In simple terms, a16z Crypto discusses key factors influencing the cryptocurrency scene in 2025, ranging from mobile wallet usage to transaction costs.

2024 marked a pivotal year in the crypto world, with activity peaking, transaction fees plummeting, stablecoins finding practical applications, and exchange-traded funds for Bitcoin (BTC) and Ethereum (ETH) receiving approval. During this time, regulatory guidelines also started to take shape, providing a clearer direction for the sector. As we step into 2025, here are five key indicators that Daren Matsuoka, partner at a16z, suggests keeping an eye on.

Mobile crypto wallets

Mobile crypto wallets are currently at the heart of the action, with a staggering 35 million users reported monthly by Matsuoka as of 2024. Notable names such as Coinbase Wallet, MetaMask, and Trust Wallet are spearheading this trend, while newer contenders like Phantom (focused on Solana) and World App are swiftly gaining popularity.

📣 Exciting News! As a researcher, I’ve just discovered that Coincbase has skyrocketed to the top spot as the number one iOS finance app in the United States. This is a significant milestone for the retail sector, indicating a growing interest in cryptocurrency investments. It seems like we’re back in a bull market, so let’s ride this fire 🔥!

— Ash Crypto (@Ashcryptoreal) November 13, 2024

The increasing popularity of mobile cryptocurrency apps is now often used as an unofficial gauge of retail investor enthusiasm. People have noticed that when these apps rank highly on Apple’s App Store, it tends to coincide with a rise in cryptocurrency values.

Even though numerous individuals possess cryptocurrency, a significant number of them are merely passive investors. For widespread acceptance, Matsuoka suggests that blockchain developers should strive for the optimal blend of security, privacy, and user-friendliness, acknowledging that this is no small feat. However, he maintains that current blockchain infrastructure can accommodate “tens or even hundreds of millions – if not billions – of active users,” implying that now is an ideal period to develop a cutting-edge mobile wallet for everyday transactions.

Based on Statista’s data, it turns out that Asian countries lead in mobile wallet usage, even with prominent U.S. companies like PayPal, Apple Pay, and Google Pay present. This isn’t a coincidence because in developing economies, mobile wallets are being utilized as a means to tackle the problem of underbanked populations. Consequently, it’s likely that future advancements in mobile cryptocurrency wallets could originate from this region.

