Amidst the swirling mists of financial speculation, Ethereum ETFs have emerged as the darlings of the moment, with yesterday’s inflows marking the asset category’s eighth-best day in history. If the celestial bodies align favorably, July might just be the most profitable month for these assets in 2025, and we’re only 11 days in. 🌠

Corporate titans, with their insatiable appetites, are gobbling up ETH at a rate that would make a locust blush, dividing their attention between ETF issuers and the more traditional whales. Meanwhile, Ethereum’s price has soared nearly 20% in a week, a testament to the robust demand following Bitcoin’s all-time high. 🚀

Ethereum ETFs: A Wall Street Phenomenon

Ethereum, the prodigal son of the crypto world, has once again crossed the $3,000 threshold, a feat not seen since February, as corporate investment surges. This stellar performance is mirrored in ETH’s various derivatives, which are also experiencing a deluge of cash inflows. 🌊

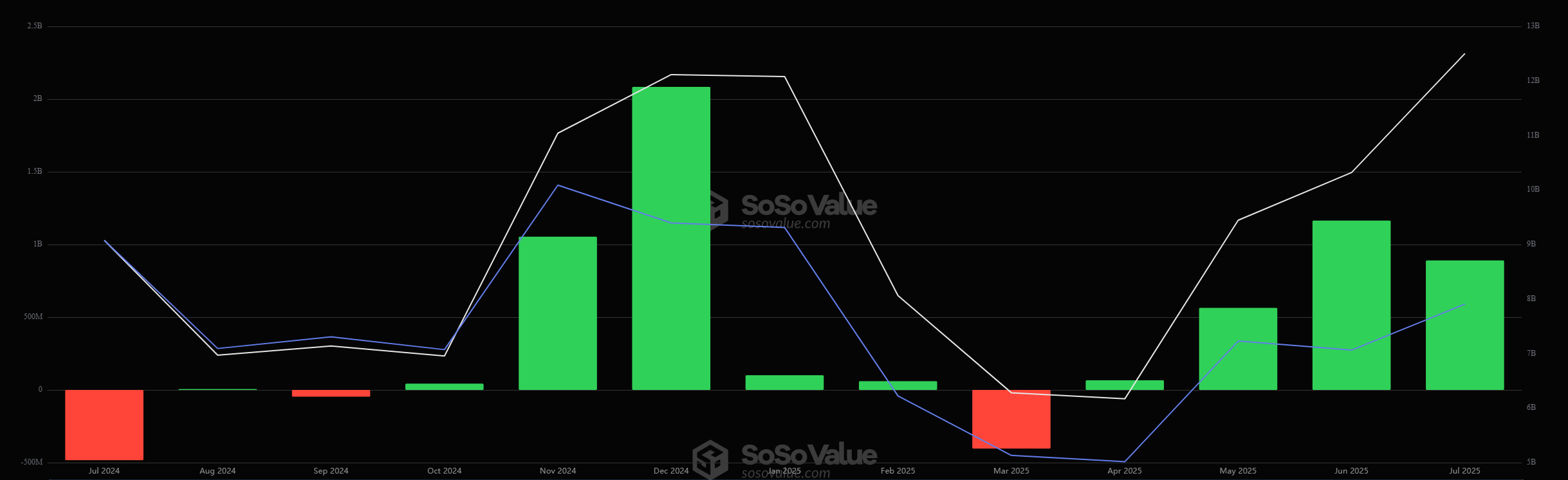

US spot Ethereum ETFs are currently on a roll, with $890 million in monthly inflows, building on two consecutive months of impressive gains:

With net inflows of $564.2 million in May, $1.17 billion in June, and an additional $507.4 million so far in July, the U.S. Ethereum ETFs have shown strong recent performance.

Yesterday’s net inflow of $211.3 million marked the eighth-best day on record.

— Mads Eberhardt (@MadsEberhardt) July 10, 2025

Indeed, depending on how these products perform today, July might become the most profitable month for ETH ETFs in 2025. These ETFs, which have been in existence for less than a year, are currently basking in a resurgence of interest. 🌞

If this trend continues, this asset category will enter its biggest bull run since its inception in July 2024. The demand for Ethereum is seemingly outpacing Bitcoin ETFs, which have long been the preferred choice among US institutional investors. 🤷♂️

Over the past nine days, ETFs have purchased nearly 380,000 ETH tokens, a quantity that surpasses the net newly issued tokens since the 2022 Ethereum Merge. Regular corporate holders are also buying nearly the same amount, further fueling the demand for ETH. 🚒

Some Ethereum ETF issuers are particularly voracious in their consumption habits. BlackRock, for instance, holds 1.5% of circulating ETH tokens, a staggering $4.5 billion in total holdings. BlackRock’s unwavering commitment is thus affecting supply and demand from both ends, hoovering up all available tokens to offer more indirect exposure. 🦅

It will be fascinating to observe how these market dynamics evolve in the coming weeks. If these ETF trends persist, they could help ensure a sustainable price rally for ETH in the short term and potentially herald an altcoin season in Q3. 🍀

Read More

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-07-12 01:41