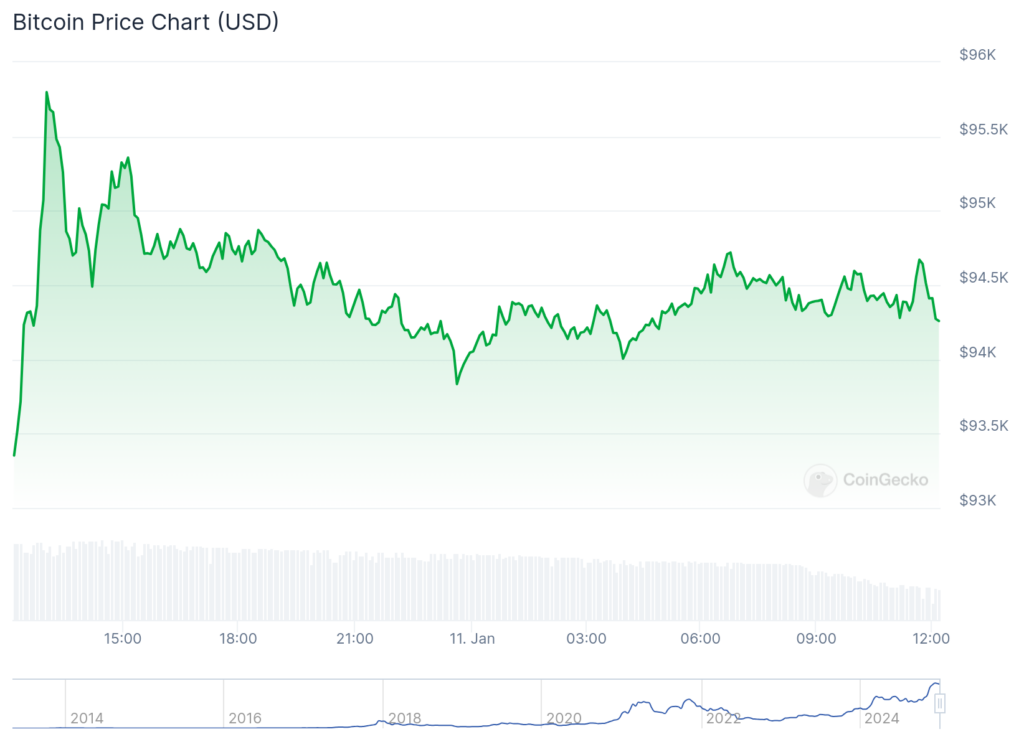

On Saturday, the price of Bitcoin held steady within a narrow band, as the mining hash rate dropped and a bearish pattern emerged, potentially leading to a downward price break.

At the most recent check, Bitcoin (BTC) was being traded at approximately $94,296. This shift comes in response to a new report from the Bureau of Labor Statistics indicating that the American economy generated more than 256,000 jobs. The unemployment rate decreased to 4.1%.

Consequently, U.S. stocks experienced a decline, as evidenced by a drop of 697 points in the Dow Jones index and 317 points in the Nasdaq 100 index.

According to crypto.news predictions, the bond market persisted in its decline, as the yield on the 30-year bond climbed to 5.0%. The yields for the 10- and 5-year bonds increased to 4.76% and 4.57%, respectively. This surge in yields suggests that the market anticipates the Federal Reserve will adopt a firm stance, which often has an impact on volatile assets such as Bitcoin and other cryptocurrencies.

