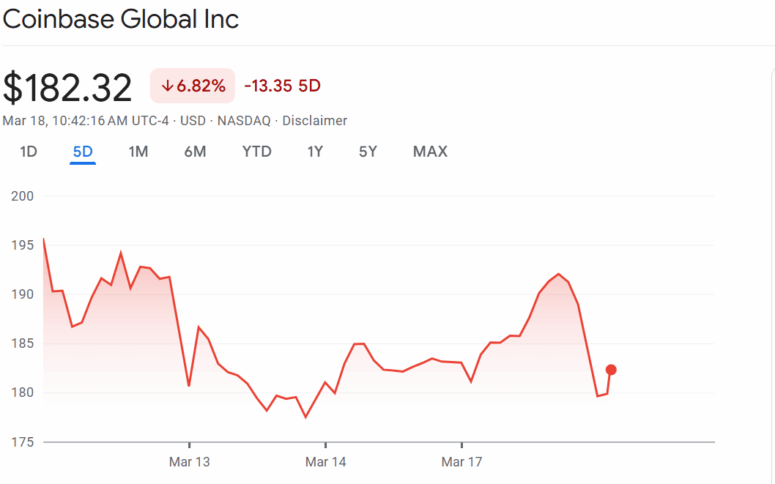

Hold onto your digital wallets, folks! Coinbase’s stock might be heading to a *whopping* $310, according to Gautam Chhugani, an analyst at Bernstein. That’s right, an analyst. You know, one of those people who predicts the future with the same precision as a weather vane in a tornado. Right now, the stock is sitting pretty at $182, so we’re talking about a potential 68% leap. It’s almost like your crypto account suddenly deciding it *does* have a purpose in life!

Why, you ask? Well, apparently the U.S. is slowly warming up to crypto (surprise, surprise). And guess who’s been an unexpected cheerleader for all things blockchain? Yep, the man with the hair that could stop traffic—Donald Trump. His administration is apparently eager to make the U.S. the “leader” in blockchain innovation. We’re not sure if they mean leading the parade or just causing a bit of a ruckus in the back, but hey, whatever works, right? According to Bernstein, this whole “support crypto more” thing could send Coinbase into the stratosphere.

Chhugani, of course, isn’t just throwing random numbers at the wall. He’s slapped a shiny “outperform” rating on Coinbase, which is basically the analyst version of giving a gold star to the stock. Apparently, Coinbase isn’t just a crypto exchange. Oh no, it’s a “universal bank” for digital money. Because why settle for just “exchange” when you could be the next financial institution for the cyber age? Get ready for the *Bank of Bitcoin*, coming soon to a blockchain near you.

This little prediction came just after Trump hosted the first-ever White House Crypto Summit (no, seriously) on March 7. And what does Trump do after hosting a summit? Well, he signed an executive order to create a Bitcoin reserve using—wait for it—crypto that the government seized from criminal cases. Because nothing says “legitimacy” like using stolen goods to start your financial empire. This move could very well be the first step in making Bitcoin as mainstream as your local coffee shop.

Joe Burnett, head of market research at Unchained (a job that’s probably 50% crystal ball gazing), sees this as a “major shift” in global finance. He said, “The U.S. has taken its first real step toward integrating Bitcoin into the fabric of global finance, acknowledging its role as a foundational asset.” Basically, Bitcoin is now officially a *thing*—not just some internet curiosity your cousin still refuses to explain at family gatherings.

As for Coinbase, well, it’s set to benefit big time. Since it’s already a one-stop-shop for all things crypto, it’s poised to grow faster than your uncle’s collection of get-rich-quick schemes if the U.S. starts playing nicer with crypto regulations. Bernstein even went so far as to call it the “Amazon of crypto financial services,” which, let’s be honest, sounds like a pretty cool title. Too bad Jeff Bezos didn’t think of that first!

But—hold on a second—before you start packing your bags for a one-way trip to the moon, let’s not get too carried away. Anastasija Plotnikova, CEO of Fideum, wisely pointed out that setting the right rules for crypto will take time. So, no, the U.S. government isn’t going to suddenly wave a magic wand and make everything perfect tomorrow. Regulatory frameworks, as she says, take *time*. Yes, it turns out even the government has to figure things out, and they’re not exactly known for their lightning speed.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-03-18 19:17