Stablecoins everywhere

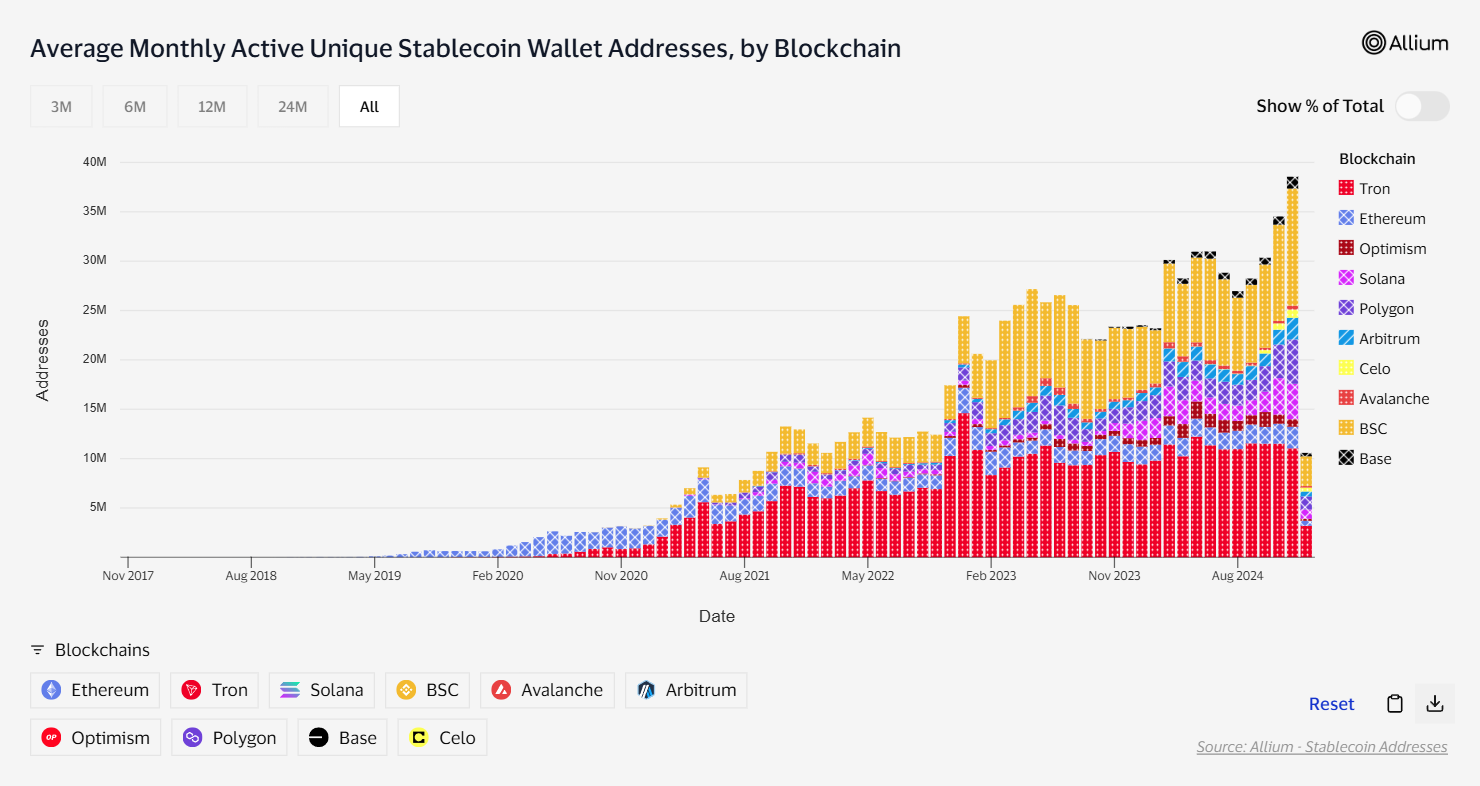

In the year 2024, Stablecoins experienced a significant surge. Their reduced transaction costs made them highly beneficial for various purposes such as cross-border transactions, remittances, and even everyday purchases. Moreover, they have become an essential tool for people residing in countries with high inflation rates like Argentina and Turkey, providing a means to preserve value.

Already, stablecoins provide the most affordable method for transferring a dollar. We anticipate that more businesses will start accepting stablecoins as a form of payment in the future.

Daren Matsuoka

However, despite ongoing efforts, there isn’t yet a clear-cut approach that bridges the gap between making stablecoin transactions as seamless as conventional ones. This leaves an expansive void in the market.

Matsuoka points out that the use of stablecoins in payments is rapidly increasing and seems to be accelerating, with Visa creating a tool to differentiate legitimate stablecoin transactions from those driven by bots.

2025 could see a surge in the adoption of stablecoins, one of the clearest applications of cryptocurrency, and according to Matsuoka, this is a key indicator to keep an eye on as it unfolds.

