As the digital currency rollercoaster chugs along, Ripple’s latest announcement has the market buzzing like a swarm of bees on a hot day. On June 3, Ripple decided to lock up a cool 470 million XRP tokens, claiming it’s part of their plan to tighten the supply and, hopefully, give the price a little nudge upward. Of course, this is nothing new. Crypto markets love creating a sense of scarcity, but whether it actually works is anyone’s guess. 🙄

Ripple Locks 470M XRP to Ease Supply Pressure

It’s a well-worn strategy for Ripple. They’ve escrowed 470 million XRP tokens as part of their ongoing effort to manage supply and keep the XRP value from sinking into oblivion. The goal? Reduce immediate circulation and put some wind in XRP’s sails. Because, why not? If you make something harder to get, doesn’t that make it more valuable? 💰

But here’s the catch: even the most optimistic of XRP enthusiasts are skeptical. With over 58 billion XRP already floating around, and a cap at 100 billion, analysts are questioning whether locking up a few hundred million will really shift the tides. As one analyst put it, “Locking tokens is only part of the equation. Without demand, you’re just rearranging deck chairs on the Titanic.” Ouch. 😬

Institutional Investors Withdraw as XRP Faces Downward Pressure

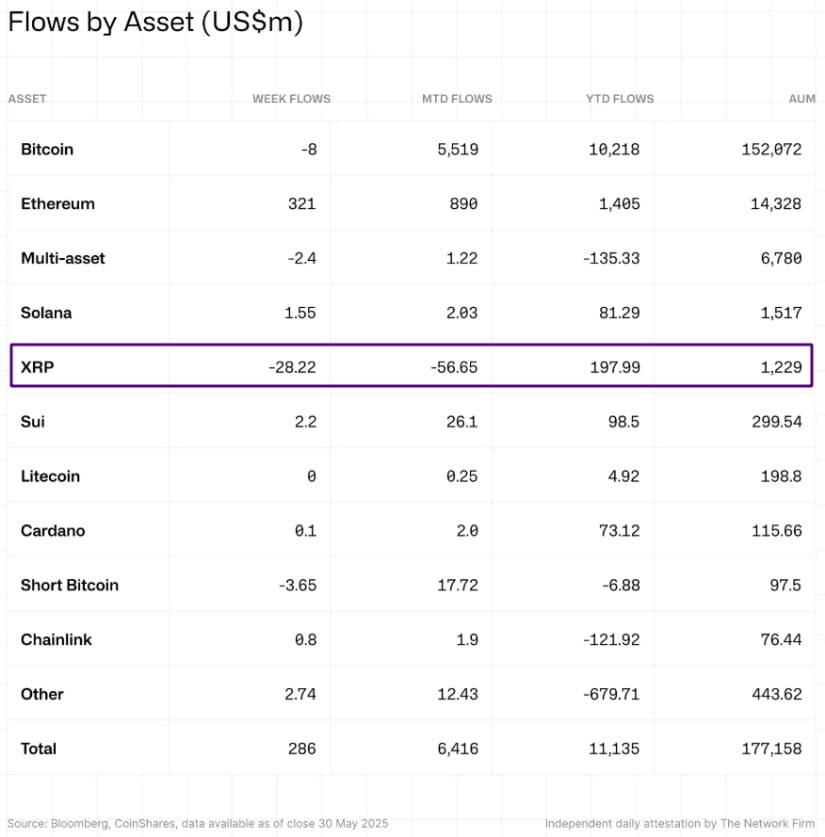

While Ripple is out here playing the supply control game, institutional investors are showing them the door. In the past two weeks, XRP funds saw a whopping $28.2 million in withdrawals, while the rest of the crypto market was busy raking in $286 million in fresh inflows. Talk about bad timing. 🔥

This mass exodus signals that institutional investors are growing nervous. With all the macroeconomic uncertainty, including U.S. tariffs making investors sweat, even a slight recovery in XRP price hasn’t been enough to restore faith. Not exactly a confidence booster.

As of now, XRP is hanging around $2.20. It’s up 1.6% in 24 hours, but that’s like a drop in the ocean. The price is stuck between $2.11 and $2.35, which isn’t exactly the breakout fans were hoping for. The technical charts don’t offer much hope either, with XRP still trading below all its major moving averages. It’s like trying to climb a mountain, but the mountain keeps getting taller.

Trading Volume and Volatility Hint at a Tense Market

Despite the doom and gloom, XRP’s trading activity is picking up. Volume surged by over 24% in the past 24 hours to almost $2 billion. But don’t get too excited – traders are just holding their breath for a breakout, which is anyone’s guess. It’s like waiting for a bus that may never come. 😅

But, hold your horses. Technical indicators are sending mixed signals. The Relative Strength Index (RSI) is flirting with oversold territory, and the MACD is showing a bearish crossover. A breakout is coming, but it’s anyone’s guess whether it’ll be up or down. It’s a gamble, folks. 🎰

For the optimists, a break above $2.35 could send XRP soaring to $2.50. For the pessimists, a drop below $2.10 might trigger a freefall to $2.00 or even $1.85. Take your pick.

Tokenomics and Holder Psychology Weigh on XRP Outlook

The big picture isn’t any prettier. Nearly 70% of XRP holders are sitting on losses, having bought near the $3.40 peak. As the Market Value to Realized Value (MVRV) ratio shows, profits are shrinking, and panic selling could be on the horizon. Welcome to crypto! 📉

Even if Bitcoin reaches $100 million, tokenomics experts argue XRP’s maximum price might top out at just $20. And that’s in the best-case scenario. Adjusted for inflation? You might want to lower that expectation a bit more. 🧐

Ripple’s Strategic Challenges Go Beyond Supply Management

Brad Garlinghouse and the gang at Ripple continue to shout from the rooftops about XRP’s value in cross-border payments, boasting partnerships with major financial institutions. But let’s be honest: none of that has moved the needle on XRP’s price. Not even a little bit. 🙄

To make matters worse, Ripple is still locked in a tug-of-war with the U.S. Securities and Exchange Commission (SEC), and the lawsuit updates are… well, slow. So slow, in fact, that you could almost hear the crickets chirping. 🦗

Until something changes – maybe a major regulatory win or a breakthrough in Ripple’s tokenomics – XRP will likely stay in the doldrums. Not even their partnership with Bank of America is putting much juice in the price these days.

Outlook: XRP Needs More Than Escrow Moves

In the end, locking 470 million XRP tokens might make Ripple feel good, but it’s probably not the miracle cure XRP needs. Between ongoing legal battles, investor disillusionment, and massive outflows, XRP’s future looks a little shaky. 😬

For XRP to get out of its rut, it needs more than just these short-term tricks. It’ll take a combination of market catalysts, regulatory clarity, and a whole lot of investor confidence. Unfortunately, none of those things are around the corner. So, buckle up. It’s gonna be a bumpy ride.

In the meantime, price action will depend on whether XRP can break above resistance at $2.35 or stay above $2.10. Until then, it’s best to keep your seatbelt fastened and your expectations in check.

Read More

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Gold Rate Forecast

- Every Upcoming Zac Efron Movie And TV Show

- Silver Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Grimguard Tactics tier list – Ranking the main classes

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- EUR USD PREDICTION

2025-06-03 20:22