As Ethereum (ETH) flutters around the $2,500 mark like a moth drawn to a flame, the air is thick with the scent of market exhaustion. Analysts, those ever-optimistic seers, whisper that this second-largest cryptocurrency might just take a breather before it attempts to scale the dizzying heights of higher resistance levels. Ah, the drama! 🎭

Ethereum: The Overheated Star of the Show

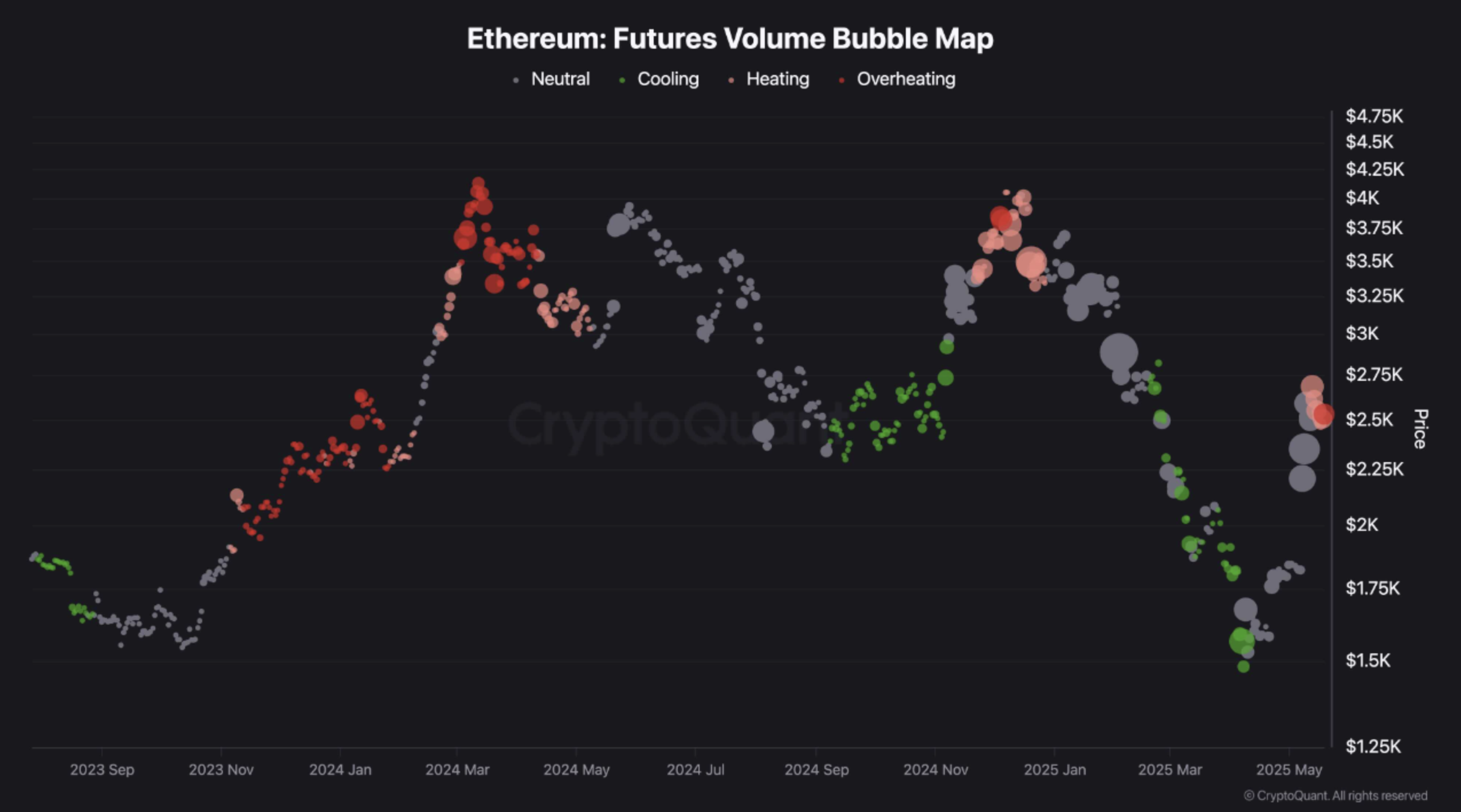

In a recent post by the illustrious CryptoQuant contributor ShayanMarkets, it appears that ETH is beginning to show signs of an overheated rally. The analyst, with the flair of a stage magician, presented a chart that illustrates ETH’s total trading volume across various crypto exchanges. Behold!

In this chart, each bubble’s size reflects the magnitude of trading volume, while the color indicates the rate of volume change, categorized into four groups – Cooling, Neutral, Overheating, and Highly Overheating. Quite the colorful affair, isn’t it?

Ethereum’s price rally, which kicked off in mid-April 2025, has seen a remarkable surge in trading activity. In just a month, the asset’s market condition has shifted from Cooling (green bubbles) to Overheating (red bubbles). Talk about a hot mess! 🔥

This current overheated condition may lead to a short-term correction as the market cools and enters another accumulation phase. However, the depth and duration of any potential pullback remain as uncertain as a cat in a room full of rocking chairs.

