- LINK holds above $12.57 as accumulation signals strong investor conviction.

- On-chain metrics remain bearish, raising doubts about a sustainable breakout.

Chainlink [LINK] has demonstrated strong investor confidence, with nearly 90,000 addresses accumulating over 376 million tokens at the $6.26 level.

This accumulation zone has now become a critical demand wall, which often acts as a foundation for future price surges.

Such massive buying interest typically reflects long-term conviction and potential upside pressure.

However, on-chain and technical signals show mixed sentiments, raising the question—can this support level truly drive a bullish reversal?

Chainlink: Rebound or deeper correction?

At the time of writing, LINK traded at $12.88, down 1.14% in the past 24 hours. Price action showed LINK bouncing around the $12.57 support zone after breaking a multi-month downtrend.

This level is pivotal; a strong rebound here could drive LINK to test $15.57 and eventually $17.78. However, if bears reclaim control, LINK can slide toward the next support at $10.17.

Therefore, LINK’s near-term trend hinges on whether buyers can defend this key price floor.

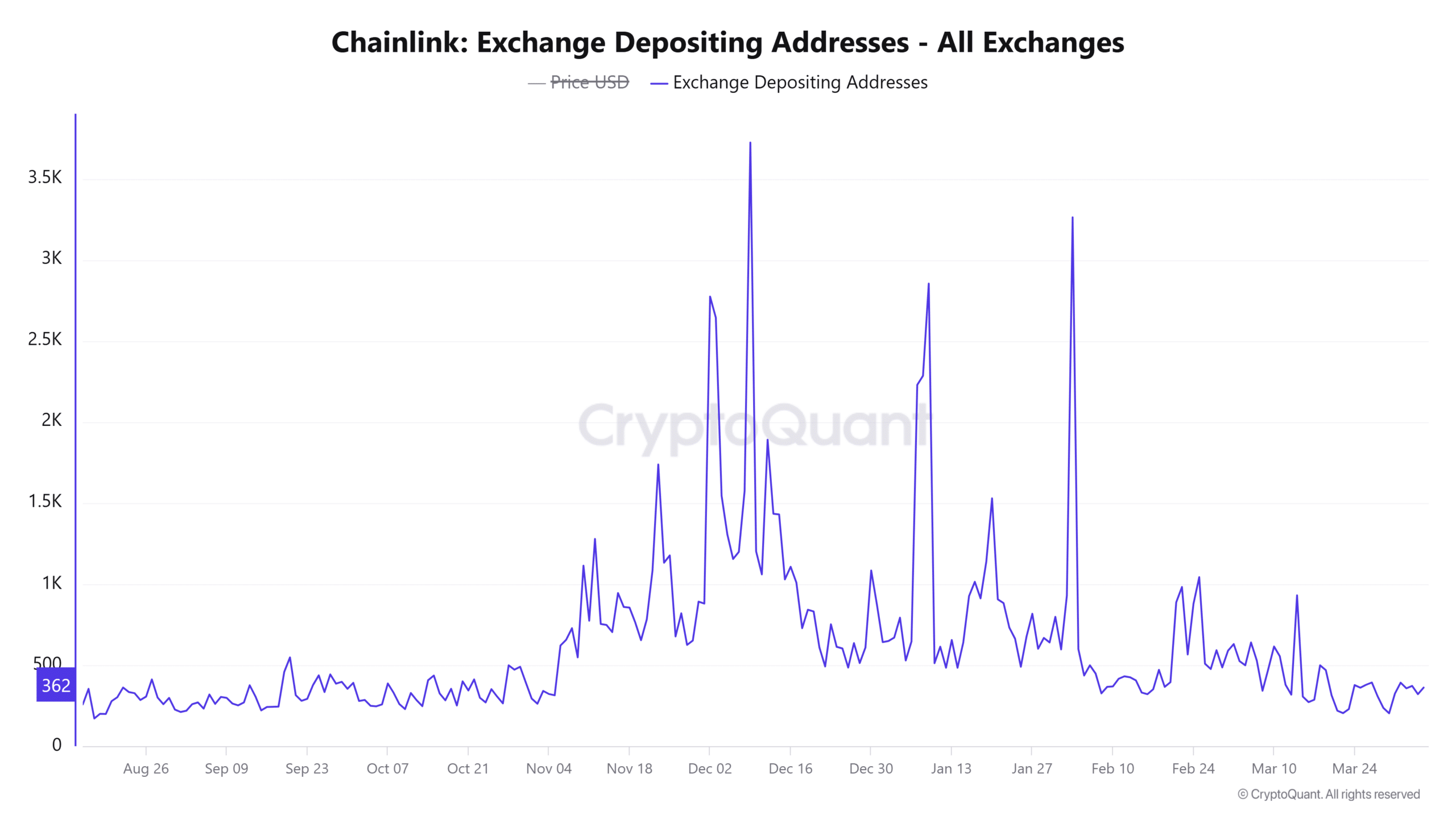

What does exchange activity say?

Exchange depositing addresses increased by 1.54%, while withdrawing addresses rose by only 0.78%. This suggests more LINK holders are sending tokens to exchanges, which could signal preparation for selling.

However, the increase in outflows still shows some confidence among long-term holders who prefer self-custody.

Overall, the exchange data reflected a neutral-to-cautious sentiment, with investors reacting to both technical setups and macro uncertainty.

How bearish are on-chain indicators?

On-chain signals currently painted a mostly bearish picture. Net network growth was barely positive at 0.15%, showing sluggish user adoption.

Additionally, the percentage of addresses “in the money” dropped by 0.95%, meaning more holders are currently underwater.

Large holder concentration fell by 0.17%, while large transactions dropped by 12.28%, suggesting whales are reducing exposure. These signals reflect reduced confidence across the board.

The MVRV long/short difference was -6.37%, a clear indication that short-term holders were suffering greater unrealized losses than long-term ones. This typically reflects panic selling and weak hands exiting the market.

However, such conditions can also form the basis for price reversals if accumulation follows. Therefore, monitoring price behavior near support becomes crucial in the days ahead.

Chainlink must hold above $12.57 and reclaim higher resistance levels to confirm a bullish breakout. However, press time on-chain signals remained bearish, and selling pressure still lingered.

Therefore, LINK is not yet primed for a bullish breakout—further downside remains likely unless strong buying momentum emerges soon.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

2025-04-06 01:15