Disney’s most recent endeavor, Disneyland Abu Dhabi, signifies a major change in their international growth plans, and it seems that investors are quite excited about this surprising news.

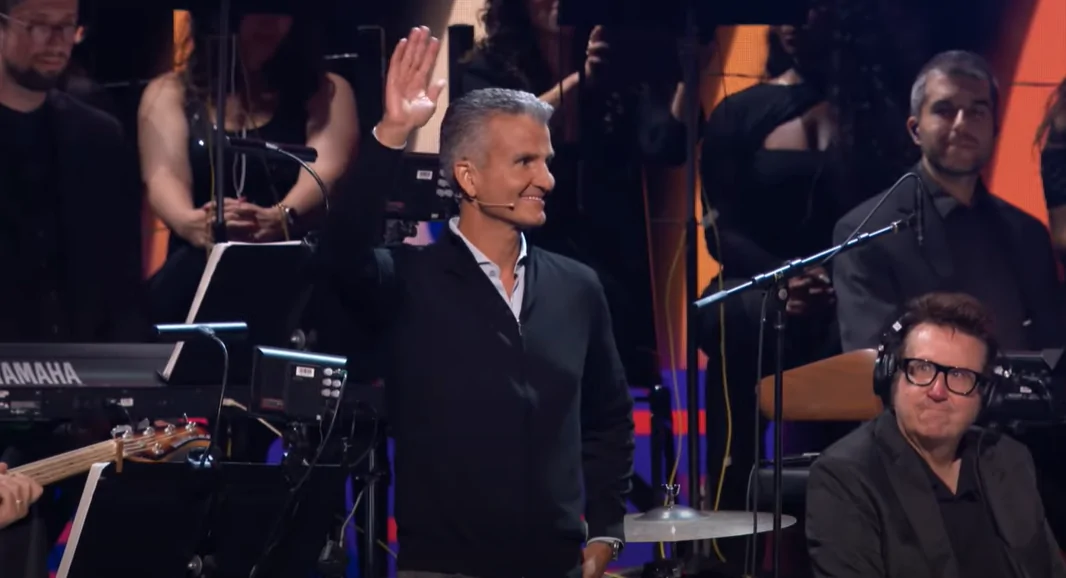

It significantly boosted Disney’s stock during a period when things seemed bleak for CEO Bob Iger, and it may have clarified investors’ perception of who will succeed Iger as company leader upon his departure. In other words, Josh D’Amaro, get ready to step up!

Crucially for Disney, they managed to keep the project a secret within the inner circle of the C-Suite, as the new park is not a Disney venture… and that’s because it won’t be owned or operated by Disney. Instead, Miral, an entertainment company based in the UAE, will be responsible for its development and management. This strategy enables Disney to expand its brand reach without shouldering the financial burdens associated with park ownership.

