What to know:

- Visa prophesies, with the solemnity of an unfashionable oracle, that “by 2025, every institution that moves money will need a stablecoin strategy.” Presumably, they have one already, and are now simply hunting for someone to mention it to at dinner parties.🍾

- The Yellow Card partnership will “explore cross-border payment options”, a phrase which here means: “Get money to go places and not get stuck in bureaucratic treacle.”

The latest from Visa’s bustling think-tank: Now that every child and his parrot have a crypto wallet, why not sprinkle stablecoins across Central and Eastern Europe, the Middle East, and Africa, just to keep things lively? Enter, stage right, Yellow Card—an outfit so devoted to innovation, they might try paying their bar tab in ten different blockchains.

Visa, determined to become the Dowager Countess of FinTech, is shovelling investments into stablecoin-centric firms. (“We’re trendsetting,” they whisper, as though the dance of late-stage capitalism were a Gatsby party everyone’s forced to attend.)

Back in 2023, when stablecoins were as trendy as beaded headbands, Visa started dabbling in Circle’s USDC, settling transactions in what can only be described as Monopoly money for the 21st century. Over $225 million later and countless executive back-pats, clients are informed via press release that they are, indeed, modern.

Visa’s oracular Mr. Godfrey Sullivan assures the world: “In 2025, we believe that every institution that moves money will need a stablecoin strategy.” He reportedly uttered this in a polished boardroom, and not at all while sipping something regrettably non-alcoholic.🍸

Yellow Card, promising to “streamline treasury operations and enhance liquidity management” (that old chestnut), joins Visa on a journey to either revolutionize money movement—or simply add another slide to next year’s PowerPoint.

Chris Maurice of Yellow Card proclaims, “Together with Visa, we’re building a bridge between traditional finance and the future of money movement.” Rumor has it, the bridge is quite scenic but beset by tolls. The pair hope to engineer a landscape where transferring money is less like wading through bureaucratic porridge and more like pressing a button labelled “Make me rich, instantly.” Or transparent, anyway—or maybe just slightly less opaque.🔍

Crypto for Advisors: Digital Asset Tax Preparation

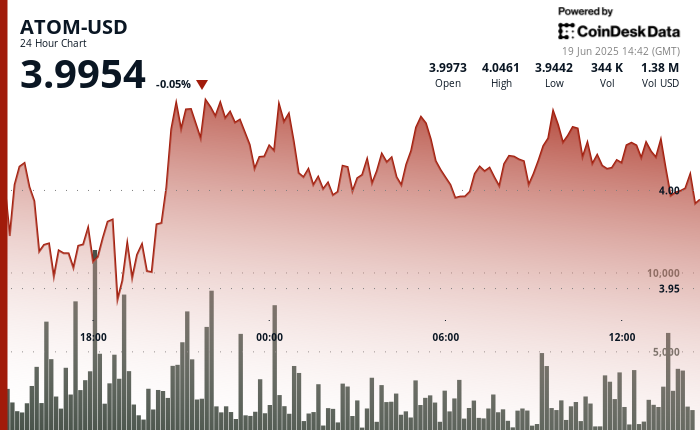

ATOM Rebounds After Dip, Establishes New Support Level

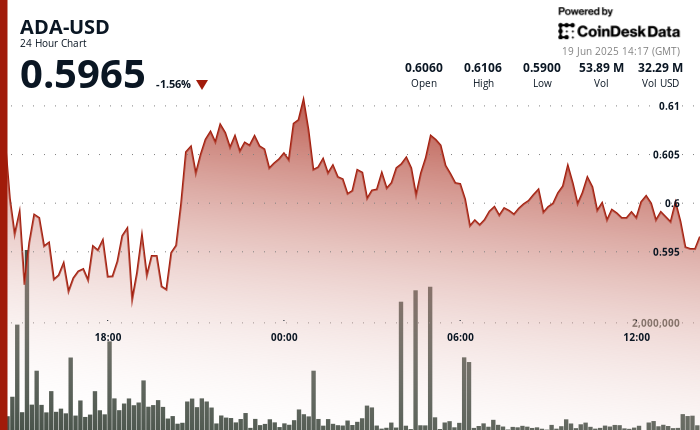

ADA Slips Below $0.60; 24-Hour Trading Volume Jumps 30% Amid Accumulation Signs

Why Pro-Israel Group’s $90M Crypto Hack Could Be a Hammer Blow for Iran’s Regime

Bitcoin Cash Jumps to $480 as 24-Hour Trading Volume Spikes 22% Above Average

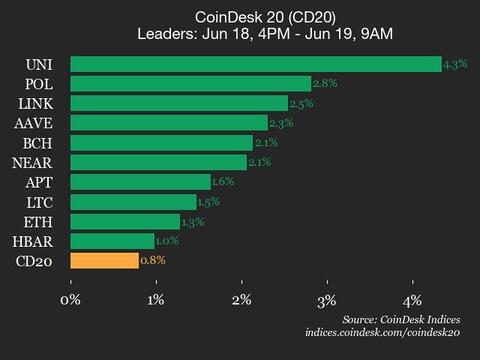

CoinDesk 20 Performance Update: Uniswap (UNI) Gains 4.3%, Leading Index Higher

Ether, Solana, and Other Majors Could Slide Further as Trump Threatens Iran Strikes

Circle Rockets After Stablecoin Bill Clears Senate, Pushes Post-IPO Rally to Over 500%

Iran’s Nobitex Source Code Exposed Day After Hackers Steal Tokens Across Bitcoin, EVM, Ripple Networks

Who’s Selling Bitcoin Above $100K and Holding Back the Price Rally?

Return of Zero Interest Rate Policy as Swiss Central Bank Cuts Rates

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

2025-06-19 18:17