Picture, if you will, a hothouse where mathematical moths flutter madly at electric bulbs, burning dollars, not wings. Such is the Bitcoin mining industry, presently embroiled in a melodrama of soaring costs and a hashrate so high it could make Everest look like a molehill in a sandbox.

This vertiginous eruption owes its gratitude not only to the pitiless height of network difficulty, but also that time-honored villain: the electric bill—and, naturally, a gladiatorial ring of mining behemoths elbowing and trampling like overcaffeinated hamsters in a race for digital cheese.

How Much for a Single Lonesome Bitcoin in 2025?

According to the clandestine oracles at TheMinerMag, the average price of birthing a single Bitcoin has ascended Mount Cost: from $52,000 in late 2024 to a respectable $64,000 in the first quarter of 2025. But why halt at respectability? The cost pirouetted past $70,000 in Q2, a leap of over 34%—one for the record books, or perhaps, the financial horror section. 🎢

“First-quarter filings from major Bitcoin mining companies highlight a rising cost of production, driven by both the surging network hashrate and, in some cases, higher energy prices.” A revelation to astonish only those recently thawed from cryosleep!

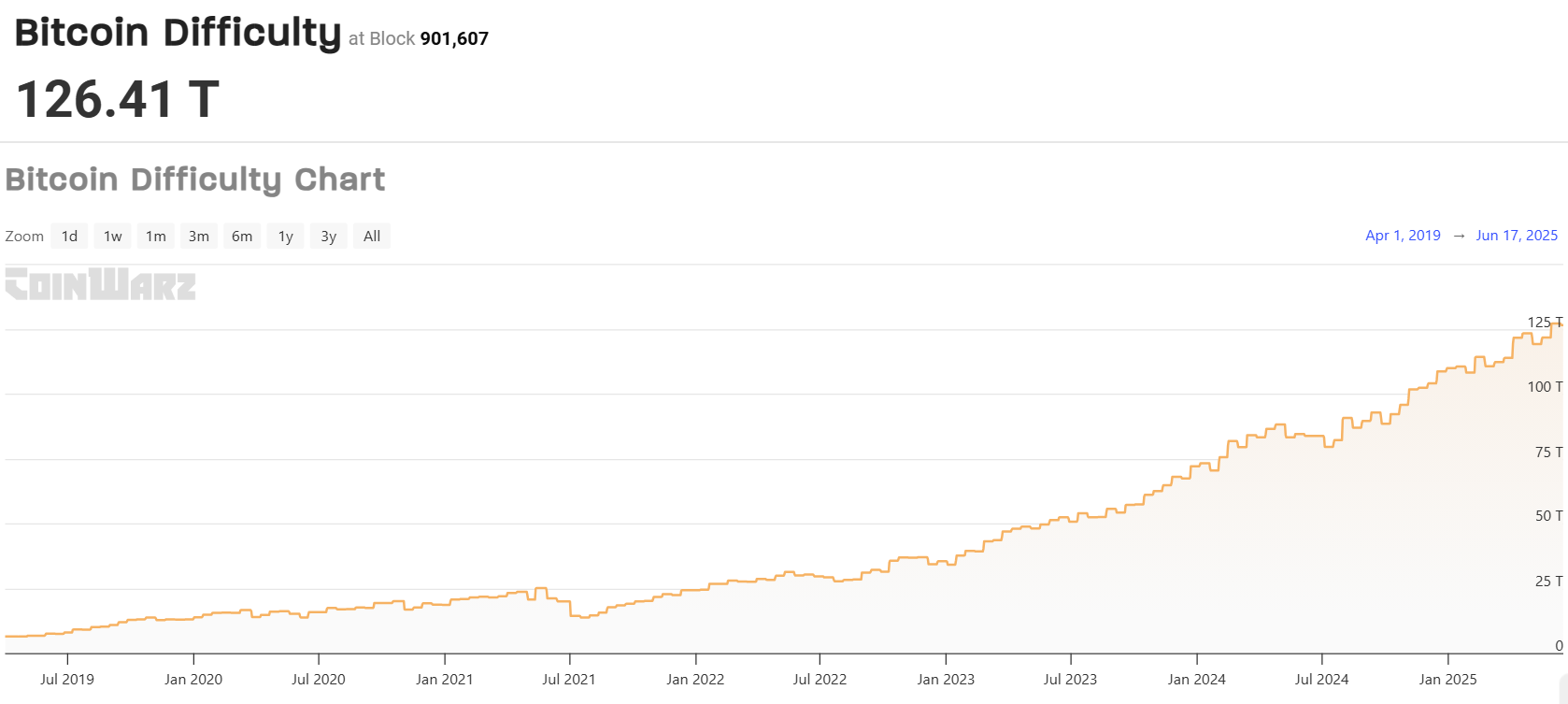

The inscrutable sages at TheMinerMag have divined a mining difficulty above 126 trillion. Coinwarz, reliably wielding their colorful charts, confirm: the upward graph now resembles the lifeline of a startled pigeon.

For the uninitiated: Bitcoin mining difficulty is a relative measure—a sort of Herculean index—compared to which the earliest days of Bitcoin (that halcyon 2009) now look like two kids shoveling digital snow in a sandbox. Today, it’s 126 trillion times more complex, because why not?

Who Invited All This Extra Difficulty?

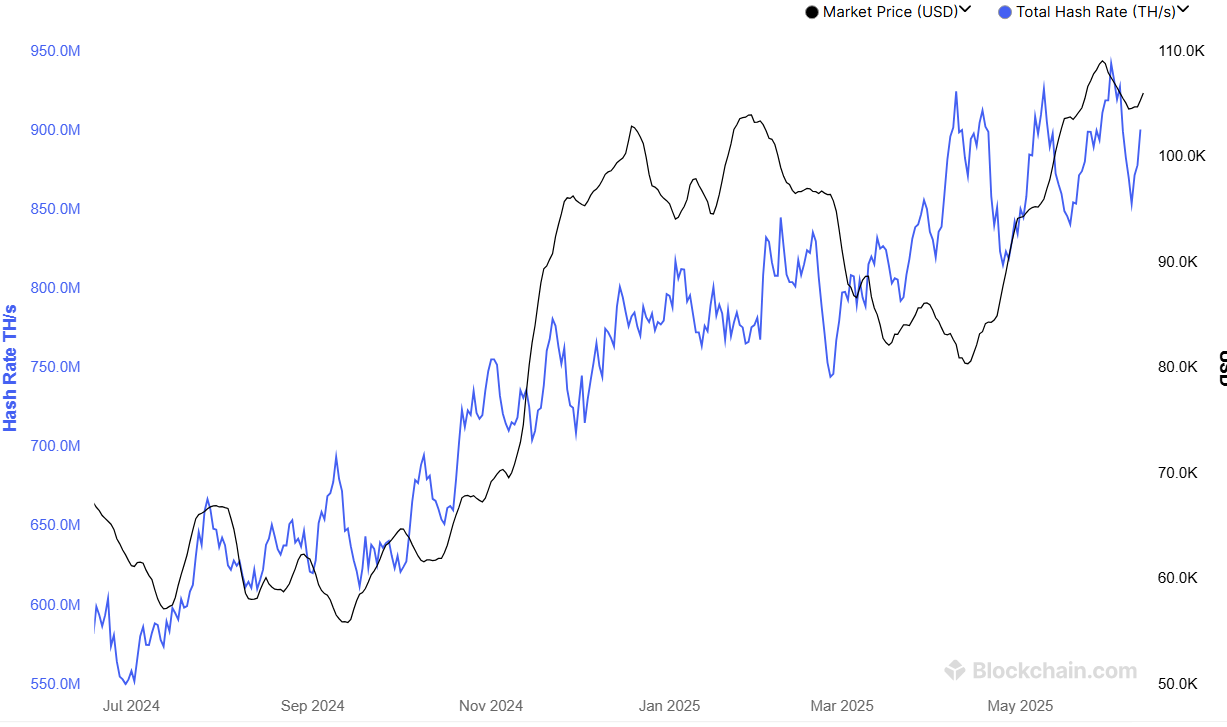

The answer arrives on a silvery server tray—a 14-day average hashrate of 913.54 EH/s, just shy of the elusive zetahash, that holy grail (1,000 EH/s). Some miners are already dusting the attic for extra hash just in case.

Hashrate, you see, is the measure of how much computational pomp and circumstance the network brings to the block-finding mosh pit. More hashrate, more miners, more cutthroat competition. Smaller profit margins: insert miner sobbing sounds here.

