Despite the introduction of exchange-traded funds (ETFs) focused on Bitcoin and Ethereum in 2024, it remains difficult for financial advisors to provide their clients with opportunities to invest in cryptocurrencies, as only about one third (35%) of them are currently able to do so.

As cryptocurrencies gain more popularity among the general public, a significant challenge arises: limited access for financial advisors, leading many clients to invest in crypto without the guidance of their advisors within the formal advisory relationship.

The findings from a recent study conducted by Bitwise Asset Management and ETF data provider VettaFi suggest that many financial advisors continue to encounter hurdles when it comes to procuring cryptocurrencies for their clients’ portfolios. Remarkably, as few as 35% of these advisors reported the ability to invest in crypto on behalf of their clients, underscoring a significant obstacle in promoting widespread usage.

The study, which took place between November 14 and December 20, 2024, involved more than 400 financial consultants. It revealed that the percentage of investments in cryptocurrencies has nearly doubled to 22% compared to the previous year. However, challenges related to access remain a concern. At the same time, it was found that as many as 71% of these advisors stated that some or all of their clients are independently investing in cryptocurrencies, separate from their professional relationship with the advisor.

Matt Hougan, as Chief Investment Officer at Bitwise, highlighted an increased awareness among advisors about the potential of cryptocurrency, and further emphasized a surge in allocation towards it unlike any time before.

However, what might be most surprising is that there’s still a lot of ground left to cover, as more than two-thirds of financial advisors – who guide millions of Americans and oversee trillions in assets – are yet to tap into the realm of cryptocurrencies for their clients.

Matt Hougan

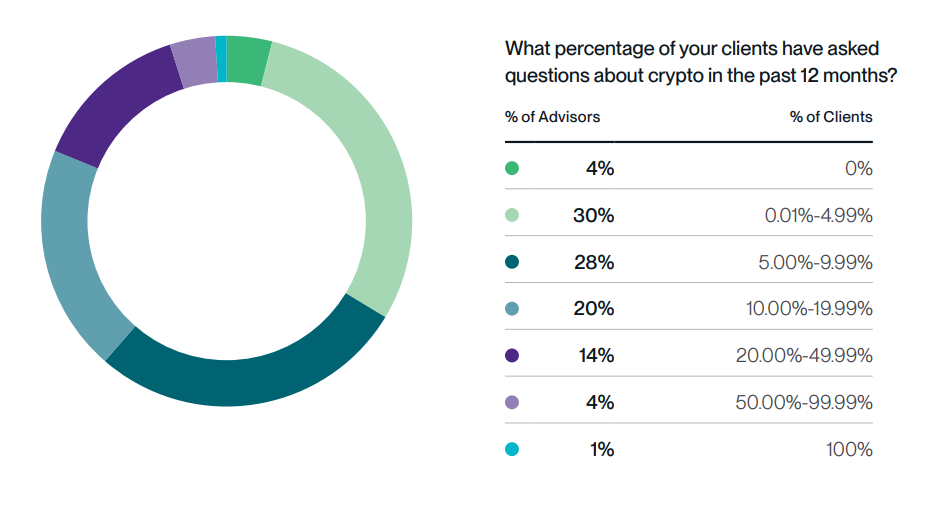

Despite a few ongoing obstacles, there’s continued high interest in the subject matter. In fact, over 96% of financial advisors reported fielding client questions about cryptocurrency in the year 2024, and a staggering 99% of those who already have crypto investments planned to either keep or boost their involvement in 2025.

As an analyst, I found that the data indicates a surge in optimism among financial advisors regarding cryptocurrency investment. Specifically, the data reveals that nearly one in five (19%) who currently have not invested in crypto are considering doing so by 2025, which is more than twice the number from last year. This upward trend suggests a growing interest in the crypto market among financial advisors.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

2025-01-10 11:18