Ah, Bitcoin. The digital currency that always keeps us guessing. And now, it seems to have done it again. But fear not, dear reader, for Geoffrey Kendrick, a bigwig from Standard Chartered, predicted this rise and, believe it or not, he’s quite smug about it.

BTC Breaks $112K; Is $120K the Next Big Thing?

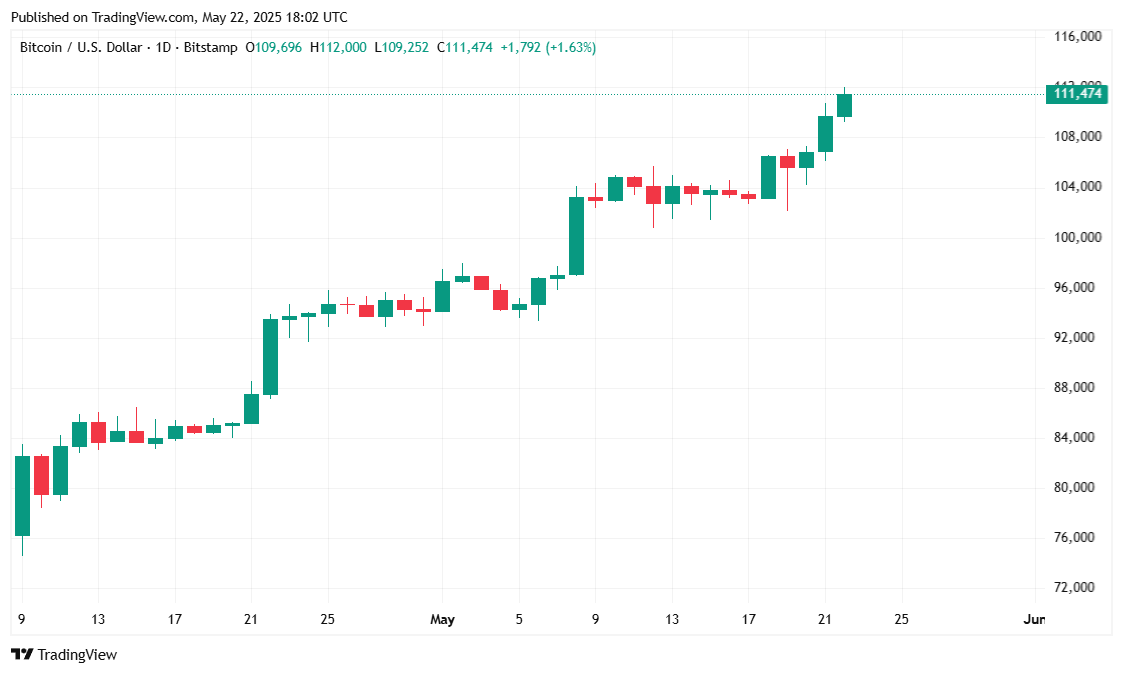

Well, well, well. Bitcoin has surged to a stratospheric $112K this afternoon on Bitstamp, and while some of us were still trying to figure out how to send a Bitcoin, it’s already hovering around $111.7K like it’s no big deal. Onward to $120K, as Geoffrey Kendrick from Standard Chartered confidently predicted. If you’ve got a good sense of humor, you’ll enjoy how accurate he’s been. I mean, who saw this coming, right? (Oh wait, he did.)

In a rather smug newsletter sent out earlier this Thursday, Kendrick and his merry band of digital asset experts pointed to three key factors that have been propelling Bitcoin’s ascent: spot bitcoin exchange-traded fund (ETF) flows, institutional purchases, and, brace yourself, the U.S. Treasury premium. (Yes, really.)

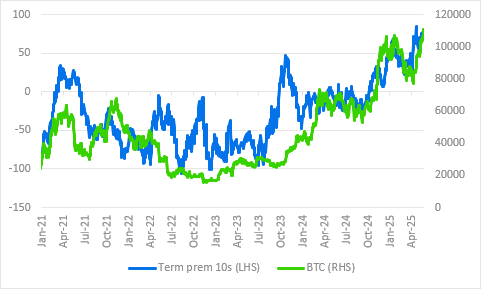

The U.S. Treasury premium, in case you weren’t paying attention, is the extra cost foreign investors pay to hold U.S. treasuries instead of simply buying U.S. dollars. Kendrick, being the savvy fellow he is, has noted that as this premium rises, so does the price of Bitcoin. And, surprise surprise, it has been steadily doing just that. Funny how these things work out.

