Ah, dear reader, a delightful update from the illustrious crypto oracle Woominkyu, who has unveiled a most splendid rebound in the Bitcoin Combined Market Index. One might say it is akin to a phoenix rising from the ashes, albeit a rather digital phoenix with a penchant for volatility. 🦅

This tantalizing tidbit suggests that our beloved Bitcoin market may be tiptoeing into an early accumulation phase, much like a cat stalking its unsuspecting prey. With sentiment improving and profit-taking taking a backseat, the on-chain indicators are positively winking at Bitcoin investors, as if to say, “Oh, darling, the best is yet to come!” 💸

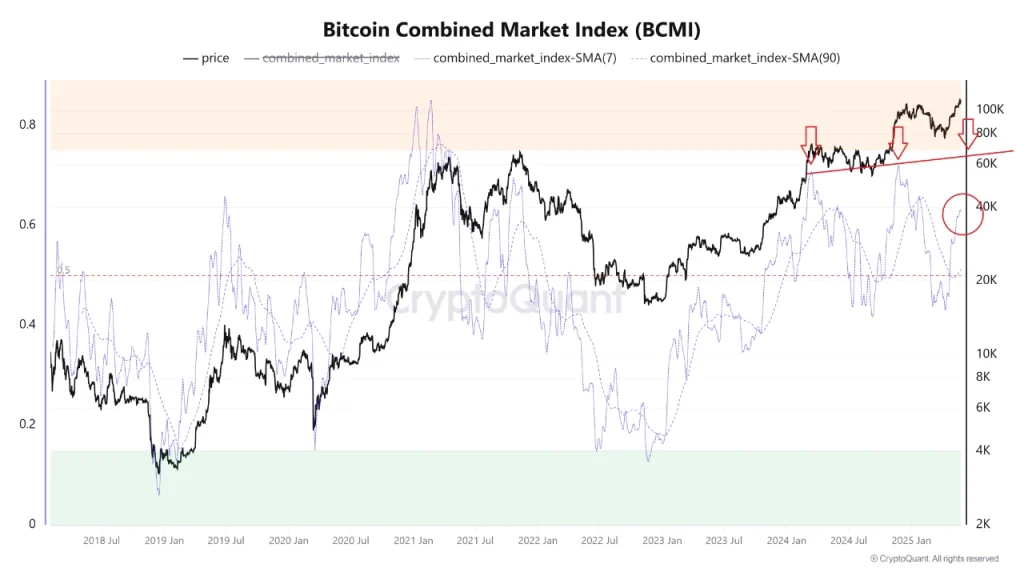

Now, let us delve into the enigma that is BCMI.

What is BCMI?

The Bitcoin Combined Market Index (BCMI), a brainchild of the ever-enigmatic Woominkyu, is a composite indicator designed to assess the overall market sentiment and cycle stage of Bitcoin. It employs four key on-chain metrics: MVRV, NUPL, SOPR, and the ever-dramatic Fear & Greed Index. 🎭

Market Value to Realised Value compares Bitcoin’s current market price to the average price at which all coins were bought, much like comparing a fine wine to its vintage. 🍷

Net Unrealised Profit/Loss measures the overall profit or loss of Bitcoin holders, a rather sobering thought for those who bought at the peak of euphoria.

Spent Output Profit Ratio tracks whether coins being moved are in profit or loss, a delightful little game of financial musical chairs.

Fear & Greed Index, the emotional barometer of investors, reflects the whims and fancies of the market. A BCMI reading below 0.15 indicates that the market is in the extreme fear zone, akin to a gloomy day in London. ☔

Conversely, a reading above 0.75 suggests that the market is in a state of euphoria, reminiscent of a raucous party where everyone is dancing on tables. 🥳

BCMI: Analysing the Current Status

According to the sage Woominkyu, the 7-day SMA of BCMI stands at a respectable 0.6, while the 90-day SMA languishes at 0.45. The rebound of the short-term average, especially in light of recent market corrections, suggests a growing confidence among investors, bolstered by increased transaction volume and stronger on-chain fundamentals. Could this be the harbinger of a bull phase? Only time will tell! 🐂

Meanwhile, the stability of the long-term average suggests that the market is stable, not overheated—much like a well-brewed cup of tea. ☕

- Also Read:

- Peter Schiff Blames Himself for Bitcoin Boom: “You Buy Every Time I Say Don’t”

What BCMI Indicates about the Current Trend?

Investor sentiment is improving, supported by a delightful drop in exchange outflows and long-term holder accumulation, while profit-taking has declined, as indicated by the decreasing Spent Output Profit Ratio (SOPR). This sets the stage for an accumulation phase, where institutional or savvy investors begin to buy while prices are still relatively low—like a savvy shopper at a clearance sale! 🛍️

In the last seven days, the Bitcoin market has reported a decline of 1.9%. In the last 24 hours alone, the market has plummeted by 0.3%. Oh, the drama! 🎭

Recently, the Bitcoin price reached a new all-time high of $111,980, surpassing its previous ATH of $108,786 recorded in January 2025. Currently, the BTC price sits at $108,492.71—at least 3.11% below the ATH recorded on May 22, 2025. Such is the fickle nature of fortune!

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more. Because who wouldn’t want to be the first to know when the next digital gold rush begins? 💰

FAQs

What is the Bitcoin Combined Market Index (BCMI)?

BCMI is a composite indicator measuring Bitcoin market sentiment using MVRV, NUPL, SOPR, and Fear & Greed Index. A veritable cocktail of financial wisdom!

How does BCMI predict Bitcoin price trends?

BCMI readings below 0.15 signal fear/bottoms, while those above 0.75 indicate euphoria/tops, helping to identify the ever-elusive market cycle stages.

What are the potential scenarios based on the current BCMI?

With the BCMI below 0.5, two scenarios emerge: a healthy correction within a bull market or an early transition into a bearish phase. Monitoring the 7-day and 90-day moving averages of BCMI is crucial for clearer direction. After all, one must navigate the tempestuous seas of cryptocurrency with a steady hand!

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Every Upcoming Zac Efron Movie And TV Show

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-05-29 13:42