In the tumultuous world of Dogecoin, after months of grinding like a beast caught in a never-ending bearish nightmare, something remarkable is afoot. A market structure shift is occurring, not by magic, but by sheer determination. Dogecoin, that humble digital mutt, is barking louder now. The breakout, followed by bullish confirmation, hints at a potential upside continuation, provided the key support levels don’t crumble like yesterday’s stale bread. Momentum indicators, now aligned, whisper secrets of a turning tide, while buyers—almost like knights of the crypto round table—begin to regain control.

In a landscape still scarred by the volatility of the broader crypto market, Dogecoin (DOGE) has been quietly preparing for a grand revival. Breaking free from its long-lasting bearish curse, it surged into $0.23 resistance like a dog who found its long-lost bone—only to be chased off, like a puppy kicked from a neighbor’s yard. Yet, this wasn’t a complete collapse. No. The pullback wasn’t a scream of defeat but a gentle rotation into support, which, against all odds, is standing firm. All signs—volume, indicators, and price action—point to a surprising strength, rather than a pitiful weakness.

Key technical points

- Major Market Structure Break: DOGE has broken out of its prolonged bearish straitjacket, initiating a trend shift with a surge to $0.23. Finally, a step toward freedom!

- Critical Support at $0.16: The price is now rotating into a support zone, bolstered by the almighty 0.618 Fibonacci and Point of Control. If it holds, we might just see a miracle.

- 200-Day Moving Average Retest: A bullish candle closing above the 200 MA, followed by a successful retest, suggests that this market’s pulse isn’t stopping anytime soon.

