As a seasoned analyst with over a decade of experience in the financial markets, I have seen my fair share of bull runs and bear markets. The latest report by Bybit and Block Scholes has piqued my interest, given its insights into the stability of Bitcoin (BTC) and Ethereum (ETH) options markets amid year-end expirations.

Having closely observed the crypto market’s dynamics over the years, I have learned to appreciate the unpredictable nature of this space. However, the resilience displayed by BTC’s open interest throughout the year-end expirations was a pleasant surprise, especially considering the typically volatile behavior associated with options nearing their expiration dates.

The report suggests that traders are exhibiting caution yet confidence in their options’ stability, which is an interesting development. This cautious optimism seems to be reflected across the market, as Bitcoin futures OI has dropped below the $60 billion threshold but hasn’t fallen as low as early November levels.

On the other hand, Ethereum (ETH) options remained relatively stable throughout December 2024, but its spot price is showing lower volatility compared to its short-term implied volatility. This discrepancy suggests that ETH’s options market might be gearing up for potential short-term volatility in the coming days.

It’s always fascinating to observe how different markets react and adapt to various circumstances, and the crypto derivatives market is no exception. As we move forward into 2025, I will continue to monitor these trends closely and adjust my investment strategies accordingly.

Lastly, as a self-proclaimed “joker in the finance world,” I can’t help but add a touch of humor: I guess traders are so confident that they’re betting on Bitcoin’s stability like they’re playing a game of Jenga—slowly and carefully removing blocks without causing the tower to collapse!

According to their recent findings, Bitcoin options trading remained steady during the end-of-year expirations, whereas Ethereum options might experience a short burst of volatility.

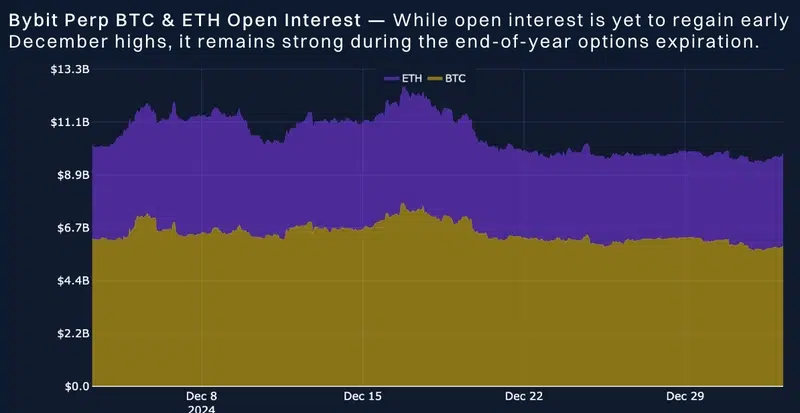

As indicated by a study released by cryptocurrency exchange Bybit and statistical platform Block Scholes, the open interest in Bitcoin (BTC) perpetual contracts held steady during the year-end settlements. This constancy was unexpected, as options usually close to their expiration tend to trigger price fluctuations.

The analysis indicates that traders exhibit a blend of caution and confidence in the steadiness of their option investments. They didn’t heavily depend on continuous contracts to safeguard the delta of expiring options. This has kept Bitcoin Open Interest (OI) quite steady, even with reduced volatility and failure to rebound to its peak December values.

According to past reports from crypto.news, the open interest (OI) for Bitcoin futures has dropped beneath the $60 billion mark. Currently, the total OI is approximately $56.6 billion, having decreased significantly at the beginning of January 2025. However, it hasn’t sunk as low as the levels seen in early November when it fell below $40 billion.

The analysis indicates that the shape of the implied volatility curve for Bitcoin options remains quite steep, suggesting that the estimated volatility will hold steady at approximately 57% during a week’s time for options involving a difference of five points.

A large portion of the expired option contracts has not been reused as of now, leading to an equal number of calls and puts (a balanced state). This suggests that, compared to early December 2024, Bitcoin’s options market currently demonstrates less leverage.

Through the last days of December 2024, Ethereum (ETH) options maintained a steady state. Contrastingly, while ETH’s current market price indicates less volatility, its predicted short-term volatility is higher.

Over the last seven days, the shape of ETH option’s implied volatility has firstly dropped significantly, then leveled off. In contrast to Bitcoin’s continuous decline, Ethereum’s pattern indicates that its options market is gearing up for possible short-term fluctuations in its spot price.

Even though they’re close to their expiration, ETH call options have picked up speed in early 2025. Currently, the Open Interest (OI) for Ethereum is approximately $25.5 billion, reaching back to the levels seen in mid-December.

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- USD CNY PREDICTION

- Gold Rate Forecast

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Every Upcoming Zac Efron Movie And TV Show

2025-01-04 00:34