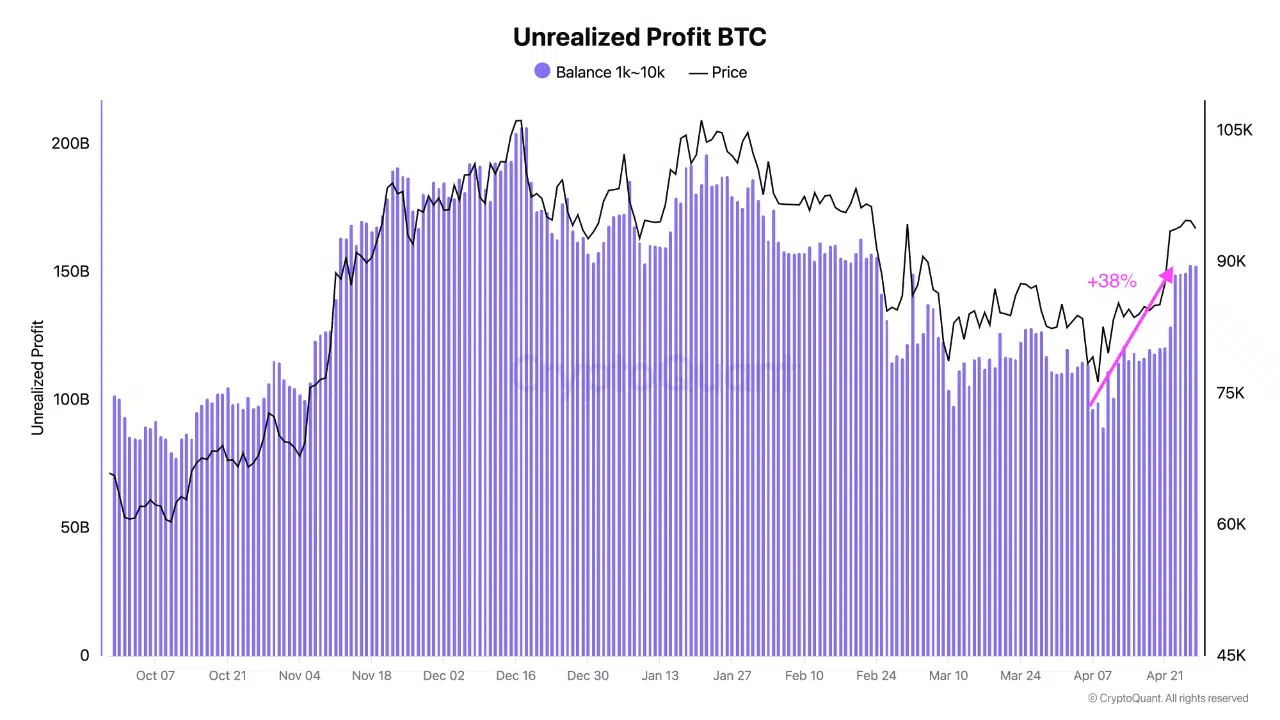

- Whales now have $150 billion in unrealized profit—because apparently their yachts needed jetskis.

- MVRV ratio says: “Maybe you’re paying too much for your precious Bitcoins, darling.”

So, in the latest episode of “Bitcoin: The Neverending Soap Opera,” whales (those mysterious types holding 1K to 10K BTC, probably with more Teslas than you have socks) are suddenly floating on a cloud of unrealized profits—up 38% since April, which makes their piggy bank worth a heart-palpitating $150 billion.

Here’s the twist: history’s been clear on this one. When these profits tilt dangerously close to $200 billion, the whales get twitchy, start cashing in, and—just like after a spicy curry—things can go sideways fast for Bitcoin’s price. With whale wallets this chubby, questions are bubbling up everywhere: Will Bitcoin get to $100K or does it need to chill at the therapist’s office (again) for a correction?

Latest price report: $94,811.68, practically unchanged but somehow still the center of attention.

Bitcoin’s Making Friends and Influencing People: The Address Book Saga 📈

Enthusiasm isn’t just reserved for the whales, though. Network vibes are strong—over 808k daily active addresses and 392k transactions and counting. Someone’s not just lurking—they’re swiping right and actually dating Bitcoin.

Granted, this much activity isn’t a guarantee the party won’t fizzle, but history says lots of invitations (a.k.a. active addresses) mean more noise on the dance floor and a better shot at price balloons next week.

Translation: If the crowd keeps growing, the punch bowl (price) may need a refill.

MVRV: Market Value Ratio – Or as Grandma Calls It, “Too Much Hype?”

Here’s the part where everyone checks their phones and someone brings up “MVRV,” which is now at a whopping 2.37. Translation: Bitcoin might be a tad “overdressed.”

Historically, a sky-high MVRV ratio is basically the crypto market’s version of yelling “LAST CALL” at the bar—correction incoming, maybe.

But wait, there’s Chart Drama: the ever-mysterious Stock-to-Flow ratio is now at 725.39, which is crypto talk for “almost nobody’s RSVPing with more Bitcoins.” Scarcity alert! Scarcity usually gets the long-term hodlers all hot under the collar because less supply + unrelenting demand = “Diamond hands” drama.

Bitcoin vs. the $95K Glass Ceiling—Is It Time for Drama? 🚧💥

Right now, Bitcoin is having a tense standoff with the $95K resistance zone—picture a stock market version of a British Bake Off soggy bottom scare. RSI is peeking around 66.98, suggesting the party might be getting out of hand (overbought much?).

If the price clambers over $95k, everyone’s betting on $105k next. If not, and it trips, it tumbles down to $85k support. And the Bollinger Bands? They’re hinting things are a bit stretched at the top—think yoga pants after Thanksgiving.

Crystal Ball: Will Bitcoin Grow Wings or Hit a Brick Wall?

Right now, Bitcoin’s sending mixed messages like an ex who can’t stop texting. Whales are flexing, addresses are up, but the MVRV ratio is shouting “be careful, darling.” Scarcity metrics have the long-term romantics swooning, but technicals say a snapback might be next if Bitcoin can’t drag itself over $95k.

keep the popcorn close. Either we’re headed for another round of “to the moon!” or someone’s about to throw a tantrum and spill the punchbowl. 🚀🍿

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2025-04-30 01:17