Ah, Kraken. One of America’s crypto giants, now making a rather bold move by listing BNB, the crown jewel of the BNB Chain ecosystem, crafted by none other than Binance. The drama that ensues is nothing short of Shakespearean.

This decision has caused quite a stir in the crypto community. Of course, it’s seen by some as nothing more than a clever strategic shift, perhaps foreshadowing a future where BNB, like a much-welcomed guest at a party, makes its way to other US exchanges like Coinbase, Gemini, and perhaps a few more. How predictable… or is it?

Legal Landscape: From Barriers to Opportunities

For years, US exchanges treated BNB like the ugly duckling at the ball, too afraid of the legal spotlight that shone on Binance, the parent company. In 2023, the US Securities and Exchange Commission (SEC) threw a hissy fit and filed a lawsuit against Binance, accusing them of, oh, just casually issuing unregistered securities. BNB being one of them. Oh, what a mess.

Exchanges, naturally, trembled. Listing BNB meant playing Russian roulette with the law. Nobody wanted to deal with that risk, right?

But lo and behold! A moment of clarity, or perhaps a moment of divine intervention, came in late 2024 when Binance settled with US authorities. Oh, the plot thickens—$4.3 billion in fines and stricter reforms. BNB was cleared to roam free, at least for now. And just like that, Kraken, in its infinite wisdom, decided to bring BNB into the fold. What a time to be alive!

Regulatory Clarity Boosts Altcoins

Kraken’s BNB listing is not just a random act of defiance or an isolated incident. It’s part of a larger trend. A *very* large trend. In January 2024, the SEC approved the oh-so-controversial Bitcoin spot ETFs. That was hailed as “historic,” and everyone promptly started applauding like it was the arrival of sliced bread.

And then, of course, institutional investors had a moment of clarity: “Oh, wait! Bitcoin is legit now! So are other digital assets!” And now, with regulatory clarity slowly but surely paving the way, US exchanges are warming up to altcoins. Who would’ve thought?

But, let’s not get ahead of ourselves. We’ve got a president who knows how to play the game—yes, under President Donald Trump, crypto might just find itself on a smooth ride. Perhaps it’s time for other exchanges to take a second look at BNB. The winds of change are here!

BNB Chain and Its DeFi Potential

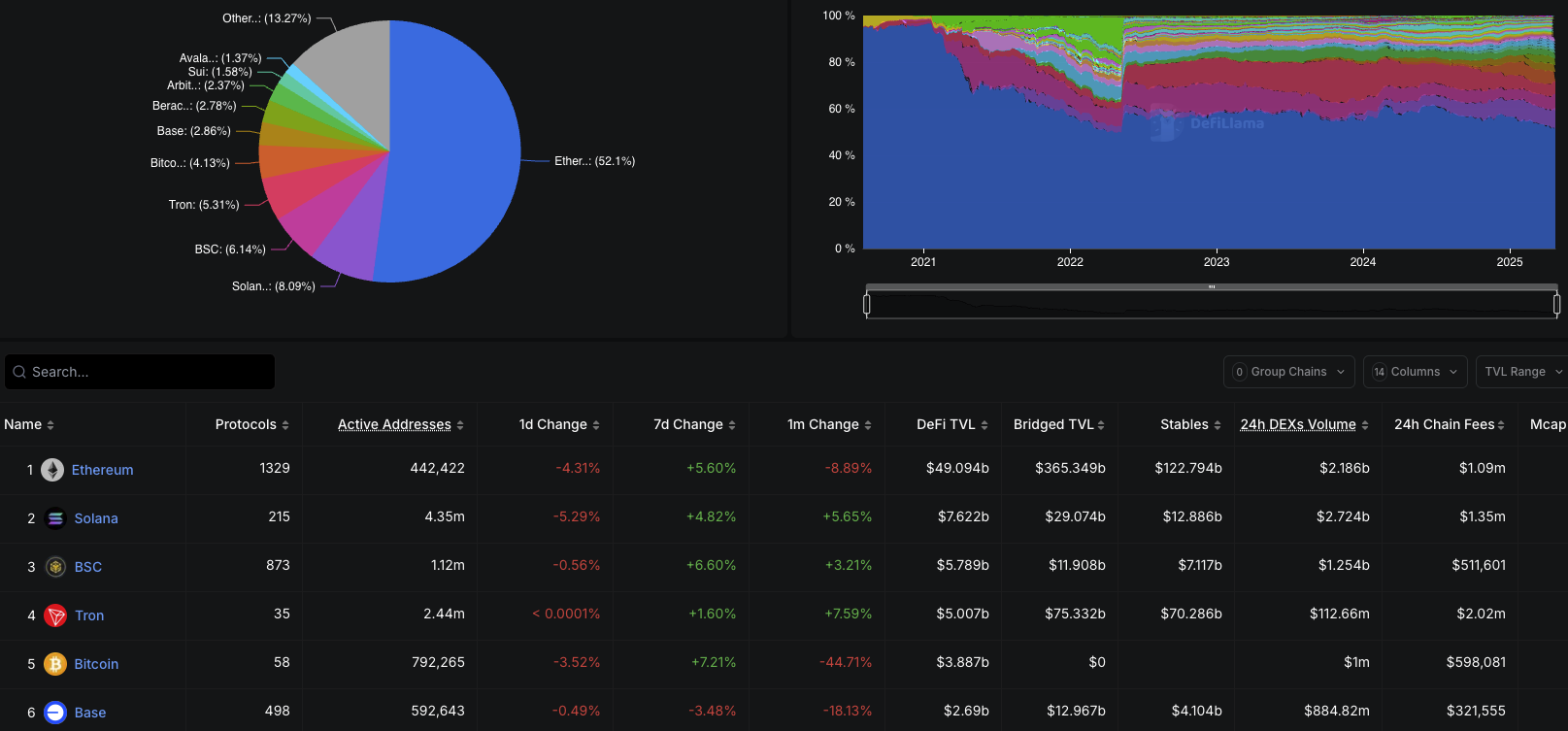

Let’s talk about BNB itself. Beyond being a simple token, BNB is the beating heart of the BNB Chain ecosystem—a blockchain that’s been growing faster than you can say “crypto revolution.” April 2025 saw more than 3.3 million active daily users, and a transaction value that surpassed a mind-boggling $7.1 billion. DeFi, GameFi, and AI are all hanging out there, having a jolly good time.

And let’s not forget the tech advancements on the horizon! In 2025, BNB Chain plans to reduce block processing times to under one second. One second! The future is now, people. There are whispers of gasless transactions and even AI integration in decentralized applications (dApps). BNB is officially the cool kid in town, and exchanges can’t seem to resist.

Kraken’s bold step may just be the beginning of a grand domino effect. US exchanges might slowly start recognizing BNB as the legitimate powerhouse it is, and the days of defensive posturing against legal risks might soon be over. It’s time to make way for the Web3 ecosystem to take center stage!

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

2025-04-24 11:15