The CryptoQuant contributor attributes this spike in volume to profit-taking and a significant resting supply at the psychologically important $2,500 resistance level. Data from CoinGecko shows ETH has jumped an impressive 59.7% over the past 30 days, outperforming Bitcoin (BTC) during the same period. ShayanMarkets concludes:

Consequently, Ethereum is expected to continue its consolidation phase until fresh demand emerges to drive a breakout above this resistance range in the mid-term. Or until the next great crypto prophecy is revealed! 🧙♂️

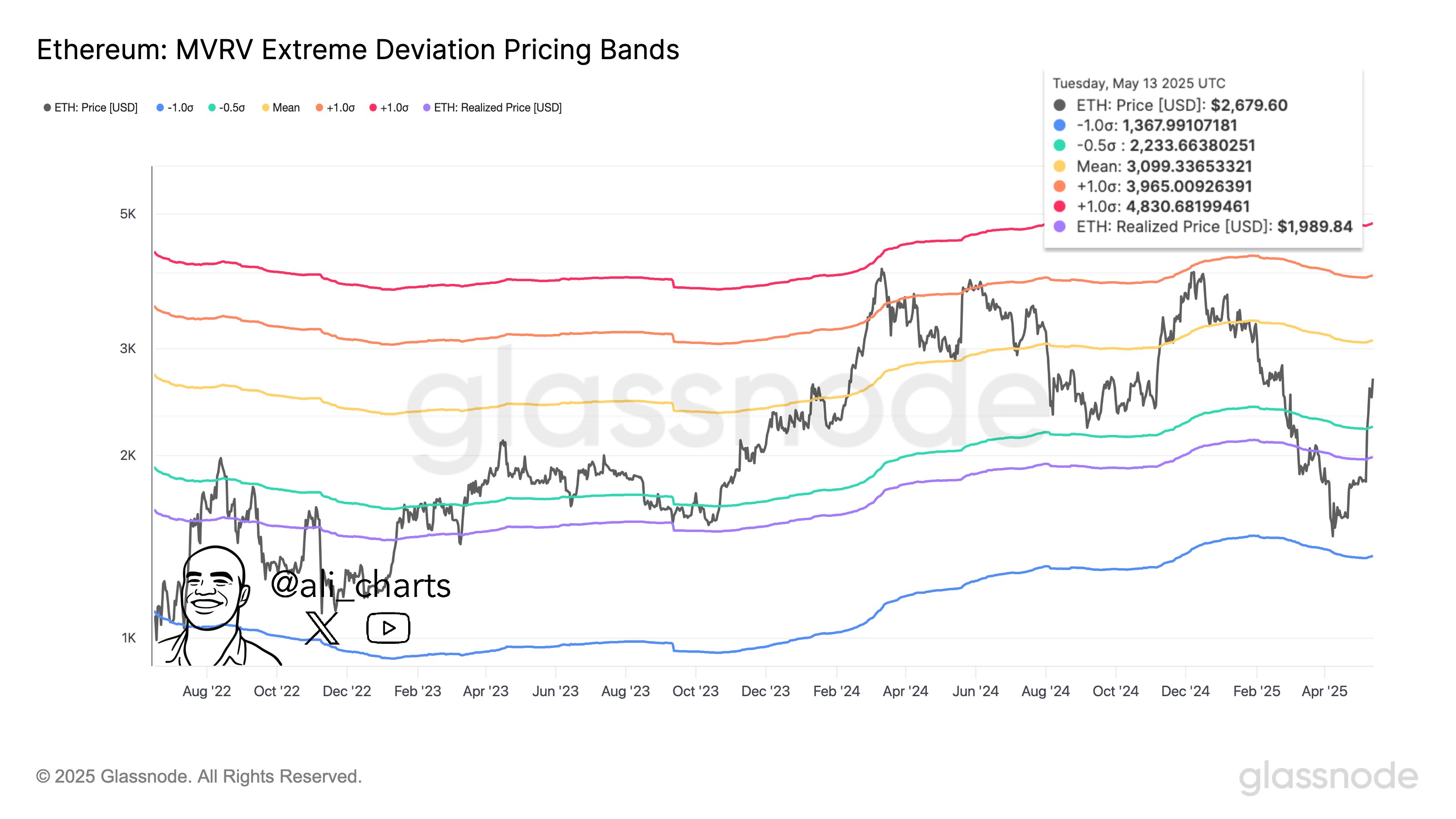

In a separate post on X, the venerable crypto analyst Ali Martinez pointed to Ethereum’s Market Value to Realized Value (MVRV) extreme deviation pricing bands. He emphasized that ETH must hold above $2,200 to maintain bullish momentum. Should this level hold, Martinez believes ETH could target $3,000, or potentially even $4,000, if buying pressure strengthens. A veritable rollercoaster of predictions!

Where Is ETH Headed? Analysts Weigh In

Ethereum’s impressive performance of late has attracted attention from several crypto analysts, who are now speculating on the digital asset’s future price trajectory. According to the ever-optimistic crypto analyst Ted Pillows, ETH’s 12-hour chart recently confirmed a Golden Cross, a bullish signal that typically precedes major price rallies. Or so they say! 🥳

In another analysis, Pillows forecasted that ETH could be eyeing a move to $4,000, noting that the asset has traded within a massive symmetrical triangle since Q3 2020. The $4,000 level lies just below the triangle’s upper boundary. A triangle? How geometric!

In contrast, crypto analyst Gianni Pichichero warned of a potential retracement to $2,350, citing the emergence of lower lows on Ethereum’s daily chart as a bearish signal. At press time, ETH trades at $2,500, up 3.6% in the past 24 hours. A true cliffhanger!

Read More

- Silver Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

2025-05-21 07:25