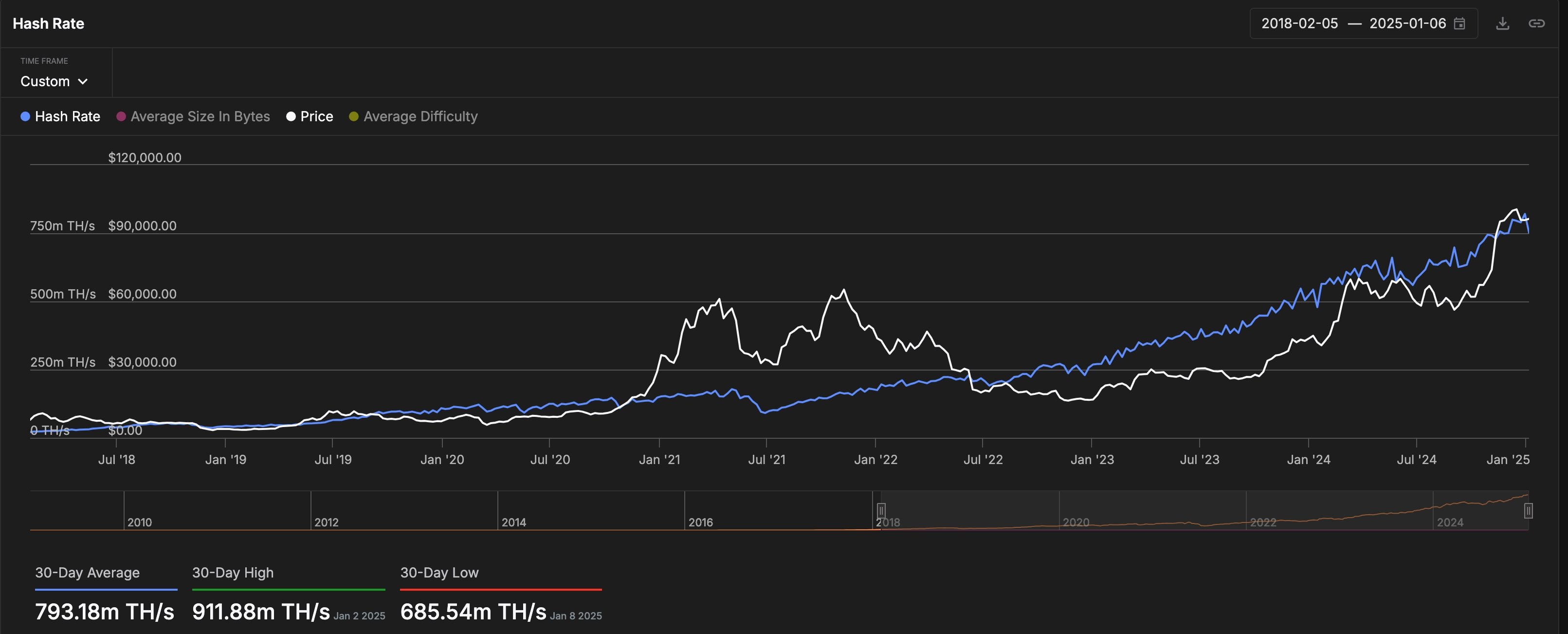

Over the last few days, data from IntoTheBlock indicates that Bitcoin’s hash rate has decreased since its price stopped advancing.

On January 11th, its hash rate was 750 terahashes per second (TH/s), which was lower than both its 30-day high of 911.88 TH/s and the 30-day average of 793 TH/s.

The term “hash rate” refers to a crucial measurement that indicates how quickly complex mathematical problems within a network are being solved.

Recent on-chain data indicates a decrease in active Bitcoin addresses from 900,000 on Monday to approximately 775,000 now, suggesting that some traders might be offloading their Bitcoins. For instance, as per SoSoValue’s report, all Bitcoin spot ETFs collectively experienced outflows amounting to $572 million over the last two days.

Bitcoin price forms a bearish divergence

Today’s graph indicates that Bitcoin could potentially experience a downturn, or a bearish breakout. A precarious ‘head and shoulders’ pattern has developed on the chart, with its neckline currently situated at approximately $90,952. This pattern is often associated with bearish trends in trading.

Bitcoin’s Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators show signs of a potential price decrease. Specifically, there’s a bearish divergence pattern, meaning the price has continued to rise while these technical indicators have shown a downward trend. Additionally, the MACD histograms have dipped below the zero line, which is often interpreted as a bearish signal in trading.

Consequently, if there’s a drop below the Head and Shoulders pattern’s neckline at approximately 90,950, it could lead to additional decreases. The initial support levels would be the 200-day moving average around $78,285, followed by $73,985, which was the highest point reached in March of the previous year.

In our previous post this week, we mentioned that Bitcoin’s price appears to be shaping a bullish ‘pennant’ formation on its weekly chart. This pattern will persist so long as the price stays above $90,000.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

2025-01-11 20:24