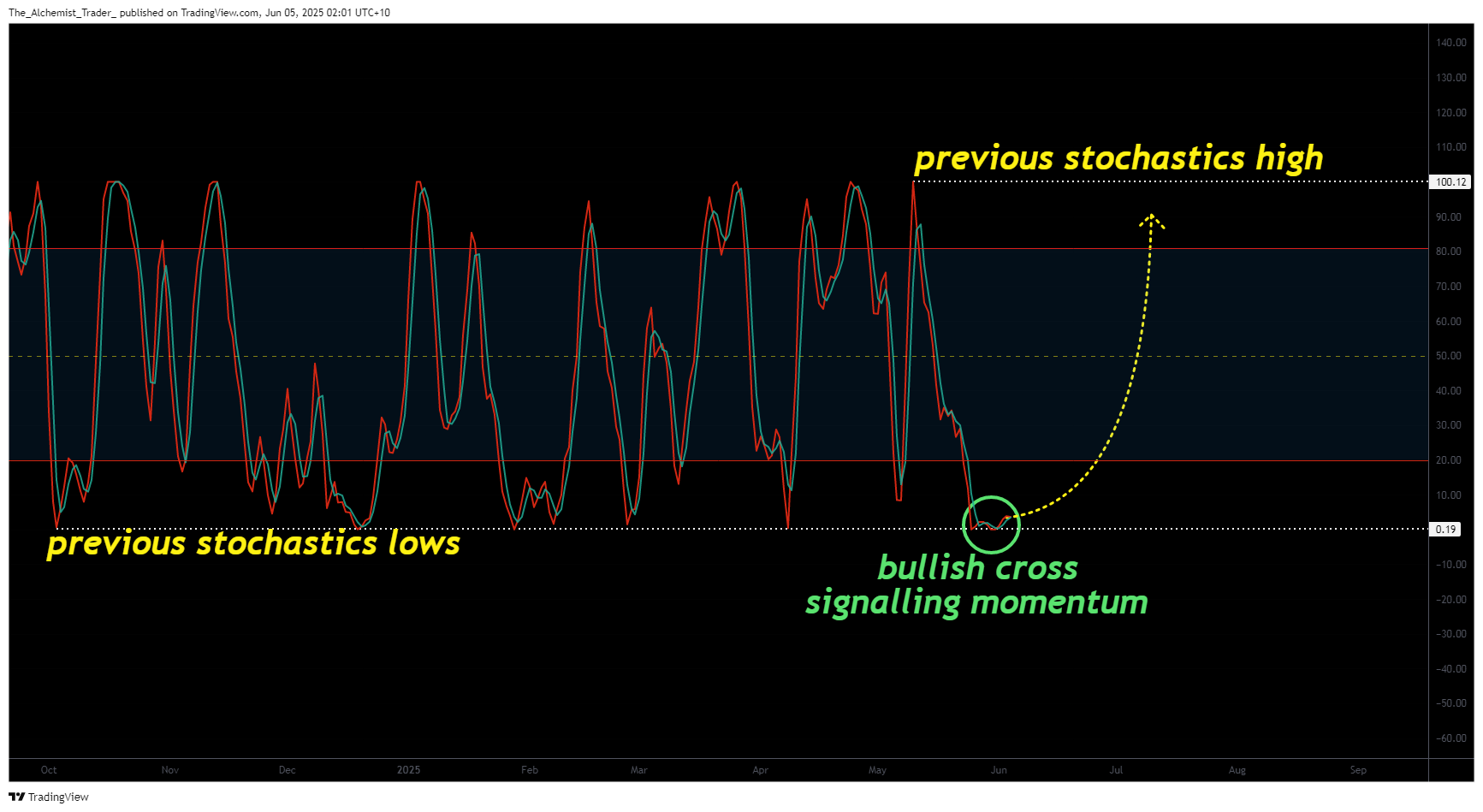

- Stochastic RSI in Oversold Region: At 19, it’s basically begging for a bullish crossover. A move above 20 would signal the kind of momentum shift that could have Dogecoin sprinting ahead.

- Bullish Continuation Signal: Constructive price action within the support cluster could set the stage for a solid long entry, perhaps leading DOGE to challenge its prior highs and maybe even shatter them.

The breakout from Dogecoin’s long-standing bearish slumber isn’t just a random burst of excitement. Oh no, it’s more significant than that. The impulsive breakout candle surged into the $0.23 resistance like a champion in a boxing match, only to be caught in a momentary stumble. But was that a defeat? Absolutely not. This rejection is more of a healthy correction than a devastating failure. It’s the market’s way of catching its breath.

And what followed? A clear and decisive shift in market structure. Higher highs, a confirmed retest of the 200-day moving average, and a blossoming Stochastic RSI setup—these signs all point to one thing: Dogecoin isn’t done yet. It’s consolidating in support zones. If these hold, the price could lift itself to new heights, potentially making a break for the $0.23 resistance and, who knows, beyond.

Now, let’s talk about the $0.16 level. Oh, sweet $0.16, you are crucial. This price holds not just technical significance, but is like the corner of a comfortable chair after a long day. A Fibonacci retracement level, a Point of Control from volume data, and a dynamic higher-low market structure form a beautiful confluence. Traders, pay attention. When these indicators align, it’s like a beacon of hope for a bullish reversal. And isn’t that exactly what we need?

But that’s not all. The 200-day moving average is showing signs of life! Dogecoin recently closed a full candle above this level—something that hasn’t been seen with such conviction in a long while. And after that, what happened? A textbook bullish retest. The price tagged the moving average, then shot back up like a rocket. It’s a clear signal that accumulation is happening under resistance, and the buyers are ready to show the bears who’s boss.

On the momentum front, the Stochastic RSI is flashing red. But in a good way! It’s sitting at 19, which means it’s currently in oversold territory—a prime spot where historical reversals have ignited. The key? The impending bullish crossover. If it crosses above 20, momentum confirmation is right around the corner. And trust me, when this happens, DOGE could be off to the races. It’s like the last few drops of water in a parched desert, suddenly spilling over and flooding the entire market.

Despite the correction from $0.23, price action is hardly showing any weakness. It’s respecting the support like a well-trained dog obeying its owner’s commands. There are multiple daily closes above $0.16, and if that support holds, a new bullish leg toward $0.23 is becoming more and more likely. Beyond that? The open space between $0.23 and $0.30 looks like a highway with no traffic—perfect for a speedy continuation.

What to expect in the coming price action

In the coming days, keep your eyes peeled. If the $0.16 support holds strong, particularly around the POC and 0.618 Fibonacci levels, it could set the stage for a glorious long trade. The goal? A return to the recent swing high at $0.23. Break that, and we might just see Dogecoin zoom toward $0.30, quicker than a squirrel outrunning a cat.

Momentum confirmation will come from the Stochastic RSI crossing above 20. If that happens, and the support holds firm, DOGE could be entering a new market phase—one where higher lows, continued trends, and increasing volume dominate the scene. But remember, if $0.16 fails to hold, all bets are off. Still, everything points to a bullish continuation and a potential market reversal that could change Dogecoin’s fortunes forever.

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Gold Rate Forecast

- Every Upcoming Zac Efron Movie And TV Show

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- Silver Rate Forecast

- USD CNY PREDICTION

- Hero Tale best builds – One for melee, one for ranged characters

- EUR USD PREDICTION

2025-06-04 20:25