Imagine, if you will, a trader of considerable reputation, who, in a most dramatic fashion, parted with upwards of one hundred million dollars on the daring arena of Hyperliquid, a decentralized exchange tickled by modern finance’s finest. But the question that naturally arises is: Was this heart-stopping loss merely the result of ill-fortune, or was it cunningly engineered by the artful practice known as liquidation hunting? Oh, what a tangled web we weave! 😉

Crypto Perp Traders Beware: The Mechanics of Liquidation Hunting

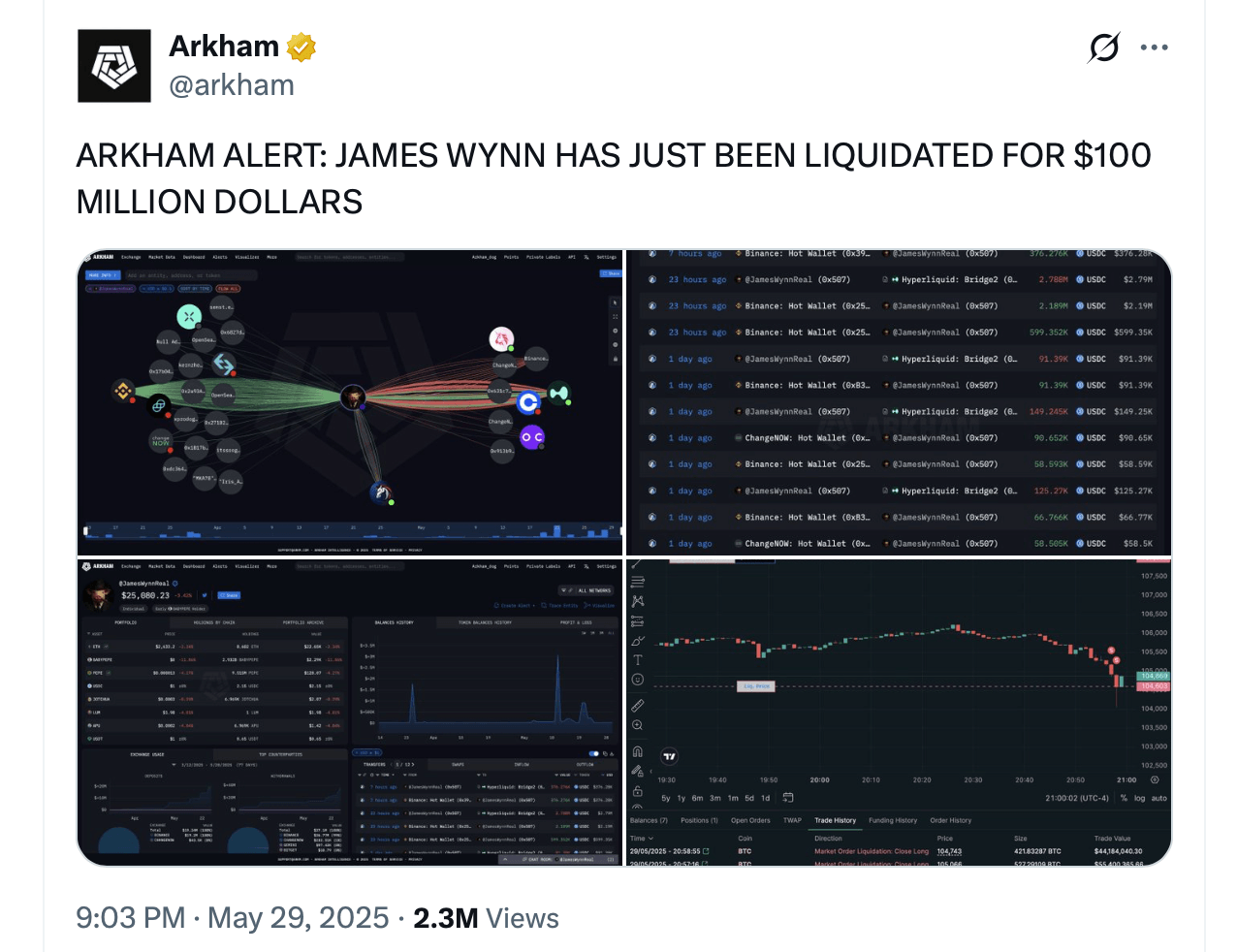

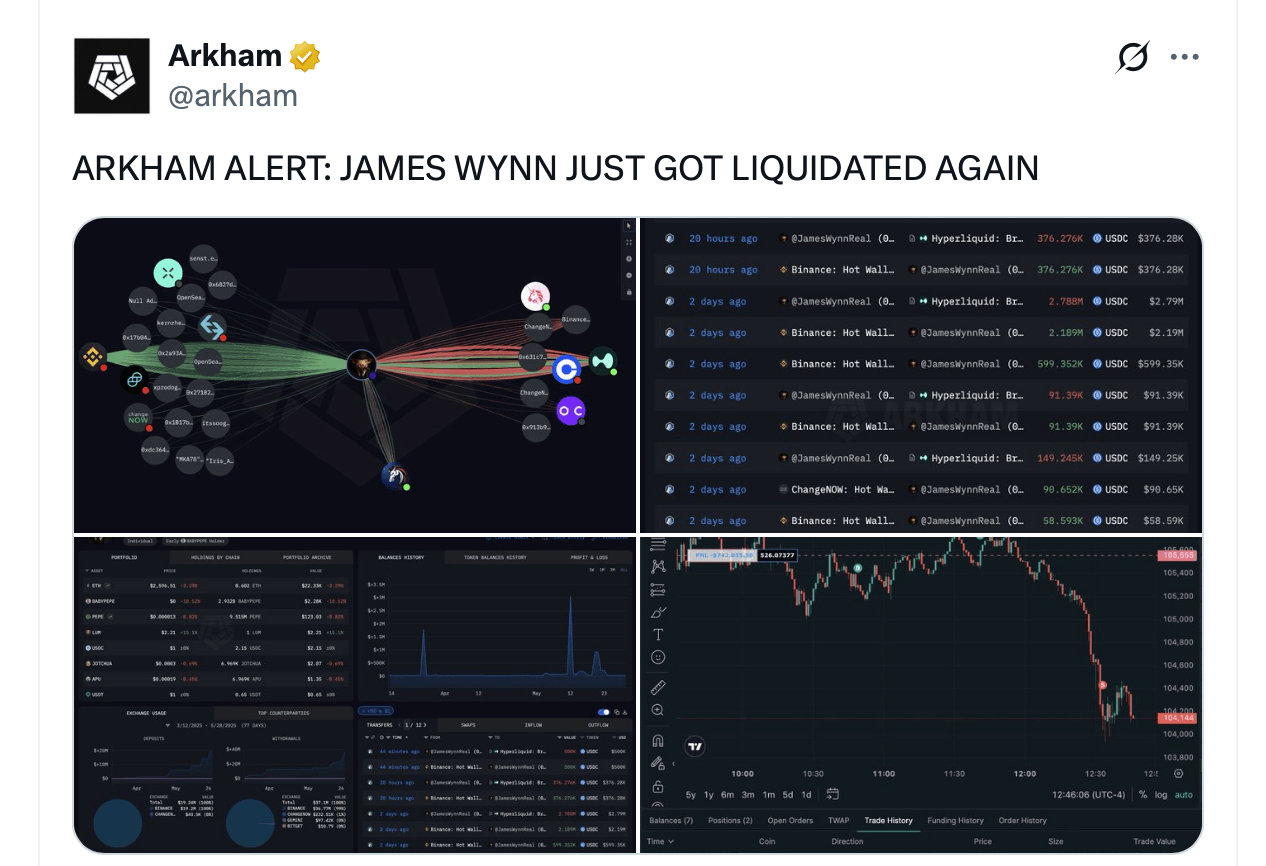

When the illustrious James Wynn beheld over $100 million gliding away from his grasp this very week, some gourmets of market legerdemain argue that this spectacle was not merely a stroke of ill luck. Wynn’s bold and leveraged long bets on the noble Bitcoin began to unravel like a poorly sewn seam as prices dipped below certain crucial milestones—an elegant demonstration of what the unscrupulous call liquidation hunting in full flourish. 🕵️♂️💰

