Dearest reader, prepare yourself for a most curious tale of bonds, markets, and the mysterious world of cryptocurrency. This article shall endeavour to break down the offering, the arguments for and against such fanciful interpretations, and the potential effects on the ever-elusive Bitcoin market. 🤔

The Treasury Offering

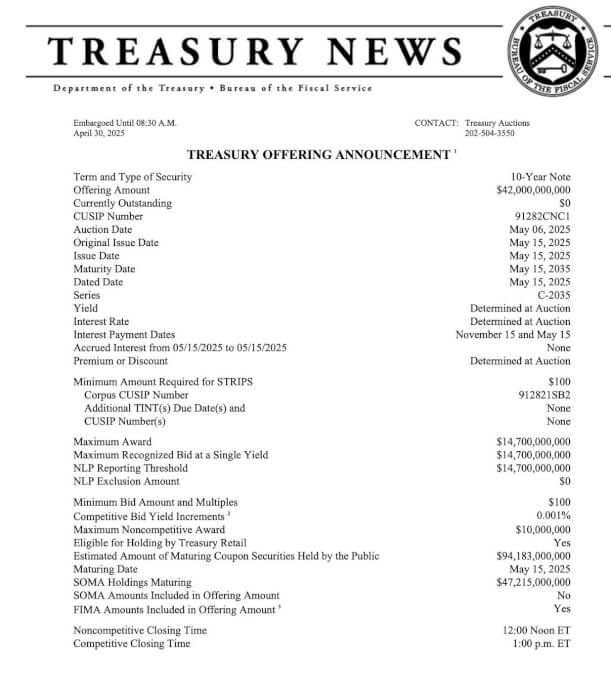

On the 6th of May, 2025, the United States Department of the Treasury announced the offering of $42,000,000,000 in 10-Year Treasury Notes. Pray, do take note of the following particulars:

- Offering Amount: $42 billion (A sum most grand, is it not?)

- Security Type: 10-Year Treasury Notes (Ah, such an elegant instrument!)

- Auction Date: May 6, 2025 (Not to be confused with any other date, dear reader!)

- Issue Date: May 15, 2025 (Set your calendars!)

- Maturity Date: May 15, 2035 (So far in the future, one can scarcely imagine!)

The “Stealth QE” Narrative

Along with this announcement, a most curious commentary emerged, suggesting that the Federal Reserve was quietly, almost surreptitiously, purchasing the entire $42 billion offering. One might be forgiven for wondering, could this be the herald of what is now being dubbed as “stealth QE”? 💭

What is Quantitative Easing (QE)?

Ah, Quantitative Easing, or QE, for short. This is a policy most favoured by central banks, wherein they inject liquidity into the markets, generally by purchasing assets such as government bonds. The intent, one presumes, is to lower interest rates and spur growth. One must admit, it does sound like a grand plan! 💰

Why “Stealth QE” and Why is it Potentially Bullish for Bitcoin?

The claim that the Fed’s alleged purchase of these bonds constitutes “stealth QE” has led some to speculate that it could result in a most favourable outcome for Bitcoin. A few arguments in favour of this most intriguing idea are as follows:

- Increased Liquidity: Should the Fed indeed be purchasing these bonds, one can expect a rather generous influx of money into the financial system. 💸

- Lower Interest Rates (Perhaps): The Fed’s demand for bonds could serve to keep interest rates lower than one might otherwise expect. A rather thoughtful arrangement, don’t you think?

- Inflationary Concerns: Some argue that such policies could lead to inflation by increasing the money supply, and here lies the charm for Bitcoin, often seen as a hedge against such monetary misadventures. 💥

- Risk-On Sentiment: Increased liquidity could, on occasion, lead to a risk-on mood in the markets, which could, in turn, benefit riskier assets like Bitcoin. Ah, the thrill of it all! 🎢

Important Considerations and Caveats

It is, of course, essential to approach such speculations with due caution. One must be wary of jumping to conclusions. Consider the following:

- Verification of Fed’s Involvement: The Treasury’s announcement does not specify who the buyers of these bonds are. Official confirmation of the Fed’s participation, and the extent of their purchases, would be most desirable. Perhaps they’re waiting for a more opportune moment to reveal their hand? 🤔

- “Stealth QE” Definition: The term “stealth QE” implies that the Fed’s actions are not openly communicated as a formal QE program, but may, nonetheless, have a similar effect on market liquidity. Quite the stealthy manoeuvre, if I do say so myself!

- Correlation vs. Causation: While the idea that QE (if it’s truly happening) could bolster Bitcoin is tantalizing, one must remember that Bitcoin’s price is influenced by many factors. The link between QE and Bitcoin’s success may, in truth, be a touch more complicated than we’d like to believe. 🧐

Conclusion

In summary, the Treasury has revealed a rather substantial offering of 10-Year notes. Speculation suggests that the Fed’s alleged purchase of the entire amount could amount to a “stealth QE,” a development which could, in theory, favour Bitcoin due to the increased liquidity and potential inflationary pressures. However, one must verify the Fed’s involvement through official channels before making any definitive claims. In the end, this situation highlights the intricate dance between traditional financial policy, the markets, and the ever-evolving world of cryptocurrency. A most complex tale, indeed. 📚

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Arknights celebrates fifth anniversary in style with new limited-time event

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2025-05-07 09:41