Ah, Solana. It seems our digital serfs are once again captivated by the shimmering promise of a swiftly ascending token. Having unceremoniously displaced BNB – a vulgar display of ambition, wouldn’t you agree? – and pierced the rather symbolic barrier of two hundred dollars, SOL now deigns to dictate the rhythm to the lesser altcoins. One suspects, of course, that this is not merely a fleeting spasm of speculative fever, but a movement underpinned by…well, *technicals*, as they say, and a disconcerting level of activity on the “chain,” whatever that may be. 🙄

The Ousting of Binance Coin

It has come to pass that Solana has, indeed, surpassed Binance Coin in the grand accounting of market capitalization. A matter of mere billions, admittedly, but significant nonetheless. SolanaFloor reports SOL boasting a valuation of $107.58 billion, a paltry sum exceeding BNB’s $106.24 billion. One wonders if Monsieur Binance is taking this lying down, or if he’s simply polishing his yacht and preparing for the next wave.

This, it appears, reflects a quiet diligence on Solana’s part, a becoming of one of the more…energetic…Layer-1 networks. As capital, like a flock of skittish birds, continues to alight upon chains that offer both haste and stability, this movement in market cap may be less a matter of fanciful boasting, and more a simple acknowledgment of inherent worth. Or so the analysts tell us.

A Glimpse Towards Past Glories

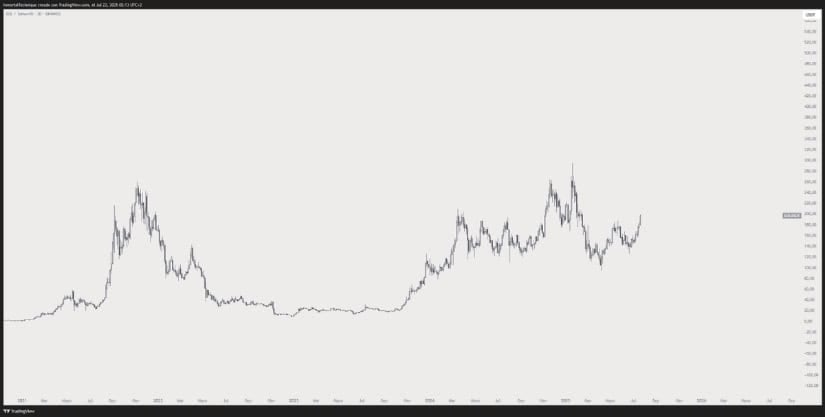

Following this…triumph, Solana now draws the eye once more with a price structure that hints at a return to former heights. Inmortal has provided us with a chart, a veritable labyrinth of lines and curves, which suggests SOL is steadily climbing, mirroring the accumulation of power so often observed before a grand expansion. How very predictable.

There is a curious symmetry to the comparison with the events of 2021. Though, this time, the foundations appear…shall we say, less precarious. Both in terms of the aforementioned market structure and the network’s actual use. One hopes they’ve learned their lessons.

From a strictly technical viewpoint (a term that always sounds so dreadfully clinical), the $200 mark seems to be holding, the price gently but firmly ascending after numerous and rather tedious retests of various demand levels. Should SOL maintain this…momentum, and remain above the $175 to $180 region, the path towards renewed glory will be opened with alarming speed.

The Forecast: $220 to $250? (One Presumes)

Bolstered by its market cap and price patterns, Solana is now exhibiting a rather straightforward breakout on the weekly chart. Cas Abbé assures us that SOL has broken above a key resistance level near $180, and with considerable conviction. Naturally.

This breakthrough unlocks the next target zone, roughly $220, a level that conveniently aligns with the first major resistance block. Should this continue – and why wouldn’t it? – Solana could conceivably accelerate into the $250 to $270 range before experiencing a moment of…reflection.

A Cascade of Liquidations (Schadenfreude Alert!)

Further bolstering this breakout, Solana has instigated over $48 million in short liquidations as the price reached $204, a height not seen for months. According to SolanaFloor, these liquidations originated primarily from the chain itself, exceeding even the activities of centralized exchanges. It seems some were overly optimistic in their pessimism. 😈

These liquidations, one suspects, may serve as an…impetus…for further ascent. The largest single liquidation amounted to over $1 million precisely at the $204 level. It’s a cruel world, isn’t it?

The Thinning of the Ranks

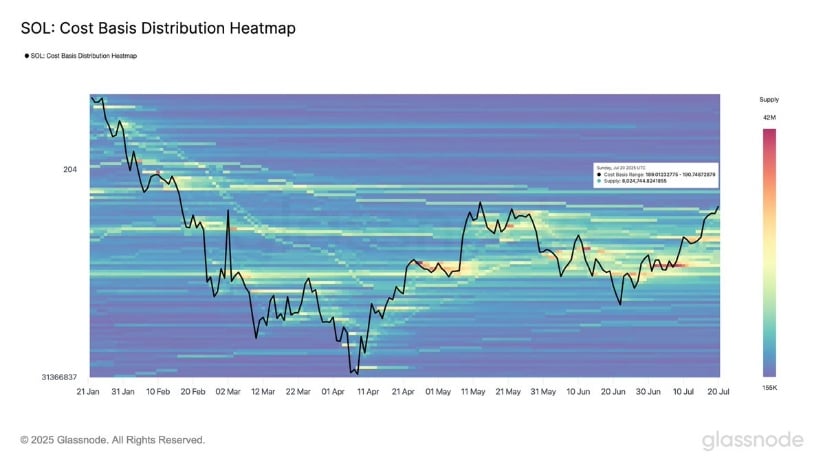

The breaching of $190, while appearing a simple technical maneuver, carries, according to on-chain data, a significance that surpasses mere appearances. Glassnode reveals that this level was a zone of concentrated accumulation, a veritable wall of resistance. But now, as the price surmounts it, the structure shifts in Solana’s favour. A wall, it seems, is becoming increasingly porous.

Above $190, the supply begins to dwindle. This alteration in structure could allow the price to advance more quickly should demand persist. Though, one must always temper enthusiasm with a healthy dose of skepticism.

Final Reflections (and a Sigh)

Solana isn’t simply reclaiming its position; it’s subtly redefining the capabilities of Layer-1 chains in this current epoch. The thinning supply above $190, combined with the recent cascade of liquidations, suggests that SOL now possesses both the momentum and the structure to ascend towards $220, and perhaps, even beyond. One can only observe, with a detached amusement, the relentless pursuit of digital fortune. 🎭

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Hero Tale best builds – One for melee, one for ranged characters

2025-07-23 04:20