As an analyst, I’m observing that my analysis indicates a persistent drop in Tron’s price, hitting a four-week low. Notably, founder Justin Sun has encouraged investors to seize this opportunity and invest during the dip.

Tron’s price dropped to approximately $0.22, marking a decrease of more than 50% from its peak in December. This drop has reduced the total market value of Tron from around $26 billion to $19 billion.

On a recent X post on Monday, Sun expressed his advice to purchase during the drop, consistently holding onto his belief that TRON is significantly underestimated in value.

The Sun’s optimistic position is supported by Tron’s robust underlying factors. This network holds the title of the third largest participant in decentralized finance, trailing only Ethereum and Solana. Its total value locked amounts to a substantial $6.69 billion.

It’s worth noting that Tron stands out in Tether transactions due to its lower transaction fees compared to Ethereum. On a Monday not long ago, Tron’s USDT transactions skyrocketed by an impressive 91%, reaching a staggering $137 billion. This makes Tron one of the leading global payment processors. Currently, the Tron blockchain boasts over 59 million USDT holders.

Buy the dip and focus on building! 2025 will be a great year!🤞

— H.E. Justin Sun 🍌 (@justinsuntron) January 13, 2025

Tron consistently holds a top position within the decentralized exchange sector, with its DEX protocols processing close to $100 billion since their launch. Over the past week alone, these protocols have exchanged tokens valued at more than $782 million, placing it among the top 10 chains by volume.

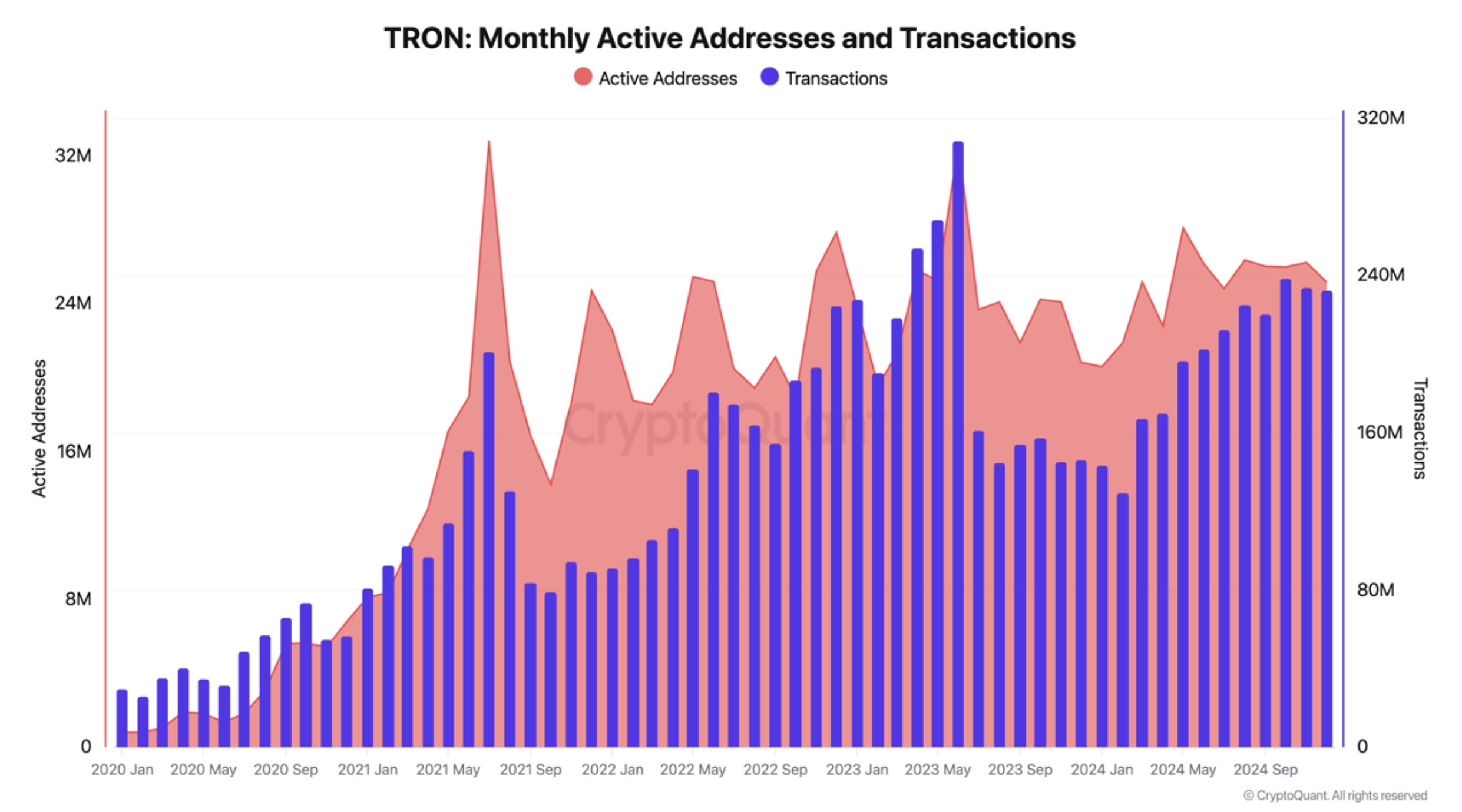

Tron enjoys enduring popularity among its users, with the number of monthly active addresses and transactions consistently high during the last few months. With approximately 2.17 million active addresses, it ranks second to Solana, boasting a significantly larger user base with around 4.27 million active addresses.

Tron provides compelling returns on staking, making it alluring for its owners. The network’s staking return at the moment stands at 4.52%, boosted by increasing transaction fees and a shrinking number of coins in circulation.

As per TokenTerminal’s report, Tron amassed approximately $2.21 billion in fees over the past 12 months. Remarkably, it surpassed Ethereum this year, earning $116 million compared to Ethereum’s $60 million. The circulating supply of Tron has been decreasing, with the figure dropping from 88.1 billion in January last year to 86.17 billion as of today.

Tron price analysis

Over the past day, Tron’s value has decreased significantly from $0.4487 on December 4 to $0.2245, as part of the wider cryptocurrency market downturn. Currently, TRX is trading below both its 50-day and 100-day moving averages. Moreover, technical indicators like the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) suggest a bearish trend for Tron.

On a brighter side, the price of Tron appears to be forming a constructive double-bottom pattern around $0.2245, and the resistance level is set at $0.2760. Typically, a double-bottom pattern signals an upcoming bullish breakout.

If TRX maintains its position above the $0.2245 support point, it’s a sign that the double-bottom pattern is holding firm, potentially leading to an uptrend. On the flip side, dropping below this level might cause TRX to slide down towards $0.20, following the ascending trendline from the lowest price points since last June.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

2025-01-14 19:20