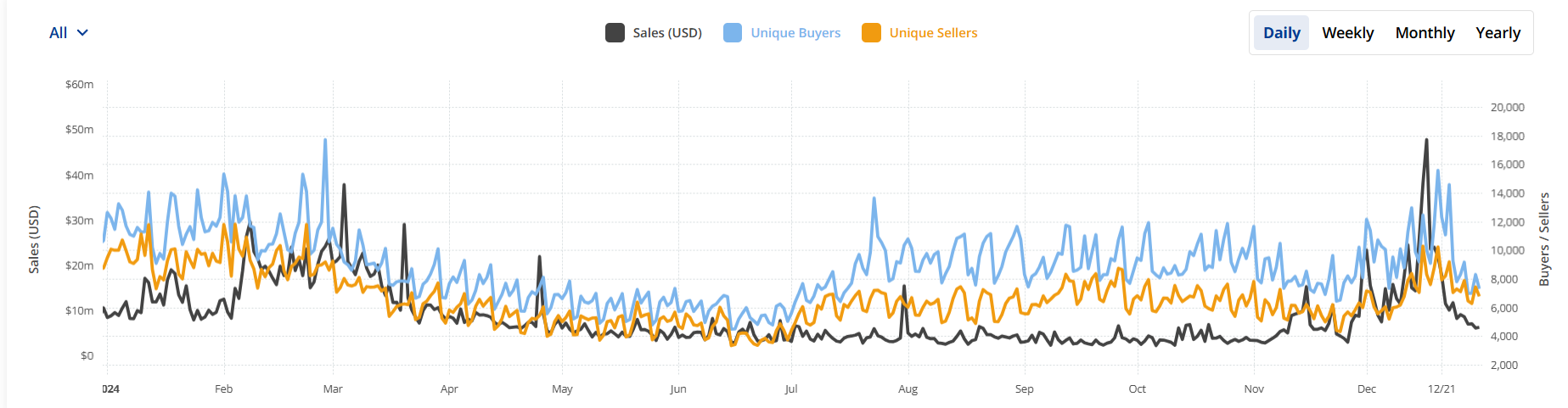

As the year drew to a close, the sales of non-fungible tokens reached an impressive peak in December, totaling a substantial $877 million. This remarkable figure places December as the second strongest sales month in the year 2024.

2024 saw digital collectibles built on blockchain technology experience significant growth in December, with sales reaching an impressive $877 million. This made it the second-highest grossing month of the year for this market. The robust end-of-year performance capped off a tumultuous year for the NFT sector, which experienced a noteworthy rebound during the final quarter.

2024 NFT sales data from CryptoSlam indicates a grand total of $8.83 billion, surpassing the previous year by more than $100 million. Although a 1.1% increase may not appear substantial at first glance, it underscores the market’s resilience as it rebounded following several months of decreased sales activity.

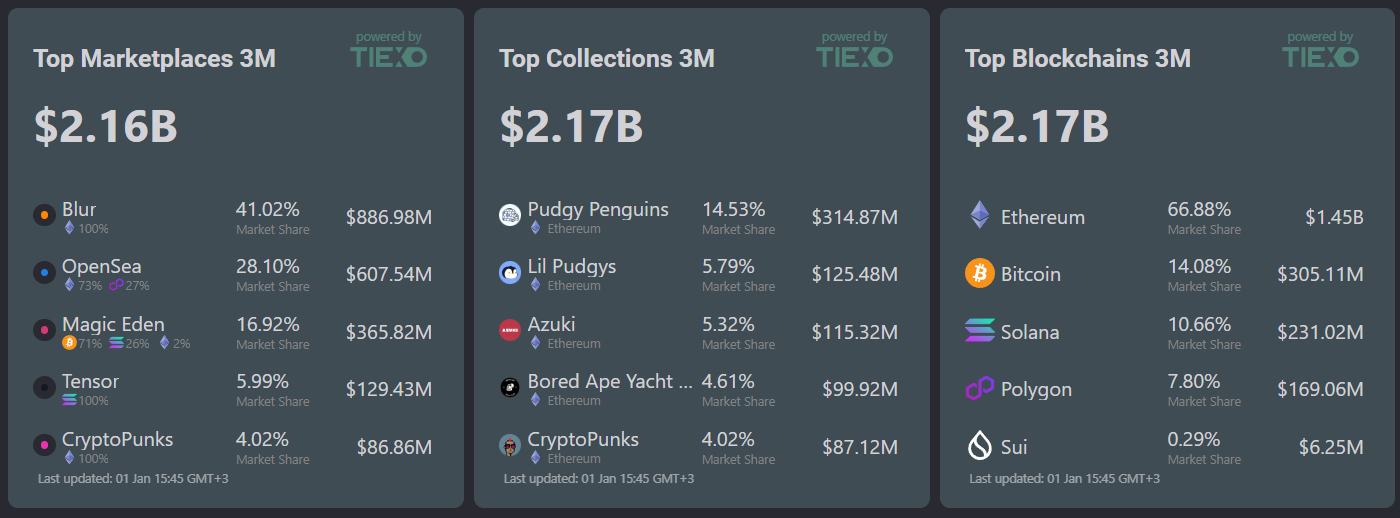

In December, Ethereum-driven NFT collections such as Pudgy Penguins, Azuki, and Bored Ape Yacht Club garnered significant attention, data reveals. It was Ethereum NFTs that dominated the month’s sales, accounting for approximately $488.4 million of the total sales figures, based on NFT Price Floor data. Specifically, Pudgy Penguins led the way with a trading volume of over $285 million. Other collections like Lil Pudgys and Azuki contributed an additional $222 million to the total.