ETPs bring Bitcoin and Ethereum to masses

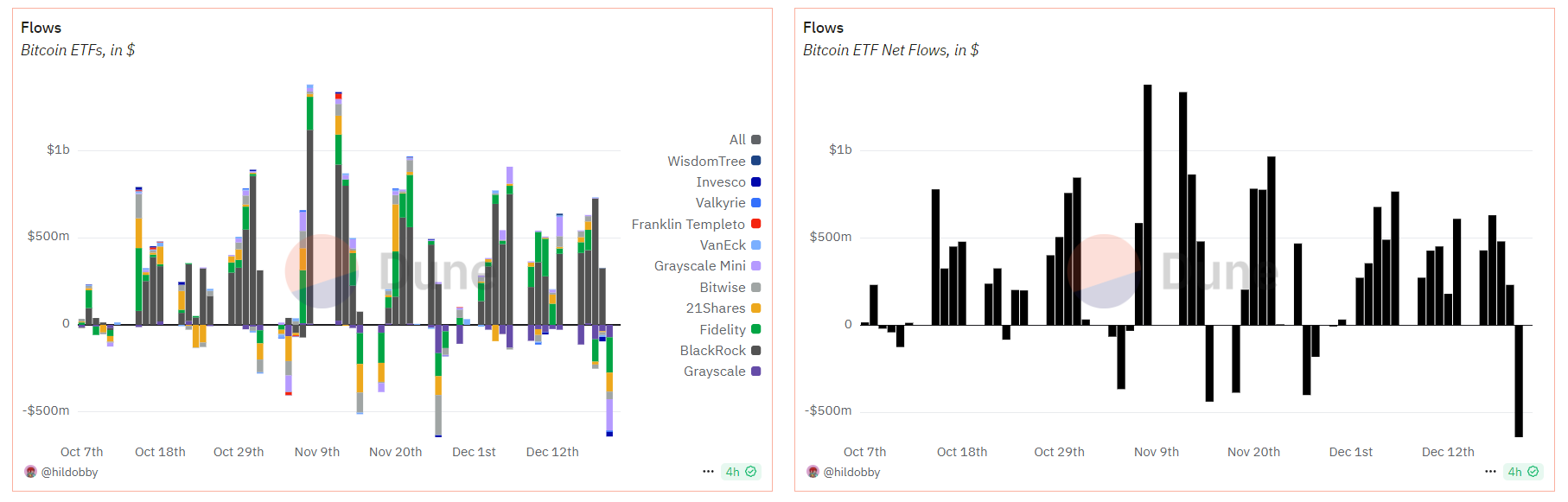

Previously, exchange-traded funds (ETFs) based on Bitcoin and Ethereum received official approval for trading within the United States. As a result, both average individuals as well as large financial entities now find it simpler to invest in cryptocurrencies.

Yet, as Matsuoka points out, thus far, these ETFs have only amassed approximately 515,000 BTC (equivalent to around $110 billion) and 611,000 ETH (roughly $13 billion). He further suggests that it will take some time to engage the distributors such as Goldman Sachs, JP Morgan, Merrill Lynch, who can make these products available to retail investors.

An a16z partner recommends monitoring deposits and withdrawals from accounts classified as custodians of Exchange-Traded Products (ETPs), pointing out that there’s a growing probability of institutional investors wanting involvement in cryptocurrencies. This, in turn, could cause higher net inflows for the ETPs.

DEXs vs CEXs

As a researcher delving into the crypto space, I’ve noticed an intriguing trend: Decentralized exchanges are gradually chipping away at the market dominance of their centralized counterparts. Despite the fact that their trading volume is yet to match that of centralized exchanges, they currently account for approximately 11% of spot trading – a figure that’s steadily increasing.

Lately, the trading volume for Decentralized Exchanges (DEX) has reached an unprecedented peak. This surge is primarily due to a significant increase in transactions on fast-paced blockchains such as Coinbase’s Base and Solana, as more people are getting involved in this digital space.

Daren Matsuoka

Matsuoka predicts that Decentralized Exchanges (DEXs) may continue to grow in market share by 2025; however, it remains uncertain whether individual investors will quickly migrate from traditional platforms. To date, the transition has been gradual, as DEXs have only managed to surpass 10% of trading volume compared to centralized exchanges after four years, according to DefiLlama statistics.

Transaction fees

As a crypto investor, I’m always on the lookout for the rising tide of popularity within blockchain networks. Transaction fees can serve as a useful indicator, reflecting the level of demand in the market. However, it’s crucial to note that while increasing fees may signify growth, they should never become so exorbitant that they drive potential users away. Balancing demand and affordability is key for maintaining a thriving network.

For the first time ever last year, Solana surpassed Ethereum in terms of total fees accumulated. Remarkably, despite Solana’s transactions costing less than a penny compared to more than five dollars on Ethereum, Matsuoka acknowledges this as a significant achievement. He explains that as various ecosystems and their related fee markets continue to develop, it becomes increasingly valuable to assess the economic worth supported by different blockchains – making the present an opportune moment for such evaluation.

Over a period, the demand for blockspace, which is essentially the overall sum of dollars spent on transaction fees, might prove crucial in gauging the growth of the crypto sector, since it signifies active participation in meaningful economic transactions and indicates users’ readiness to pay for these services, according to Matsuoka.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Hero Tale best builds – One for melee, one for ranged characters

2025-01-07 15:36