Amid the bustling market, a sharp 18% rally has lifted the spirits of SEI, breaking through multiple technical barriers and drawing the attention of short-term traders like moths to a flame. As volume and volatility metrics align with the promise of a bullish continuation, SEI now trades near $0.3324, a price that whispers of potential and peril. Market watchers, with their eyes glued to the charts, are now in a suspenseful dance, waiting to see if this move holds or fades like a forgotten dream.

Breakout Above Descending Resistance Highlights Renewed Momentum

The daily SEI/USDT chart, a masterpiece shared by the insightful analyst HexaTrades, confirms a breakout above a descending trendline that has been a relentless guardian of price action since March. This long-term trendline, a formidable fortress, had previously repelled multiple bullish assaults, maintaining a steady pressure on SEI throughout Q2 2025.

The recent price surge, a dramatic leap from $0.29 to $0.3399 within a single session, marked the first confirmed breakout in months, a moment that could signal a broader shift in market behavior, a turning point in the saga of SEI.

The green target zone, a beacon of hope, extends up to $0.42, suggesting a path for continuation if buyers can maintain their momentum. A risk zone just below $0.28 marks the point of no return, giving this setup a favorable structure for those daring enough to place directional trades. The clean breakout pattern may invite additional bids if SEI revisits the $0.29–$0.30 zone and holds, reinforcing the current trend structure. With higher lows continuing to form since late June, SEI appears to be entering a short-term upward phase, a gentle ascent in the midst of market turmoil.

Intraday Volatility and Volume Data Paint Mixed Picture

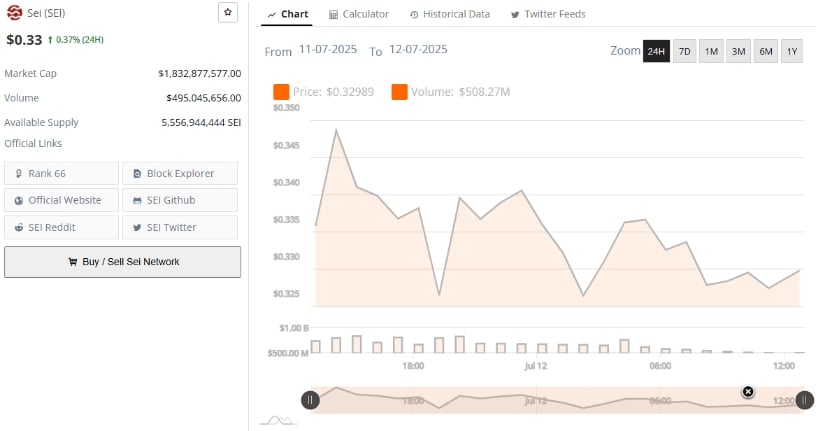

Additionally, data from BraveNewCoin between July 11 and July 12 reveals a tale of two days: SEI reached a session high of $0.347 before retracing to a low near $0.325. Despite opening around $0.33, the token failed to sustain its highs, reflecting a mixed intraday sentiment, a day of both hope and despair. Price action during this 24-hour window shows multiple rejections near the $0.345–$0.350 zone, which now acts as a short-term resistance, a barrier that must be overcome.

Total trading volume during the period hit $508.27 million, a slight increase from the previous day. However, volume levels tapered off into the close, a sign of momentum fatigue, a weariness that could spell the end of the current rally. The price remains range-bound for now, with support seen near $0.325 and resistance at $0.350, a narrow path that SEI must navigate with care.

Market cap stands at $1.83 billion, ranking SEI as the 66th largest crypto asset, a position that is both a badge of honor and a target for those who seek to dethrone it. A decisive move above $0.350 with increased volume may be needed to confirm any sustained breakout beyond the current range, a moment that could redefine the future of SEI.

Technical Indicators Suggest Room for Upside Extension

On the other hand, according to TradingView data, the SEI/USDT daily chart shows bullish continuation supported by the Awesome Oscillator (AO), which has flipped positive, a sign of renewed energy. The histogram is expanding, indicating momentum buildup following a prolonged period of contraction in June, a period of rest before the storm.

With the price structure now printing higher highs and higher lows, the breakout pattern aligns with bullish trend reversal criteria, a pattern that whispers of a new beginning. The Crypto Volatility Index (CVI) for SEI has also risen steadily, currently at 196.24B, a reflection of renewed attention from both retail and institutional participants, a gathering of forces that could propel SEI to new heights.

If price clears the $0.3446 resistance and sustains above $0.33, SEI could retest the $0.38–$0.43 range, a journey that could be filled with both triumph and tribulation. Should momentum weaken, the key support level to monitor will be near $0.30, where a retest could either confirm strength or trigger a deeper pullback, a moment that could define the fate of SEI in the market’s grand narrative. 🌟🚀

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2025-07-13 00:29