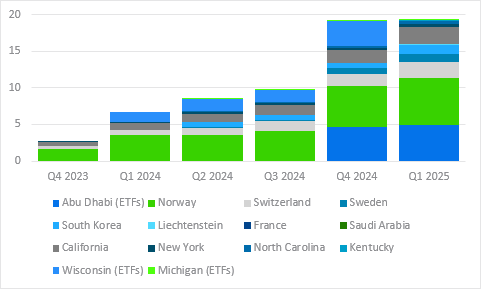

Now, net bitcoin ETF flows have shot past $43 billion, according to some fancy data, and institutional purchases are growing faster than the number of excuses I can think of to avoid a workout. Companies like Strategy (whoever they are) are sitting on 576,230 BTC, worth a cool $64 billion. Even the government is on board, with 13-F filings revealing increased allocations to Bitcoin ETFs and other Bitcoin-related assets. That’s right, Uncle Sam’s jumping in too. Who would’ve thought?

According to Kendrick (who seems to be on a roll), all these factors have placed Bitcoin on a path to hit $120K by summer. But why stop there? By the end of the year, Kendrick predicts $200K, and by 2028, he’s calling for $500K. Well, if you’re going to dream, you might as well dream big, right?

Market Metrics: A Quick Overview

Bitcoin, in case you hadn’t heard, is currently sitting pretty at $111,462.53, showing a 4.57% increase today and a 7.25% bump over the past week, according to Coinmarketcap. It’s been bouncing around in a range between $106,220.61 and $111,970.17, breaking through some serious resistance levels. The total market capitalization of Bitcoin has risen to $2.21 trillion. Yes, trillion. Makes you feel good about that stray Bitcoin you still hold onto, doesn’t it?

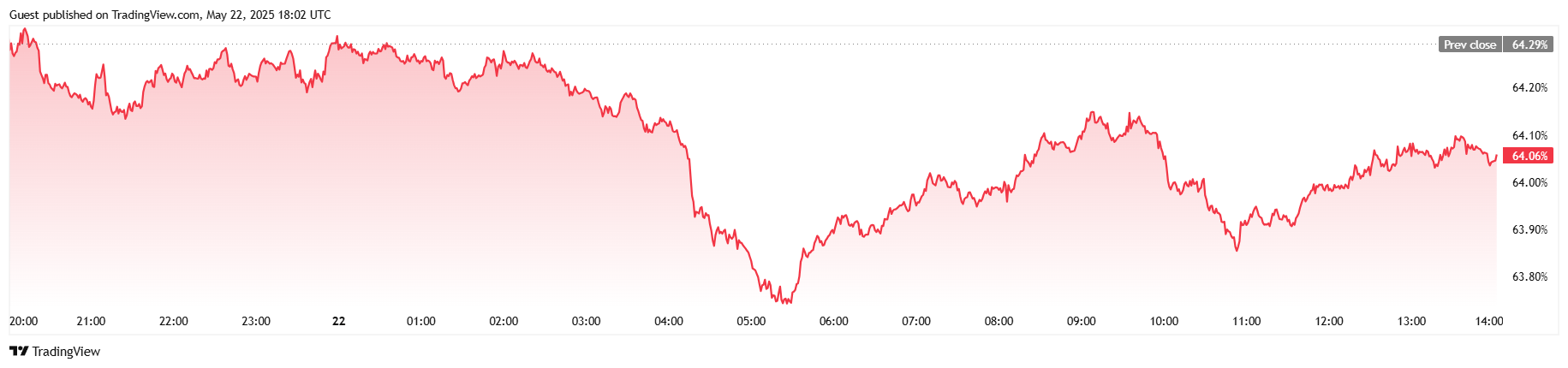

Trading volume has soared to $77.93 billion, up 8.40%, which suggests that the market is not only alive but dancing to its own crypto beat. However, Bitcoin dominance has slipped slightly to 64.08%, signaling that altcoins are stealing some of the spotlight. But, with $81.05 billion in bitcoin futures open interest, it seems like traders are all in. Why not throw caution to the wind?

And for the grand finale, it seems the bears were caught off guard by today’s Bitcoin surge, with a hefty $4.21 million in liquidations in the past 24 hours. Oh, how the mighty have fallen! Short positions took a hit, while the long positions barely felt the sting. Can’t say we didn’t see that coming.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2025-05-22 22:27