On the Blast network, a branch of the Aave protocol called a fork, mistakenly triggered liquidations of user positions valued at approximately $26 million due to an incorrect adjustment in a threshold setting.

On April 11, Pac Finance, which is built on top of decentralized finance platform Aave but runs on Coinbase’s layer-2 chain Blast, tried to change its loan-to-value (LTV) settings. However, unintentionally, the adjustment resulted in a lower liquidation threshold instead.

The aftermath saw a massive liquidation of ETH-backed positions on the platform. As reported by Will Sheehan, Founder of Parsec, a single user suffered significant losses amounting to approximately $24 million due to the Aave fork occurrence on Blast. Furthermore, data from on-chain analysis indicated that numerous users experienced financial setbacks totalling thousands of dollars in ezETH.

Giant swath of ezETH Liquidations on pac finance last night on blast, someone got tagged for $24m — Will Sheehan (@wilburforce_) April 11, 2024

Aave fork Pac Finance admits error

Shortly after being brought to their attention, Pac Finance admitted to making an error and informed those affected. The team also shared that they were working on a solution to rectify the issue.

To fine-tune the Loan-to-Value ratio, we assigned a skilled smart contract engineer the responsibility of implementing the required modifications. Unfortunately, we found out that someone had inconspicuously modified the liquidation threshold without informing us beforehand, resulting in the present predicament.

Pac Finance team

To prevent any more issues, Aave committed to establishing a community platform for dialogue about upcoming enhancements and adjustments to their decentralized finance lending system. Pac Finance also announced their plan to implement a governance contract to promote openness and restore confidence among users.

Stani Kulechov, the founder of blockchain development firm Avara and the overseeing entity for Aave’s project, took to Twitter to express concern over a current issue, stating that it underscores a fundamental problem associated with protocol offshoots.

One challenge with duplicating software code is the limited understanding of the complex inner workings and specific settings involved.

Stani Kulechov, Avara Founder

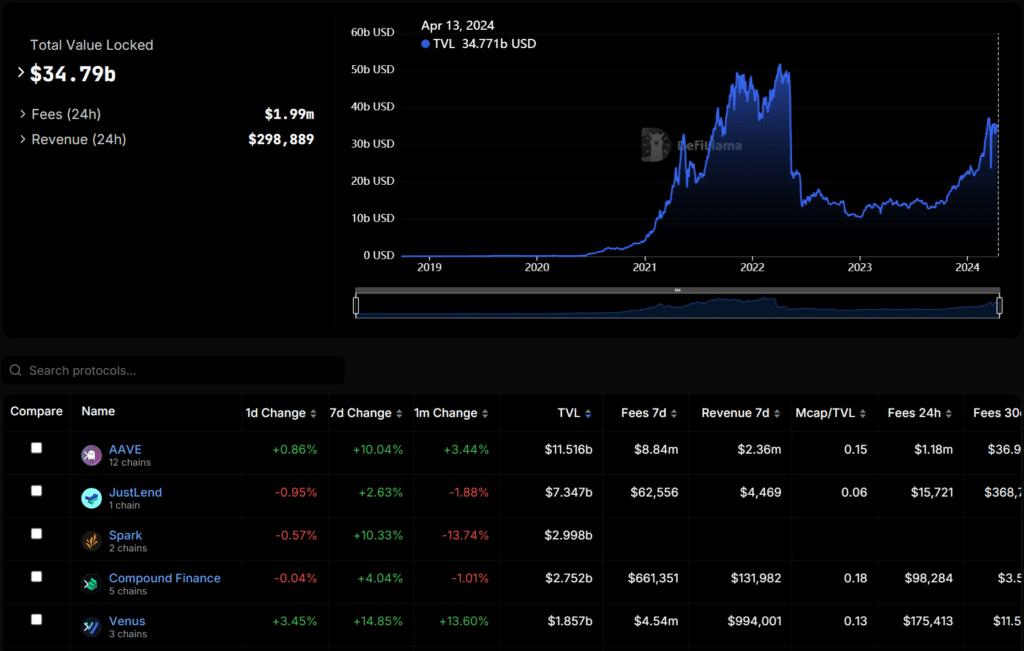

In the world of decentralized finance (defi), the lending market is a significant player, offering users the chance to both borrow funds and contribute liquidity to the growing crypto community. As reported by DefiLlama, the value of assets secured in lending protocols amounts to an impressive nearly $35 billion.

Aave stands out as the leading contender in the market, boasting a total value locked of $11.5 billion and accessibility over a dozen chains such as Ethereum, Arbitrum, Polygon, Optimism, Avalanche, Gnosis, Base, Metis, Binance Smart Chain, Scroll, Fantom, and Harmony. Additionally, it has introduced its stablecoin, GHO, to challenge Maker’s DAI token on the Ethereum blockchain.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Hero Tale best builds – One for melee, one for ranged characters

2024-04-12 18:02