As a seasoned analyst with over two decades of experience in the volatile and ever-evolving world of cryptocurrencies, I find myself intrigued by the remarkable performance of Aave (AAVE) in recent days. Having closely observed the market since its inception, I’ve learned to recognize the signs of a potential breakout, and AAVE seems to be exhibiting all the right indicators.

In recent developments, Aave is leading the pack among cryptocurrencies due to its impressive resurgence which started three days back during times of market turmoil.

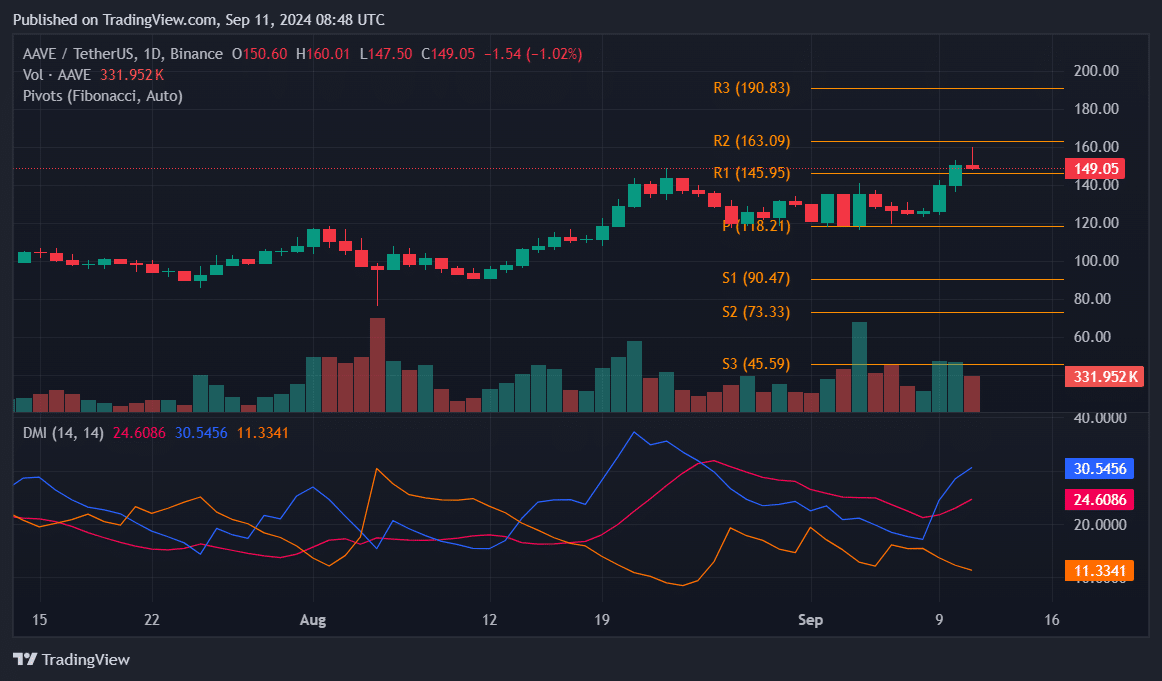

In the last day, Aave (AAVE) experienced a significant increase of 11%. Earlier today, it reached a high of $160, marking the first time it has reached this level since the Terra crash in May 2022.

Even though the asset has encountered resistance near this psychological price, it seems determined to hold onto the $150 value. In spite of this hurdle, Aave is currently being exchanged at $149, marking a 19% growth since September 8 and a robust 67% rise over the last month.

Significantly, during this rising phase, the asset’s Positive Directional Indicator (+DI) has surged to 30.54, suggesting robust upward movement, even amid broader market uncertainty. Simultaneously, the Negative Directional Indicator (-DI) has declined to 11.33, indicating a decrease in selling pressure.

Furthermore, the Average Directional Index (ADX) has climbed up to 24.6, indicating an increase in the trend’s strength. This suggests that Aave’s current uptrend is strong, however, traders need to be vigilant for any possible price changes.

In simpler terms, the significant levels of resistance (R1) for Aave are found at $145.95, a level that Aave has already exceeded. If the bullish momentum persists, potential upward targets lie at $163.09 and $190.83.

On the negative side, if there’s a downturn, Aave has two possible safety nets: one at $118.21 (Pivot point), and another at $90.47. These points might provide some protection during market fluctuations.

Anonymously known cryptocurrency market expert, Saint Pump, thinks that Aave’s price movements indicate a period of accumulation lasting nearly two years. He anticipates favorable performance from this asset in the coming midterm.

The two-year long ascending price channel appears ready to burst. It’s expected to perform favorably in the near future. However, keep in mind that the book is not very liquid and its intraday price movements can be quite volatile and harsh, so avoid buying at the daily highs. Instead, wait for a correction before jumping in.

— Saint Pump (@Saint_Pump) September 10, 2024

Instead of buying immediately at the day’s peak, he recommends being careful because the asset’s thin trading volume and unpredictable short-term price fluctuations make it risky. He suggests that potential investors should hold off until there is a price drop before making a purchase.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

2024-09-11 12:36