As an analyst with over a decade of experience in the cryptosphere, I’ve seen my fair share of blockchain projects come and go. However, the rapid growth and promising potential of Berachain and Linea Protocol have piqued my interest more than most.

Berachain seems to be on an unstoppable rise, becoming one of the fastest-growing players in the crypto industry. With a hefty $1 billion valuation and a portfolio of DeFi applications that rival some of the biggest names in the game, it’s hard not to get excited about Berachain’s future.

On the other hand, Linea’s zero-knowledge technology and backing by Consensys make it a formidable competitor in the L2 space. With over $383 million locked in its network and a growing ecosystem of notable players, Linea seems poised for success.

That being said, as we all know too well in this industry, past performance is no guarantee of future results. The recent experiences of Wormhole and EigenLayer serve as a reminder that even the most promising projects can face challenges along the way. But with Berachain’s 90% odds and Linea’s 89%, I’d say the odds are definitely in their favor.

And to lighten the mood, let me leave you with this joke: Why don’t cryptocurrencies ever get lost? Because they always find their way back to the blockchain!

Users of Polymarket are anticipating that Berachain and Linea Protocol will distribute their airlifts during the initial three months of the current year.

In a modest survey by Polymarket involving approximately $22,000 worth of assets, the estimated likelihood of Berachain’s airdrop is 90%, while that of Linear stands at 89%.

Berachain airdrop hopes rise

Berachain has experienced rapid growth within the cryptocurrency sector. Additionally, it boasts a substantial financial backing, having secured $43 million in funding in 2023 and an additional $100 million in March of the previous year. This funding placed its valuation at a billion dollars.

As a researcher delving into the blockchain landscape, I’ve come across a layer-1 network that boasts a collection of decentralized finance (DeFi) applications within its ecosystem. This network, known as BEX, serves as an alternative to Uniswap (UNI), providing users with a seamless token swapping experience. Additionally, BEND, another component of this network, functions as a rival to Aave (AAVE), catering to the needs of borrowers and lenders within the DeFi sector.

BERPS platform empowers users to trade their preferred tokens, whereas BGT Station invites users to engage in BGT’s decision-making process. The company’s own stablecoin, HONEY, serves as a bridge connecting these decentralized applications within the ecosystem.

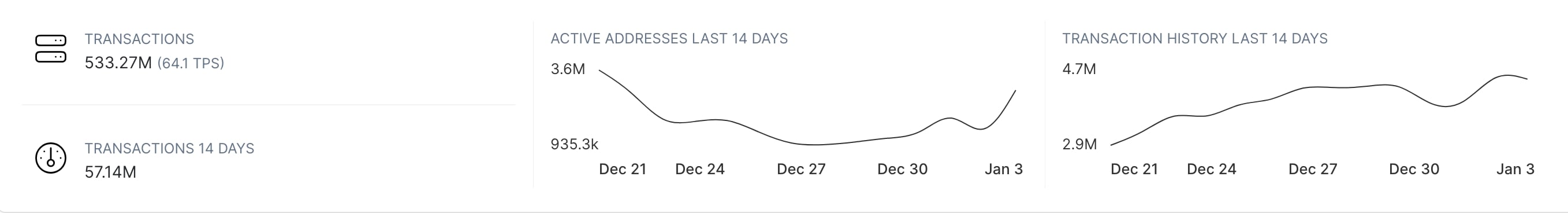

Data recorded on the blockchain indicates that Berachain’s network has processed more than half a billion transactions since its beginning. Approximately 57.14 million of these transactions have occurred within the past two weeks. Furthermore, the number of active addresses on Berachain has significantly increased, climbing from 945,000 on December 15 to nearly 3 million today.

Linea’s ecosystem is growing ahead of airdrop

Currently, Linea stands out as a widely recognized layer-2 network. Powered by zero-knowledge tech, it aims to boost the efficiency of Ethereum. Competing networks such as Arbitrum, Base, and Optimism are also in the running.

Data recorded on the blockchain indicates that Linea has processed approximately 241 million transactions within its system. Over the past two weeks, it has managed nearly 240,000 transactions.

It appears that the total value locked within Linea exceeds $383 million according to recent findings. Notable contributors to its system include Mendi, ZeroLend, and Lynex.

It’s plausible that Linea gained its prominence because it was founded by Consensys, a notable figure within the cryptocurrency sector. Notably, Consensys has secured more than $450 million in funding from prominent investors such as Third Point, ParaFi, and Softbank. The Linea Foundation, a Swiss entity that began operations last November, is responsible for managing the airdrop.

As an analyst, I’ve observed the varying outcomes of recent airdrops in popular crypto projects such as zkSync, EigenLayer, Wormhole, LayerZero, and Hamster Kombat. For instance, Wormhole’s token has experienced a significant decrease, falling by approximately 82% from its peak listing price. Similarly, EigenLayer has seen a decline of around 30%.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-01-04 19:42