Ah, Q1—a time when our beloved cryptocurrency market took a nose dive. But lo and behold, Q2 2025 emerged like a phoenix from the ashes, with the crypto world swaggering back to a hefty $3.46 trillion market cap. This miracle, ladies and gentlemen, was brought to you by Exchange-Traded Fund (ETF) inflows and a Bitcoin rally that had everyone wondering if they should be investing or simply buying a lottery ticket instead. Yet, keep your party hats on, as macroeconomic worries and geopolitical shenanigans were still lurking in the shadows, making us question if we’d ever be free from the world’s ridiculousness. 😂

Bitcoin Resurrects a Trillion-Dollar Market: What Just Happened?!

After the great Q1 market hiccup, Q2 2025 decided it had better things to offer, with crypto enthusiasts feeling like they just won the lottery. The total market cap leapt a jaw-dropping 28.2%, largely thanks to ETF inflows and, oh yes, the marvelous Bitcoin rally. Hold your applause, please.

According to the oracle of crypto wisdom, Token Insight’s Q2 2025 crypto exchanges report, supportive labor data and whispers of the Fed cutting rates gave us a glimmer of hope. However, the looming giants of global growth headwinds and geopolitical nonsense decided to rain on our parade, preventing a full-fledged crypto renaissance.

The crème de la crème of centralized exchanges recorded an eyebrow-raising $21.6 trillion in volume—though this marked a slight drop of 6.2% from Q1. Meanwhile, Bitcoin went from a humble $83K to a staggering $111.9K peak, closing out the quarter near a crisp $106K. Isn’t it adorable how spot trading volumes fell flat on their face? With a daily average of $40 billion, we’re down from Q1’s dreamy $51 billion, leading to an annual total of $3.63 trillion (a not-so-cheerful drop of 21.7%).

In a surprising twist, derivatives kept their crown as the reigning champs, hitting $20.2 trillion in Q2 volume—a pitiful 3.6% decrease. Average daily volumes hovered around $226 billion. Looks like traders couldn’t resist hedging their bets amid all the uncertainty—also known as “the everyday norm” in crypto.

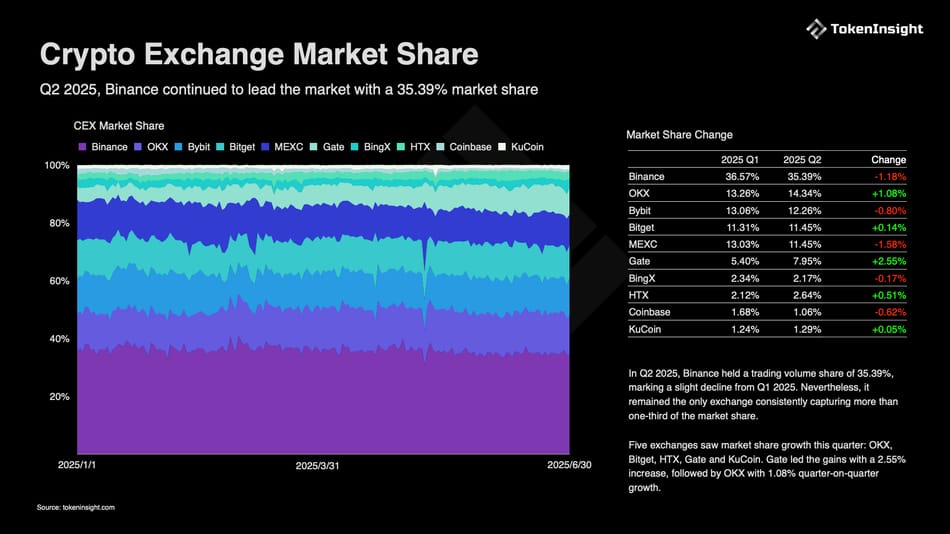

Let’s take a moment to bow to the queen of exchanges, Binance, which clutched a whopping 35.4% of total trade volume, even though it slipped slightly from Q1. Meanwhile, the minions—OKX, Bitget, HTX, Gate, and Kucoin—expanded their territories, with Gate taking the biggest slice of the pie (+2.55%).

In a dramatic tale of derivatives, Binance held a strong position at 23.8% of open interest, while HTX, Bitget, and OKX each increased their shares. But, dear reader, don’t let the excitement distract you from BTC’s impressive 31.6% gains in Q2. The now-famous token BNB only managed to rise 8.9%, while OKB, BGB, and KCS were practically begging for attention with minor upticks. Most other altcoins, however, seemed to have slipped into a deep slumber.

Despite Bitcoin’s triumphant performance, volume concentration continues to be a buzzkill. With macroeconomics resembling a soap opera, Q3 predictions hint at flat or falling spot trading ($3–3.5 trillion projected) while derivatives continue their reign. The future may see exchange tokens drifting a bit further apart, mirroring the chaotic patterns of capital flow across the globe. Just another day in the unpredictable world of cryptocurrency! 🌍

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-07-16 21:03