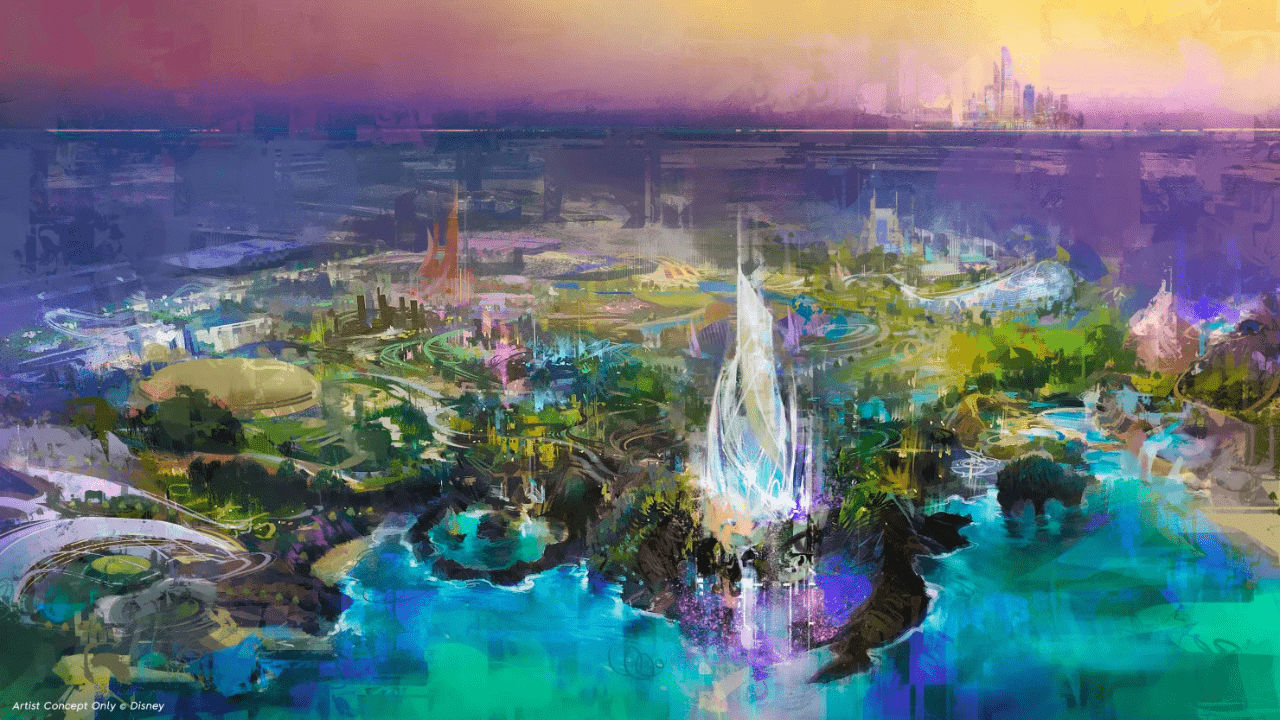

The proposed Disneyland in Abu Dhabi, while not officially a Disney theme park, will be Disney’s seventh theme park resort. It will be located on Yas Island, known for attractions like Warner Bros. World and Ferrari World. Miral, the funding, development, and operational entity, will handle the park, with Disney contributing its intellectual property and creative guidance through its Imagineers in a consultancy agreement. This setup mirrors Disney’s arrangement with Tokyo Disney Resort, where the local company owns and operates the park under license from Disney. However, unlike Tokyo, Disney may not be as actively involved in Abu Dhabi due to a potential focus on intellectual property rights rather than partnership dynamics. As of now, it seems Miral might not require much more from Disney beyond its name and brands.

The asset-light strategy of Disney, which involves licensing its brand and creative skills instead of building and managing theme parks, has been positively received by Wall Street. This tactic helps the company to earn money through licensing fees and royalties, boosting profitability without adding debt. After the announcement, Disney’s shares saw a substantial increase, indicating investor faith in this low-risk, high-return business model.

It seems that not everyone fully supports this decision. With Disney’s almost complete profit structure in this deal, they are entrusting their cherished brands to a Middle Eastern company. This could potentially lead to issues in a hypothetical future, given the possibility of geopolitical disputes and disagreements. This is a concern that some also express about The Walt Disney Company with its capital expenditure investments in China. However, unlike China, Disney would only need to safeguard their brands in the UAE, not worry about losing significant physical assets.

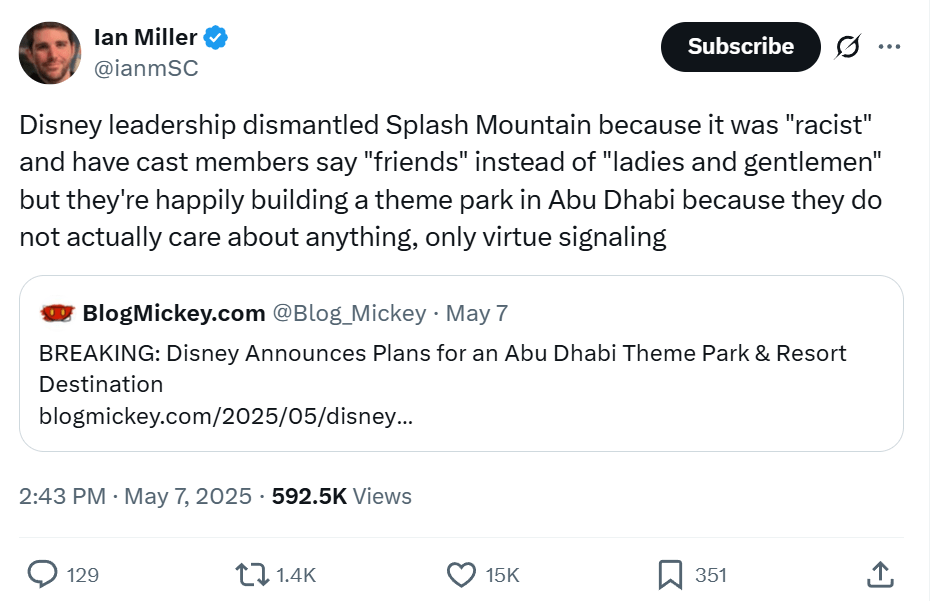

Nevertheless, while some find it acceptable that Disney confronts potential risks, they express discontent over what appears to them as a contradiction in Disney’s actions. This is particularly evident when considering their stance on Florida compared to the United Arab Emirates (UAE).

From a financial standpoint, the prospect seemed hard to resist for Bob Iger and Josh D’Amaro, regardless of any political or societal challenges. Additionally, this move could provide insight into the type of CEO Josh D’Amaro might develop into if he assumes the role in the future.

Disneyland Abu Dhabi, due to its strategic position, being within a four-hour flight for one-third of the global population, sets it up to draw in a multicultural audience from around the world. As highlighted by Disney CEO Bob Iger, this park will embody the quintessential Disney experience while also reflecting the unique Emirati culture, thereby merging Disney’s storytelling with the UAE’s rich cultural heritage. This blend is designed to offer an exceptional and resonating experience for both local and global visitors.

Disneyland Abu Dhabi symbolizes a strategic shift in The Walt Disney Company’s method of global expansion. By utilizing partnerships that enable brand growth without taking full ownership, Disney reduces financial risk and amplifies potential earnings. This approach not only meets investor demands for capital effectiveness but also paves the way for future international projects. While this strategy may potentially distance the company from its progressive allies in the U.S., it undoubtedly brings immense joy to investors.

Read More

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- EUR CNY PREDICTION

- Hero Tale best builds – One for melee, one for ranged characters

- Capcom has revealed the full Monster Hunter Wilds version 1.011 update patch notes

2025-05-09 18:11