As a seasoned crypto investor with over a decade of experience in this wild and unpredictable market, I must admit that the recent surge in Aave’s price has caught my attention. With its market cap exceeding $1.89 trillion and a 12.4% increase on Aug. 20, it’s hard not to notice.

The cost of Aave increased by more than 12% due to increased whale activity and a general uptick in the worldwide cryptocurrency market.

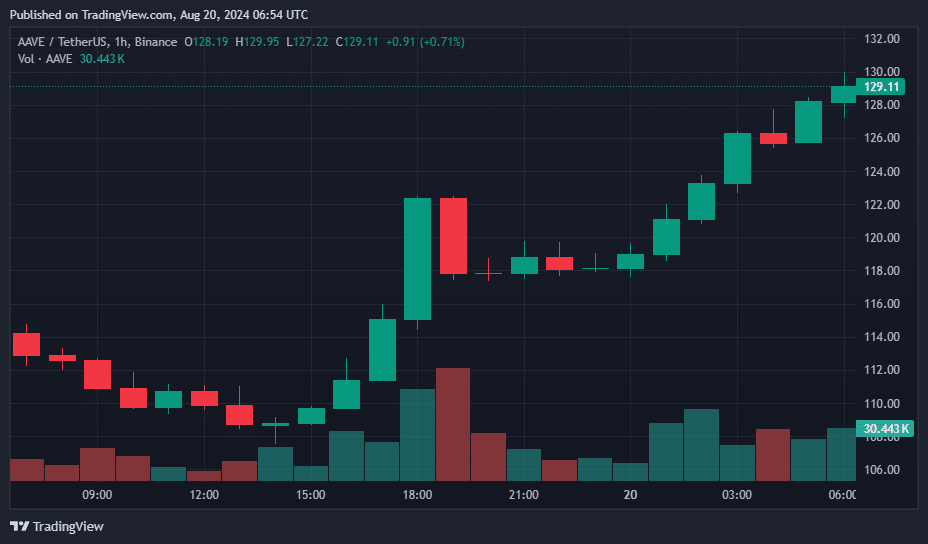

Currently, Aave (AAVE) stands as the 47th largest cryptocurrency, boasting a market capitalization of over $1.89 trillion. The surge in price on August 20 resulted in a 12.4% increase, placing its value at approximately $126.9, based on information from crypto.news.

Despite this rise, the cryptocurrency remains down 80.8% from its all-time high of $661.6, while its daily trading volume is staying at $392 million.

2 whales (identified as “0x3737” and “0x1D15”) have recently made significant transactions involving the cryptocurrency AAVE:— Lookonchain (@lookonchain) August 20, 2024

During this timeframe, Lookonchain, a firm specializing in blockchain analysis, disclosed that big-time investors or “whales” had substantially boosted their Aave holdings within a span of only three hours. Based on their findings, these major investors amassed a total of 31,407 AAVE, which translates to around $3.92 million in value.

In one instance, the whale address 0x3737 spent 813 ETH, equivalent to $2.18 million, to purchase 17,690 AAVE at a price of $123 per token. Another whale, identified by the address 0x1D15, withdrew 13,717 AAVE worth about $1.73 million from Binance. As of press time, that whale holds a total of 19,373 AAVE, valued at $2.45 million.

Whale activity around Aave surges as DeFi shows signs of maturation

As a crypto investor, I’ve noticed an uptick in whale activity that seems to align with a wider rebound in the DeFi sector. This observation is backed up by Edward Wilson, the Marketing Head at Nansen Analytics, who’s been keeping a close eye on things.

As a researcher, I recently shared my insights with crypto.news about a significant transition happening in the cryptocurrency market. Instead of the hype surrounding meme coins, there’s now an increasing focus on DeFi projects that are built on strong fundamentals. This shift, in my opinion, reflects a maturing phase within the market, where long-term, sustainable growth is becoming more desirable than temporary excitement.

To add, it’s been observed that experienced investors have significantly boosted their Aave holdings, totaling roughly $5 million since August’s start. This increase in investment appears to be backed by positive technical trends seen on the Aave price graph.

“The emerging ‘Adam and Eve’ structure indicates a robust possibility for continued price growth. This is consistent with the market’s recent emphasis on solid financial foundations.”

Edward Wilson

Previously in July, a proposal from Aave’s founder, Marc Zeller, for a token buyback plan led to a 8% price increase in Aave. This move added to the enthusiasm surrounding the token’s potential future growth.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- PUBG Mobile heads back to Riyadh for EWC 2025

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Arknights celebrates fifth anniversary in style with new limited-time event

- USD CNY PREDICTION

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-08-20 11:10