Liquidation hunting is but a stratagem employed by the deep-pocketed and seemingly amorous “whales” of the market—those who delight in exploiting the natural mechanics of leveraged trade. By skillfully nudging market prices towards known liquidation zones, these cunning entities set in motion a cascade of forced closures, and with such calculated precision, they often walk away with freshly discounted Bitcoin—how charming! 🐋💼

In the perpetual markets, such as those offered on Hyperliquid, traders indulge in leveraged positions that are ruthlessly liquidated should their fortunes waver below certain margins. When Wynn boldly wagered a billion dollars on Bitcoin at around $108,000, his fortune was already a sitting duck—until the price plummeted past $105,000, and poof—over $100 million disintegrated in a blink of an eye. Truly, the art of dramatic loss! 🥴

And this is no idle fancy, dear reader. Research confirms that liquidation hunting is very much a real and deliberate affair, often orchestrated with sophisticated algorithmic dance moves. These digital maestros scour the market for clusters of precariously positioned traders near margin thresholds, and with a deft push, set off a domino chain of forced sales—what an elegant chaos! 🎩🔮

Here is the cunning in brief: the “whales” scrutinize vulnerabilities within open interest, liquidation data, and funding rates, selecting targets with the precision of a needle. Then, with the force of a hurricane, they introduce large orders that breach liquidation levels—setting off a chain reaction of forced selling or buying—creating a spectacle of volatile delight for the manipulative orchestrator. The result? More profit from the disorder, naturally. 💸🐋

This mechanical dance raises some very proper questions about fairness and ethics. Critics protest that it weaponizes liquidity gaps, preys upon naive traders, and distorts the very essence of honest market discovery. Others consolation that such tactics are simply a part of the game—akin to traditional arbitrage, or perhaps a clever stop-loss sweep, in the ever-fascinating world of finance. 🤷♀️

Hyperliquid’s burgeoning volume of trade—an astonishing $248.3 billion in May—attests to the popularity of these high-frequency, leverage-fueled spectacles. During this period, their coffers filled with roughly $70 million in fees—evidence that, for some, the game of chance and skill is quite profitable indeed.

Operating as a decentralized exchange where perpetual contracts dominate, Hyperliquid allows traders to take significant risks—sometimes up to 40 times their stake—securing, at least in theory, grand opportunities for riches or ruin. As Wynn’s tragic tale demonstrates, the stakes are perilously high. ⚖️🎲

In order to safeguard their fortunes, traders might consider some prudent behaviors: lowering their leverage—say, below 2x—thus avoiding the siren call of catastrophic swings. Keeping a generous collateral buffer beyond the minimum margins (10-20%) offers some cushion against sudden drops. Setting stop-loss orders wisely beyond market noise can help, though such protections are not invulnerable to the pesky cunning of liquidation hunting. Monitoring order books, large walls, and unusual surges can grant some foresight into manipulative schemes. 📊🔍

Dividing one’s bets across multiple trading pairs or platforms can lessen the blow of any one liquidation cascade—much like spreading jam on bread. And some platforms are beginning to introduce anti-manipulation features, though one might say that the industry is still in its infancy when it comes to such ethical improvements.

As for the moral debate—well, it is as lively as ever. While some view liquidation hunting as within the bounds of legal play, many argue it fosters unfairness and disadvantages smaller investors, twisting the market into a skewed reflection of true value. Others, however, see it as just another facet of the free market—a place where information and capital serve as the ultimate weapons. 🤔

Was Wynn the unwitting victim of a meticulously planned attack, or was he simply on the wrong side of a turbulent tide? The truth, alas, remains as elusive as a perfect lady’s smile. The mechanics are undeniable; the intent, less so. In this intoxicating world of high-stakes crypto, fortunes vanish faster than you can say “liquidation.” As long as such tactics persist, the line between unlucky chance and calculated assault shall remain blurred.

To all traders brave enough to venture into these perilous waters: remember this—liquidation hunting is very real, very cunning. To succeed, you must know its workings, accept its presence, and employ every safeguard at your disposal. Failure to do so might leave you penniless—a fitting fate for those who underestimate the subtlety of these market wizards. 💁♀️💥

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Arknights celebrates fifth anniversary in style with new limited-time event

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2025-06-01 18:31