Ah, a splendid leap into the treacherous waters of regulated crypto banking! Ripple, in its eternal quest for stability and dignity, aspires to don the illustrious cap of a national trust bank, thereby waving a rather grandiose flag for stablecoin respectability and custodial excellence.

Ripple National Trust Bank Reinvents the Regulatory Racket with RLUSD Shenanigans

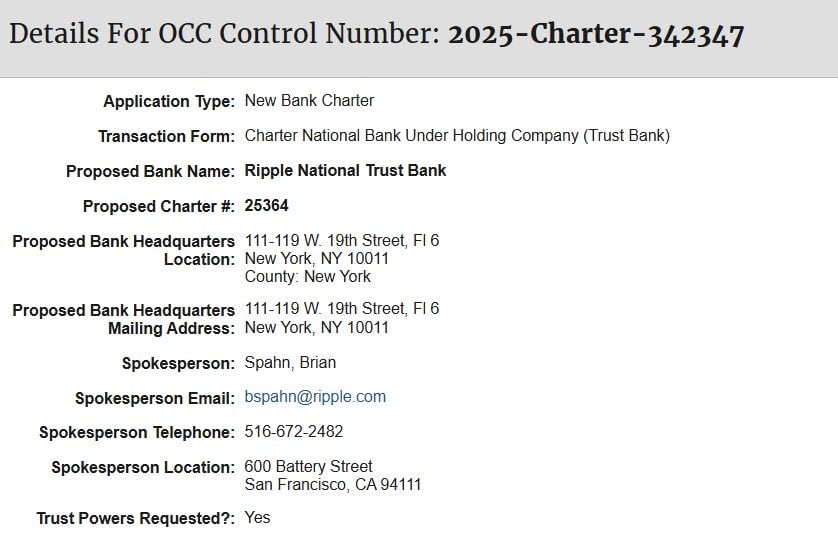

In a theatrical flourish reminiscent of a grand Victorian unveiling, Ripple has advanced its ambitions for regulatory supremacy with an application to birth the Ripple National Trust Bank. With this audacious move, it craves a deeper plunge into the comforting bosom of federal supervision. The entangled tale unfolds as the blockchain virtuosos officially submitted their grand ambitions to the U.S. Office of the Comptroller of the Currency (OCC) earlier this very month, invoking the hallowed control number 2025-Charter-342347. The magnificent institution—Ripple National Trust Bank—shall make its courtly home at none other than 111-119 W. 19th Street, 6th floor, in the illustrious conurbation of New York City, under the watchful eye of charter number 25364.

Permit me to elaborate: Ripple yearns for trust powers. Yes, dear reader, a true dream! This coveted ambition would empower the bank to cavort in the realms of digital asset custody and fiduciary services whilst under the eagle eye of our dear federal overseers. The ever-articulate Brian Spahn, nestled safely in Ripple’s San Francisco lair, shall be the voice of this initiative. The OCC has graciously opened a period of public commentary that will echo until the golden day of August 1.

This illustrious regulatory undertaking follows Ripple’s audacious proclamation that it intends to embrace a dual licensing model for its illustrious creation, Ripple USD (RLUSD). It seeks to entwine the jurisdiction of the New York Department of Financial Services (NYDFS) with that of the esteemed OCC, as if in a grand ballroom dance of governance. CEO Brad Garlinghouse, that modern-day bard, declared upon the social platform of X: “In true homage to our time-honored compliance lineage, Ripple is embarking upon an application for a national bank charter from the OCC. Should the fates smile upon us, we would bask in both state (via NYDFS) and federal scrutinies—a novel and, dare I say, unique benchmark for trust in the vast ocean of stablecoins.” 🤝

Ripple’s foray comes amid a sweeping tide wherein crypto firms lust after bank charters, all in sweet anticipation of the GENIUS Act, which seeks to bestow upon us the rigid federal regulations for stablecoins—complete with dollar backing, transparency—a veritable bouquet of compliance that includes AML/KYC adornments. Having waltzed past the Senate, it now patiently awaits the favor of the House. Ripple’s esteemed subsidiary, Standard Custody & Trust Company, has also laid its crown jewels bare with an application for a Federal Reserve master account. Garlinghouse mused: “Dare we dream? Such access would enable us to clutch the RLUSD reserves directly with the Federal Reserve, conferring an additional layer of security to pepper our noble endeavors with trust.” 🏦

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-07-13 07:57