The mantra targets $10, according to analysts, due to anticipated exponential growth driven by robust acceptance, strategic collaborations, and emphasis on compliant RWA tokenization.

presently, MANTRA (OM) stands at approximately $3.91, slightly dipping from its peak this week. This decline has caused the token’s market capitalization to surpass $3.74 billion. Despite this drop, MANTRA is garnering substantial interest within the blockchain sector, and analysts foresee notable growth for it in 2025.

From my perspective as an analyst, it’s clear that MANTRA currently dominates the regulated RWA tokenization sector, being the first Layer-1 blockchain specifically designed for this purpose. Predictions suggest that, by 2030, this project is poised to claim a substantial portion of the over $16 trillion RWA tokenization market, given its strategic positioning.

As a researcher involved in the MANTRA project, I’m thrilled to report that our strategic collaborations with Google Cloud, MAG, Zand Bank, and Pyse have significantly propelled our initiative forward. Furthermore, the escalating interest in MANTRA, particularly within the UAE market, underscores the faith investors are placing in our project.

Among Layer-1 blockchains such as Solana and Sui, Mantra distinguishes itself by emphasizing regulatory-friendly Real World Asset (RWA) tokenization. Experts suggest that this strategy grants Mantra a competitive advantage within the blockchain community.

MANTRA’s future aspiration encompasses a whopping $100 billion locked on-chain by the year 2026, which implies substantial growth potential given its current market capitalization of $3.74 billion. Industry experts predict that OM could potentially multiply tenfold in the long run, although a more achievable short-term target is a tripling to around $10 per token.

MANTRA prepares for a breakout

OM’s chart is shaping up like a classic bull flag pattern within the accumulation phase, hinting at a powerful breakout opportunity. The pattern features recurring lower highs and lower selling pressure, implying robust accumulation from institutional investors. This technical configuration, coupled with rising volume trends, resembles patterns observed in other prosperous Layer-1 blockchains preceding their dramatic price surges.

Based on current support at around $3.60 and resistance at approximately $4.10, this digital coin may be gearing up for a possible uptrend. Should it manage to surpass the $4.60 threshold, financial experts predict a potential sharp increase, with price predictions potentially reaching up to $10. The rising institutional interest and expansion of the ecosystem are driving these positive forecasts.

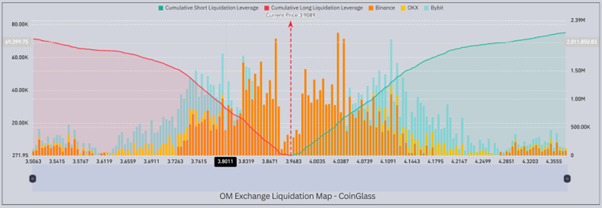

Over the last month, a large number of short positions on OM have been forced to close, potentially indicating an upcoming price squeeze. Within the last day, over $2 million worth of these short positions were closed. In the past week, more than $9 million, and in the last 30 days, over $20 million in short positions on OM have been liquidated.

The growing frequency of quick closures (short liquidations) rather than prolonged investments (long positions), indicates a significant demand for purchasing and hints at a possible rapid increase or surge (explosive upward movement), reminiscent of the patterns observed during past cryptocurrency market surges.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-01-09 14:30