TheMinerMag traces this hashrate inflation to lavish expansion by the industry’s most intrepid firms, because nothing spells “thriving business” like mortgaging your last GPU farm for two percent more speed.

“The recent rise in Bitcoin’s network hashrate has been driven largely by public mining companies scaling and energizing new capacity. Leading firms such as MARA, CleanSpark, IREN, and Riot have all reported increases in realized hashrate,” the report trilled. Bravo, titans of industry! The treadmill is now self-powered.

Alas, every silver lining has its rain cloud. The celebrated metric “hashprice” (how many digital crumbs you get for each piece of effort) is now a paltry $52 per PH/s—a number so modest, it could blush.

Worse yet: transaction fees have plunged like lemmings off a digital cliff. In May, they accounted for a whisker-thin 1.3% of block rewards, and in June dropped below 1%—one could almost hear the miners rummaging for spare change in the network’s digital couch cushions.

Wild Diversification: The Miners’ New Dance

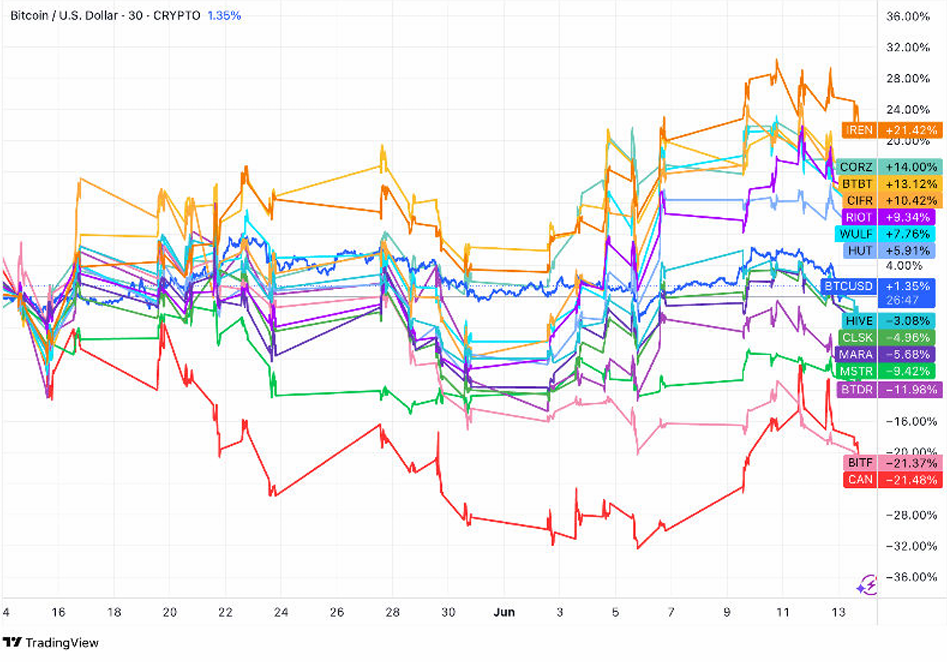

Surprise: mining stocks no longer waltz in lock-step with Bitcoin’s price. TheMinerMag’s report shows miner stocks behaving like moody teenagers, reflecting each company’s willingness to dance with new ideas—or embrace despair. 🤷♂️

“The growing divergence comes despite Bitcoin’s relatively stable price, highlighting a decoupling between BTC and mining stocks. This trend suggests that equity investors are increasingly evaluating miners based on their adaptability in the post-halving environment — particularly their ability to pursue new narratives — rather than simply mirroring Bitcoin’s price movements,” the report confessed, perhaps with a shrug.

So, the miners have retreated to the fortress of diversification. Riot cranked its Bitcoin-backed credit line with Coinbase up to $200 million—one assumes in case of a rainy day or a particularly ugly meme war. MARA parked 500 BTC with Two Prime, seemingly on a quest to “expand its yield strategy”—whatever that means after three espressos. Others now dabble in AI and High-Performance Computing, chasing fresh profits lest the algorithmic wolves catch their heels.

With arithmetical gravity pulling costs skyward and profits whispering ever softer, mining’s new golden rule is no longer “hold on for dear life.” Instead: Adapt, or you’ll be yesterday’s password.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-06-17 13:07