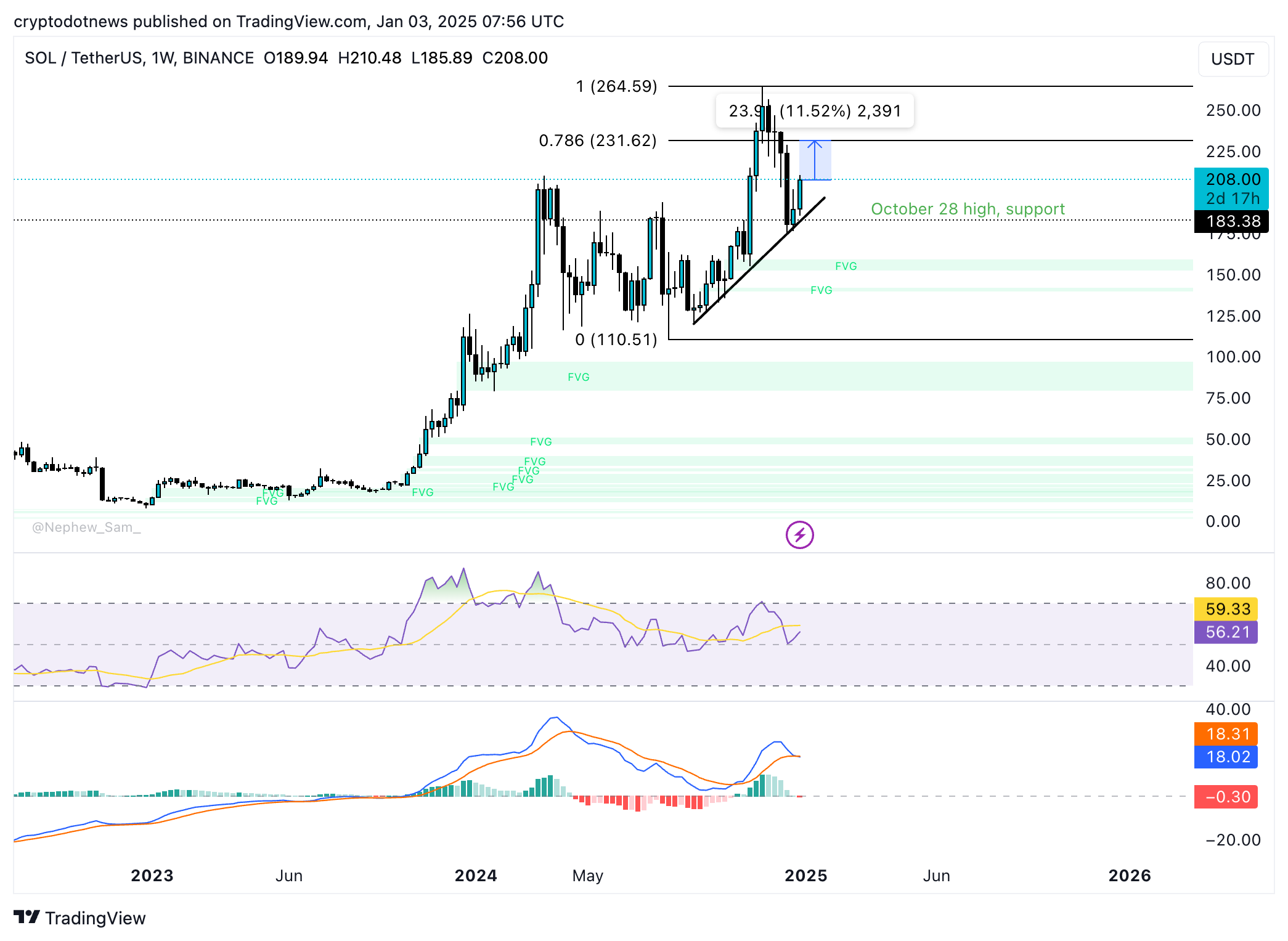

Looking at Solana’s weekly chart, we see that it is currently on an upward trajectory, nearing the 78.6% Fibonacci retracement level of its rally from the $110 low to the $264.59 peak, which stands at approximately $231.62. Notably, the $200 mark continues to be a significant milestone for Solana (SOL).

At the moment, Solana’s value sits around 12% lower than its closest resistance level, with the peak of $183.38 on October 28 acting as a strong support for the token. The Relative Strength Index (RSI) is trending upward and stands at 56, suggesting a moderate bullish sentiment. However, the Moving Average Convergence Divergence (MACD) indicates that the positive momentum in Solana’s price trend might be reversing.

Pump.fun continues to dump SOL tokens

According to an on-chain analysis by Lookonchain, it appears that the Solana launchpad known as Pump.fun is consistently transferring its SOL tokens. On January 3, a wallet linked to this platform deposited approximately 292,437 SOL, worth over $55 million, into Kraken and subsequently sold nearly $42 million in SOL tokens.

On Friday, the launchpad’s wallet deposited 63,171 SOL( worth upwards of $13 million) to Kraken.

63,171 dollars worth of SOL ($13.11M) was recently deposited into Kraken by Pump Fun 30 minutes ago.

To date, Pump Fun has deposited a total of 1,564,064 $SOL ($316.5M) into Kraken and sold 264,373 $SOL for approximately 41.64 million USDC.

— Lookonchain (@lookonchain) January 2, 2025

If Pump.fun’s SOL token continues to be offloaded, it could potentially heighten the selling pressure on the altcoin. This is a concern if the launchpad doesn’t halt its current trend soon. Traders should keep an eye on whale transactions and Solana’s supply on trading platforms to anticipate any imminent price adjustments in SOL.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Maiden Academy tier list

2025-01-03 14:33