In a post on crypto.news, Nicolás Lallement, co-founder of NFT Price Floor, pointed out that the market for NFTs had an impressive first quarter in 2024, with both Ordinals (Bitcoin) and Solana NFT collections seeing significant growth. He also remarked that a readjustment or repricing of Ethereum-based NFT collections was needed at this point.

The current trend of tokens associated with NFTs is serving as a catalyst for this price adjustment. Notable projects such as Pudgy Penguins, Doodles, and Azuki have either debuted or revealed intentions to introduce meme/Layer 2 governance tokens. This has sparked a surge in interest and caused a reevaluation of the pricing for high-value NFTs.

Nicolás Lallement

Lallement emphasizes that the repricing of NFTs isn’t solely due to airdrops. Instead, many holders have moved their profits from meme coin trading into long-term investments, focusing on high-quality collections. This trend is particularly apparent on Ethereum because it hosts the most established collection of blue chip NFTs.

As we move towards 2025, I expect a positive ripple effect that will encompass the entire Non-Fungible Token (NFT) market. This ripple is likely to begin with collections linked to airdrops, followed by Ethereum’s popular PFP (Profile Picture) blue-chip collections, art platforms like Art Blocks, and eventually, it may also involve Solana and Bitcoin.

Nicolás Lallement

In the final quarter of the year, the NFT market experienced a significant rebound following a challenging third quarter. Despite just over $1 billion in sales in Q3, it saw an impressive 96% increase, reaching approximately $2.2 billion in Q4. The strong sales figure of $562 million in November paved the way for December’s near-billion-dollar performance.

Experts in the digital currency field attribute the market surge to growing trust and optimism within the crypto sector. For example, analysts at DappRadar observed that surging token prices likely sparked positivity, attracting new investors into the industry. Sara Gherghelas, a blockchain analyst from DappRadar, suggests that this divergence is likely due to increased trading activity in high-value collections like those from Yuga Labs, along with rising token values.

In her report, Sara Gherghelas stated that enhanced liquidity and heightened interaction with premium collections have been bolstering trust among collectors and investors. Now, they are considering NFTs not just as investment opportunities but also as cultural artifacts.

Still far from its peak

2024’s cumulative NFT sales have fallen significantly short of the market’s peak years, such as 2021 when NFT transactions totaled approximately $15.7 billion, nearly twice the amount recorded this year. The following year also saw impressive figures with a staggering $23.7 billion in sales.

Lallement posits that NFTs occupy an exceptional place, serving simultaneously as high-risk investment opportunities and symbols of prestige. He elaborates by stating that in the maturity phase of a bull market, investors who have amassed wealth often divert their attention from speculative ventures to acquiring status items such as digital art or collectibles.

The origin of this action is rooted in the ambition to showcase wealth and earn respect among their peers within their social circles. For NFTs to regain their prices from 2021-2022 peaks, it’s probable that Bitcoin needs to reach a substantial price (like $150K) and Ethereum should set a new record high (multiple times its previous peak, approximately $10k).

Nicolás Lallement

After achieving these benchmarks, Lallement predicts a shift in investment capital from interchangeable tokens to carefully chosen Non-Fungible Tokens (NFTs). He posits that as investors begin to redirect their returns into valuable NFT collections, it may trigger another surge in overvalued assessments. He suggests that robust token performance can boost investor trust, generate prosperity, and rekindle the speculative and cultural allure of NFTs as both investments and status symbols. In summary, this pattern is expected to persist, reinforcing the rollercoaster-like growth trajectory of the NFT market, mirroring broader trends in the crypto sector.

In Q4, Blur and OpenSea dominated the NFT marketplace scene, accounting for nearly 70% of all transactions, as reported by Tiexo’s analytics platform. Blur emerged as the frontrunner with approximately $885 million in sales during this period. OpenSea came in second place with around $607 million in sales. Magic Eden, specializing in Solana NFTs, registered about $365 million worth of transactions.

The diverse nature of transactions happening in the NFT marketplace indicates that the NFT sector is still evolving, meaning no single platform or blockchain has completely taken over yet. While Ethereum remains dominant in total NFT sales to date, Solana and Bitcoin are increasingly becoming significant players as well.

The surge in NFTs during December has left us pondering about its future direction. Will the enthusiasm persist till 2025, or will it wane? We might get answers shortly as experts foresee Bitcoin’s rally reaching its peak around mid-2025, which could potentially influence the NFT market as well.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-01-06 16:16